The 18-year cycle guides everything we do over at Cycles, Trends & Forecasts. It’s the primary tool we use to forecast the future.

For example, the current COVID crisis continues to echo the last mid-cycle crisis in 2001.

(The mid-cycle is a recession in the middle of the 18-year real estate cycle — a recessionary point in the economy — but a point where real estate doesn’t crash.)

The echo I’m talking about is the aftermath of the 9/11 attack on the World Trade Center.

The Global War on Terror that dominated the second half of the last cycle, has now been replaced with The Global War on COVID.

Not only did 9/11 alter national security laws forever — but also biosecurity laws. Laws that are still in place and being built upon in response to COVID.

Seven days after 9/11, the anthrax ‘terror’ attack unfolded. Anonymous letters laced with deadly anthrax spores were mailed to media companies and Democratic senators.

Islamic terrorists were blamed at the time. But found later to have been sent by a government scientist.

Still, it allowed biosecurity measures to be rushed in, and a new regime of national and international legislation introduced.

That included mandatory quarantine and compulsory vaccinations during any declared public health emergency.

The pattern of history is simply repeating.

The new Victorian state pandemic laws Daniel Andrews is pushing through parliament under the guise that it will keep everyone safe is nothing more than a grab for more power.

Powers that allow him to continue to do whatever he decrees is good for health — including denying the right to protest — so long as there’s a pandemic.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

No surprise that people are fleeing Melbourne.

It seems like every second person I speak to these days has a plan to go. And that doesn’t bode well for the economy — or the housing market, for that matter.

Following the terrorist attacks on the World Trade Center, businesses reconsidered the value of location.

Height limits of strategic buildings were reassessed globally.

Uncertainty and fear around travel escalated.

There was also a significant effect on tall office buildings in CBDs.

Vacancy rates in tall buildings within CBDs shot up compared to low-rise commercial buildings on the edge of the city.

A similar trend is happening this mid-cycle. However, this time it’s affecting residential locations.

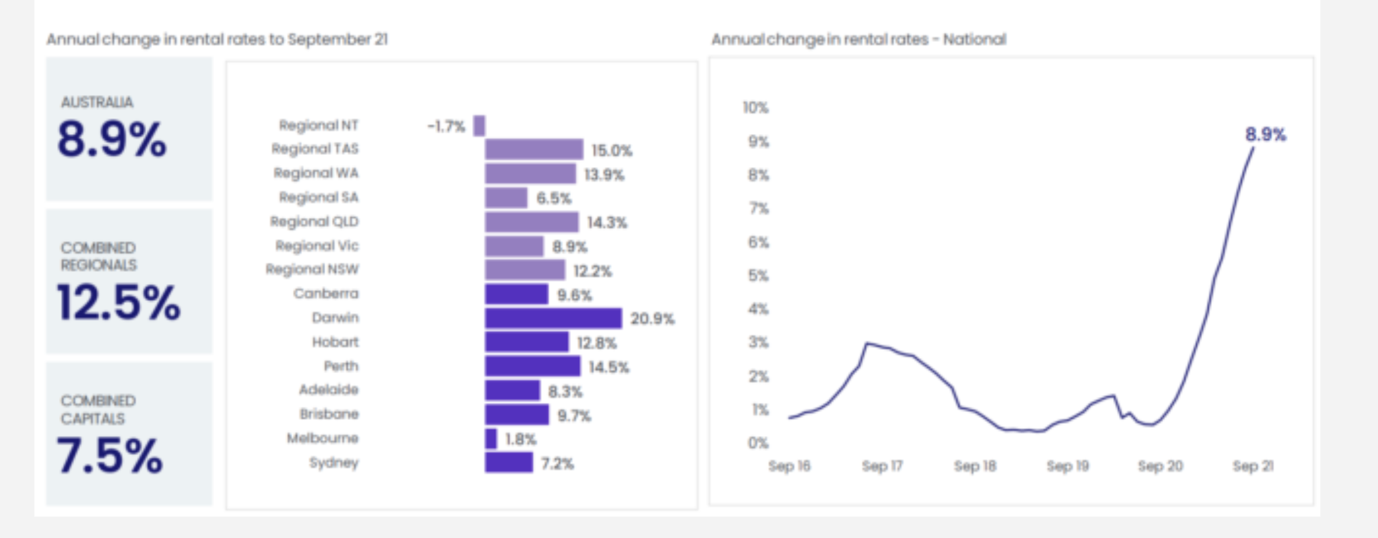

Rents are soaring in other states and regions previously deemed too remote, too small, lacking in culture, etc.

It’s clear that folk don’t want to live in inner-city areas under the microscope of draconian pandemic laws.

Things have flipped.

Inner-city areas are no longer attracting as much competition as the regions.

An influx of people is pouring into towns and cities unprepared for a rapid burst of population growth.

It’s why rents are increasing at their fastest pace since 2008.

|

|

|

Source: CoreLogic |

That is, except Melbourne.

Andrews’s ‘vaccinated economy’ is leaving no option for tens of thousands to flee the once-vibrant city — and flooding into neighbouring states that have greater freedoms of movement.

Rising rents feed directly into rising land prices. In the areas benefitting most, we’re in for a boom such as we’ve never seen before. Smaller capitals by population. Attractive regional towns and cities.

In Melbourne, however, there’s likely to be a pullback in growth as soon as we see elevated levels of stock hit the market.

We forecast this in Cycles, Trends & Forecasts prior to COVID hitting, giving subscribers a heads up on the locations to target for the second half of the cycle. Regions are now reaping windfalls in land price gains.

If you want to stay one step ahead of the competition, you can benefit also. Sign up to Cycles, Trends & Forecasts today!

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.