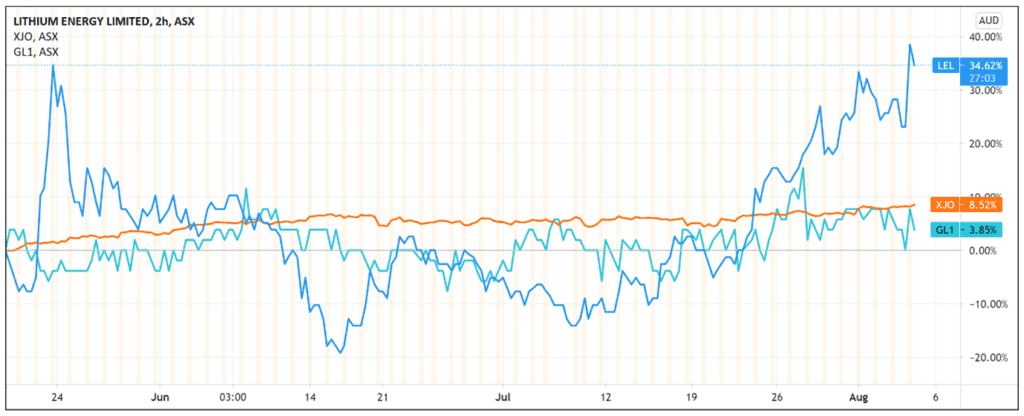

The Lithium Energy Ltd [ASX:LEL] share price is up after the approval process for LEL’s Solaroz lithium project nears completion.

LEL shares rose as much as 17% in early trade, peaking at 56.5 cents a share, just shy of LEL’s 52-week high of 59 cents.

Lithium Energy, the battery materials company developing a lithium project in Argentina, today relayed that the Environmental Impact Assessment (EIA) is entering the final evaluation stages.

Approval nears

LEL’s Solaroz project is entering the final stages of evaluation conducted by the Unit of Environmental Management (UGAMP) of the Jujuy Province.

UGAMP employs representatives across different provincial agencies and, along with the Mining Secretary, is responsible for the final approval of Mining EIAs.

Lithium Energy confirmed today that in late July it held two ‘positive public consultation meetings’ with local representatives, landowners, first nations representatives, and various UGAMP agencies.

LEL said these consultations allow the EIA process to advance to the next stage.

This stage has a time frame of two weeks during which ‘relevant stakeholders’ can offer ‘technical input.’

What happens after the Environmental Impact Assessment?

Once the EIA gets approved, LEL plans to undertake an ‘extensive work programme’ of geophysical surveys and drilling.

The programme will seek to locate lithium-bearing ‘brines of economic interest.’

As it stands, LEL’s Solaroz project comprises eight mineral tenements totalling about 12,000 hectares, located in the Salar de Olaroz basin.

The basin is well-known to lithium investors as it is home to two brine projects, one by ASX-listed Orocobre Ltd [ASX:ORE] and the other by the NYSE-listed Lithium Americas.

For reference, in the latest June quarter, ORE produced 3,300 tonnes of lithium carbonate from its Olaroz facility, also located in the Jujuy Province.

Orocobre reported that in the June quarter, ‘brine concentration remained at higher levels than in recent years.’

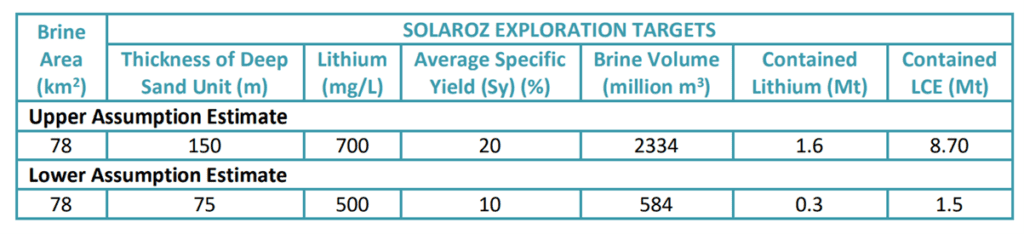

Source: Lithium Energy presentation

Source: Lithium Energy presentation

Lithium Energy share price outlook

Piedmont Lithium Inc [ASX:PLL] has shown last month the importance of overcoming regulatory hurdles and the selling pressure that can ensue if relevant approvals — like permits — are blocked or stalled.

So today’s news of the EIA approval process nearing completion will encourage investors and likely contributed to the run-up in LEL’s share price.

But Piedmont’s permit issues in Gaston County have probably dampened any cavalier optimism that regulatory approval is guaranteed.

Nothing is more certain than the final approval itself, signed and sealed.

Finally, as LEL pointed out today, despite the ‘highly prospective’ nature of its tenements, the company must still complete ‘extensive’ geophysical surveys to locate lithium-bearing brines of economic interest.

Of course, LEL’s prospects at locating such brines are buoyed by the tenements’ proximity to tenements held by established producers like Orocobre and Lithium Americas.

But the drilling and surveying must be done to confirm what is right now still ‘highly prospective’.

As LEL itself said today, its current exploration target for the project is conceptual in nature.

LEL noted there has been ‘insufficient exploration to estimate a Mineral Resource, and it is uncertain if further exploration will result in the estimation of a Mineral Resource.’

Investors will now likely shift their attention to the upcoming exploration results.

With all that said, it is clear governments are eyeing off a greener future while enterprises are eyeing off ways to profit.

Lithium is at the core of this as the white metal is a key part in the global EV supply chain.

So if you want more information on a sector enjoying resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report