Firefinch’s lithium-centric spin out Leo Lithium [ASX:LLL] has been itching to prove its strength as a successful standalone since its inception in 2021. Following that theme, today it says it’s found more high-grade thick intercepts from the Northeast (NE) Domains at the Goulamina Lithium Project.

This is in contrast to the mother company’s ongoing struggle brought on by insufficient production, funding issues, and general delays experienced at its Morila mine in Mali.

Firefinch remains suspended in trade on the ASX following a failed capital raising and not yet finding the means to fix its funding predicament — which it will need to fix in order to tackle general lack of equipment and inability to ramp up production.

Having said that, Leo went up more than 6% by the afternoon, though it continues tracking below the S&P 200 average by 24%:

Source: TradingView

Leo aims to impress with latest drilling results

While Firefinch remains in suspension on the ASX, after suffering funding and production issues nearly a year ago and saw two board members walk out, spin out Leo Lithium has cheered investors today with the latest on the Goulamina Lithium Project in Mali.

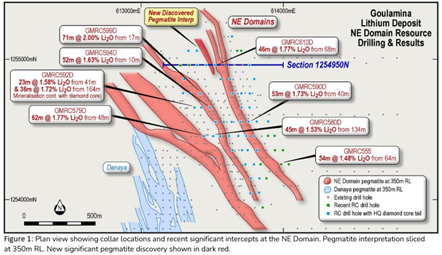

Following assay results from its resource drilling program, Leo says it has made the discovery of further high-grade, thick interceptions, which have been taken from Danaya and the Northeast (NE) Domains of the project.

The lithium group presented the following down-hole pegmatite intercept highlights:

Leo said that the main objective of the Resource Drilling Program was to boost confidence levels in the orebody, and to convert a large amount of Inferred Resource into the Indicated Resource category.

The group also added the additional objective to increase the overall resource base at the project.

With the latest results laid out on the table, Leo believes that it is progressing well towards meeting these objectives, and its plans remain on the right track.

The group will continue drilling at Goulamina and said that it is now entering a new phase, focusing on testing potential northern strike extensions.

Leo expects to provide further drilling results in coming months, and to update the Mineral Resource Estimate for the Goulamina deposit, which is anticipated before the end of the June quarter.

Further drilling results from the NE and Danaya Domains will be reported after review throughout the second quarter.

Leo Lithium Managing Director Simon Hay commented:

‘The latest set of results from our ongoing drilling campaign are again set to enhance the already high-quality Goulamina Resource. The Li2O grades received from the combined Danaya and NE Domain targets are overall higher than the current average Mineral Resource Estimate (MRE) grades for Goulamina. This is a fantastic result and positions us to deliver a robust MRE upgrade by the end of the current half year. With the high-grade mineralisation remaining open along strike, there is further growth potential ahead as we test potential northern strike extensions this quarter.’

Source: LLL

A boom for drillers

Lithium is only one part of a universe that is chock-full of potential.

It’s part of a wider industry making massive bull market-like gains in the face of recession, interest rates and wider market sentiment.

To put it bluntly, drillers are booming.

More booms are marked to happen for every single metal on the periodic table.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our experts definitely seem to think so. But how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

James has spent time out in the field and brings the inside-industry knowledge to you, here at Fat Tail Investment Research.

Let’s start with six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart,

For Money Morning