In the ever-volatile world of African mining projects, Leo Lithium [ASX:LLL] has recently found itself in the eye of a storm. With a market cap of just shy of $500 million, the lithium developer has faced a series of setbacks, leading to a rollercoaster ride for its shareholders.

Shares are again suspended for the company, this time by the ASX rather than the company itself, due to ‘failing to respond to ASX queries adequately‘.

It appears the company is continuing to try to play for time as negotiations with the Mali government continue over Leo’s development of the Goulamina Lithium Project in Mali, which is set to be one of the largest spodumene mines in the world.

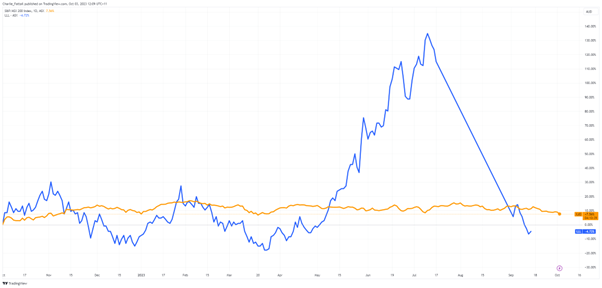

Shares in the company are down by only -4.72% in the past 12 months, but what highlights the scale of the damage from these painful negotiations is the whopping -55.70% drop in share price in the past three months alone.

So what are the discussions about, and what will happen when the company trades again?

Source: TradingView

Mali takes a bite of the lion

Today marks day 68 of paused trading in the past two and a half months for the company, which has gone dark on all communications.

So what is the background to this mess?

The Mali junta government came to power in a coup in August 2020 amid a broader conflict with jihadist insurgents, placing the military in charge. The junta kicked out UN peacekeepers and brought in Russia’s mercenary Wagner Group, which presided over a murderous campaign.

In mid-July, Leo Lithium’s shares were abruptly halted due to correspondence from the Malian junta government. Mali’s interim President, Assimi Goita, announced his intention to sign a new law called the ‘2023 Mining Code’.

This new mining code grants the military-led government the authority to increase its ownership in projects across the country, potentially diluting Leo Lithium’s stake significantly.

Leo Lithium had already reduced its ownership to 45% by allocating 5% of the Goulamina Lithium Project to Chinese lithium giant Ganfeng Lithium in exchange for funding.

Ganfeng had already owned a 50% stake in the company, but after the details of the new law came to light, it was revealed that the Mali government intended to take a 35% stake in the project.

This would dilute Leo’s share in its one and only project to only 27.5%. In a matter of weeks, Leo went from joint ownership to potentially a minority interest in its baby — its shares fell almost 50%.

The Goulamina Lithium Project is located in southern Mali, approximately 150km south of the country’s capital.

It is one of the world’s largest undeveloped hard rock lithium deposits, with a Measured, Indicated and Inferred Mineral Resource of 211 million tonnes at 1.37% Li2O.

Source: Leo Lithium

Subsequent negotiations between the parties devolved to the point where Mail suspended all mine direct shipping ore (DSO) operations while development was allowed to continue.

Leo Lithium had been targeting 185,000 tonnes per year of DSO exports until spodumene production commenced.

Leo Lithium’s CEO, Simon Hay, expressed confidence in the project’s future despite the hurdles. He highlighted the continued support from Ganfeng, emphasising their cooperation agreement and subsequent equity investment.

This investment not only injected much-needed funds into the project but also brought Ganfeng into a more active role in the discussions.

However, the situation worsened as hinted resolution came and went, and the company went quiet.

That leads us to today, the most recent suspension.

So what’s next for the troubled company?

Outlook for Leo Lithium

This development has cast a shadow over the company and raised questions about its management team.

Now that the ASX has suspended Leo Lithium’s shares indefinitely, shareholders will eagerly await a Q&A response from the company, which the ASX will force to regain listing.

Many shareholders are calling for heads to roll from Leo’s leadership due to the lack of communication and presumed obfuscation.

While the company can’t be blamed for Mali’s political landscape and the uncertainties surrounding the mining code, Leo has shown a masterclass in poor communication that has meant investors fill the void with negative assumptions.

The challenges highlight the risks in operating in developing countries such as Mali, which have a long history of coups.

In a more positive light, construction appears to continue unabated from the negotiations. If all goes well, the company forecasts that the first spodumene concentrate production will be targeted for the second quarter of 2024.

Lithium demand is also expected to continue to rise as EV demand increases globally, with analysts predicting a supply deficit to remain until 2030.

While uncertainties persist however, Leo Lithium’s communication and strategic decisions will continue to come under question as shareholders await further developments in this high-stakes saga that has gripped the lithium industry.

Other Net Zero metals worth your time

Stopping climate change will require trillions and a global supply of critical minerals — one special metal from this range is copper.

This means that we’re going to need a lot of red metal, and more exploration will be required to restock supplies.

If you subscribe to Fat Tail Commodities, you will have access to resources expert James Cooper’s most recent thoughts on the subject.

James will give you a wealth of ideas, and veteran insights for the copper industry.

He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about the coming red draught and click here today.

Regards,

Charlie Ormond

For Fat Tail Commodities

Comments