Life360 [ASX:360], a San Francisco-based consumer tech juggernaut, witnessed its shares skyrocket by 37% today, trading at $11.05 per share.

The move followed the announcement of its ambitious venture into the advertising arena through the free version of its popular app.

Life360’s app is targeted towards parents who use it when their teenage children start driving to track where they’re going and how fast they’re travelling.

In Australia, the company has a user base of 1.7 million currently on the free app, with a tiered membership coming in the second quarter.

Life360 also released strong earnings today, beating guidance and showing a healthy uptick in users.

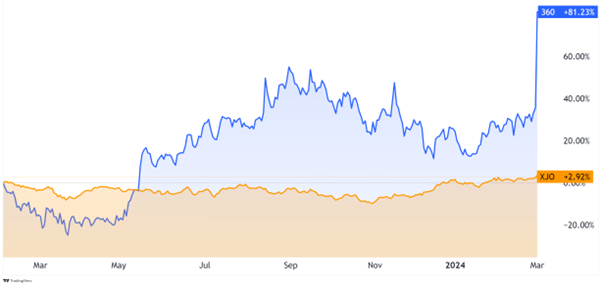

Before today’s moves, the company’s stock had largely gone sideways for over a year as investors looked for clearer signs they were making ground in key markets.

Do today’s results shift the needle enough to warrant the share price explosion?

Source: TradingView

Life360 opens new advertising revenue stream

Life360 CEO Chris Hulls described the company’s shift to advertising on its free app as a door to ‘unparalleled reach‘ as he opens his millions of daily active users to advertising on the app.

The change is anticipated to potentially match, if not surpass, its existing subscription revenue streams, marking a pivotal moment for the company renowned for its family-oriented location-tracking app.

Operating both free and premium versions of its app, Life360 has become a staple for families worldwide, allowing them to monitor loved ones’ locations and driving speeds.

With a global user base exceeding 61 million monthly active users, and an average app engagement of five times daily in the US, investors were clearly excited about the potential revenue from future deals.

Chris Hulls, the co-founder and CEO, expressed confidence in the new advertising strategy, deeming it a ‘low risk‘ endeavour for the company.

Prior testing with banner ads ‘went better than planned’, according to Mr Hulls, with ‘no negative user impact at all.’

With over 20 million daily active users engaging with the app’s free version, the launch of the ads within this calendar year will be one to watch.

The company’s earnings also showed a marked improvement, with revenue up 33% to US$305 million.

The big driver of this was its 52% increase in subscription revenue, which topped US$200 million.

This finished its FY23 results with an adjusted EBITDA of US$20.6 million and a Net loss of US$(28.2) million.

This was well ahead of its guidance of EBITDA range of US$12–16 million for FY23.

While Life360 is still running a loss, the results showed definite improvement from its FY22 result of US$(63.5) million loss.

The company’s global monthly active users (MAU) also saw a strong uptick, gaining 26% or 13 million in FY23.

Outlook for Life360

The results certainly show that management has turned a corner in the eyes of investors.

While its impressive gains today mean its share price is up 133.5% in the past 12 months, it’s still below its pre-pandemic high of $13.65.

Despite this, clear progress has been made in its strategy to refocus on balancing growth with profitability.

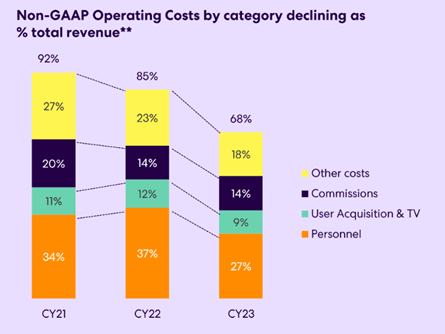

The lower spend on R&D, marketing and careful operating cost discipline is the thing that I see as its biggest improvement over prior years.

Source: Life360

So what’s likely the trajectory from here?

That one is harder to guess. The company says they have a ‘significant runway remaining in U.S. penetration,’ but I would be more sceptical.

31% YoY growth in Daily Active Users (DAU) is fantastic, but how sustainable is it?

Looking at other major app examples, Ads can turn off some of its user base. As a result things can get bumpy for growth trajectories when ads come into the equation.

Life360 is acutely aware of the tightrope they are walking.

‘We’re being very thoughtful and careful. The last thing we want to do is erode user experience,’ said Mr Hulls.

For its FY24 outlook, Life360 is targeting US$365–375 million revenue and its core subscription revenue to continue its 20% growth trend.

That would see it closer to breaking even, with an EBITDA loss of US$(8)–(13) million expected.

FY24 should see positive operating cash flow if its DAU numbers maintain their current trajectory.

The primary thing to watch out for will be its active user base numbers to monitor if the advertising changes hurt its free user base and growth.

Another tech miracle that’s already happening

If you’re looking for other tech stories to invest behind, look no further than the incredible moves of Bitcoin [BTC].

The asset class many had claimed dead has now pulled a return of 158% for the past 12 months. That makes it the best-performing asset class by far in the past year.

Just look at its performance in the past few days.

Compare that to the ASX 200s +1.63% gain in the past week…you can see why more people are taking notice.

Our exponential investor and tech specialist, Ryan Dinse, has been a long-time cryptocurrency investor and isn’t surprised at all.

In fact, he mapped out these movements last year. What is next on his timeline?

Could Bitcoin go to US$1 million? Does that sound ridiculous, too good to be true?

Watch his video here to see how the market looks in this bull run, and where it’s headed next.

Regards,

Charlie Ormond

For Fat Tail Daily