The Lithium Energy Ltd [ASX:LEL] share price is down 3.5% today despite setting an exploration target for its Solaroz Lithium Brine project in Argentina.

At the time of writing, LEL shares were trading for 41.5 cents.

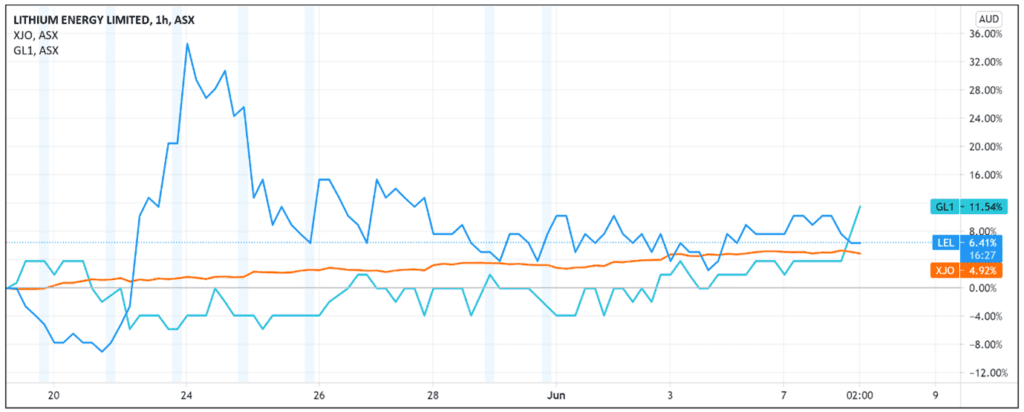

Having debuted on the ASX last month, the lithium producer has shot up over 100% after raising $9 million at an issue price of 20 cents per share.

The intense bidding reflects a similarly intense interest in the ASX lithium sector as markets anticipate a global switch to greener energy and electric vehicles.

Lithium Energy was the second lithium IPO in May, with Pilbara-based Global Lithium Resources Ord [ASX:GL1] currently up 45% on its issue price of 20 cents per share.

Lithium target identified

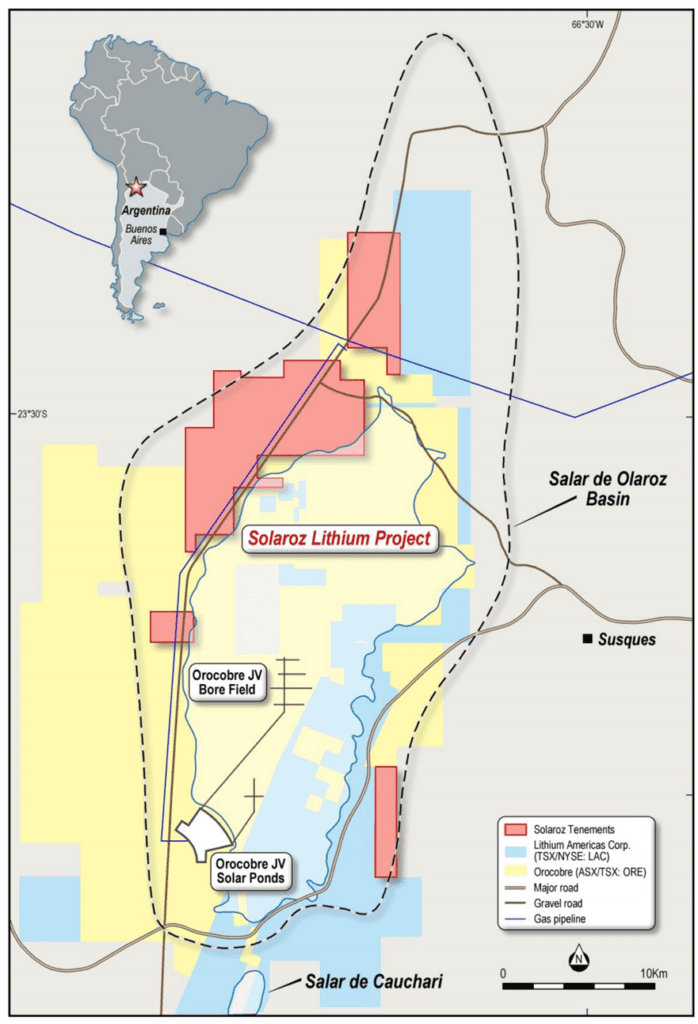

Lithium Energy revealed it has established a conceptual exploration target for its flagship Solaroz Lithium Brine project in Argentina today.

The target includes 1.5–8.7 million tonnes (Mt) of contained Lithium Carbonate Equivalent (LCE) based on a range of lithium concentrations of between 500 mg/L Li and 700 mg/L Li.

The key here is the conceptual nature of the exploration target.

As LEL acknowledged, the potential quantity and grade is at this stage conceptual only. So far, there has been ‘insufficient exploration to estimate a mineral resource’.

Investors are also likely to notice it is ‘uncertain if further exploration will result in the estimation of a mineral resource’.

Lithium Energy didn’t arrive at this target arbitrarily, however.

The miner arrived at it after a ‘detailed examination of extensive geological data that exists in relation to the brine rich lithium aquifer that comprises the Salar de Olaroz Basin.’

And it is true that the Solaroz area is rich in data and lithium mining history, located in what is often called South America’s ‘lithium triangle’.

The triangle’s lithium producers include the $2.3 billion Orocobre Ltd [ASX:ORE], whose historical data LEL reviewed to estimate its exploration target.

Lithium Energy referred to Orocobre’s 2011 ASX update, which reported a measured and indicated resource of ‘1,752 million cubic metres of brine at 690 mg/L Lithium; 5,730 mg/L Potassium; and 1,050 mg/L Boron which is equivalent to 6.4 million tonnes of lithium carbonate and 19.3 million tonnes of potash.’

LEL relied on ORE comparisons because some of Orocobre’s exploration surveys were undertaken ‘over or closely adjacent to Lithium Energy’s Solaroz tenements’.

LEL ASX outlook

Lithium Energy’s Chairman, William Johnson offered optimistic commentary on today’s update:

‘The Solaroz Project offers tremendous upside potential for Lithium Energy, given its highly prospective and strategic location next to Orocobre’s producing lithium brine project.

‘We are targeting the same Lithium brine mineralisation from the Olaroz Salar as that currently being extracted by Orocobre.

‘This Exploration Target confirms the Solaroz Project as a Lithium project of potentially world-class scale.’

However, investors will likely note the wide distance between Lithium Energy’s upper target of 8.7Mt of LCE at 700mg/L lithium and its lower target of 1.5Mt of LCE at 500mg/L lithium.

The gap is likely due to the uncertainty stemming from the estimate’s conceptual nature.

As a result, investors will likely await actual exploration and assay results, the expenditure for which will no doubt be funded by LEL’s $9 million capital raise.

Governments are eyeing off a greener future while enterprises are eyeing off profitable ways to accelerate this future.

Lithium is at the core of this as the white metal is a key part in the global EV supply chain.

Therefore, if you want more information on a sector enjoying a resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.