The Leigh Creek Energy Ltd [ASX:LCK] share price is pushing higher today on news the company’s Carbon Capture and Storage (CCS) viability was confirmed.

LCK shares are currently sitting at 14 cents per share, up 5%.

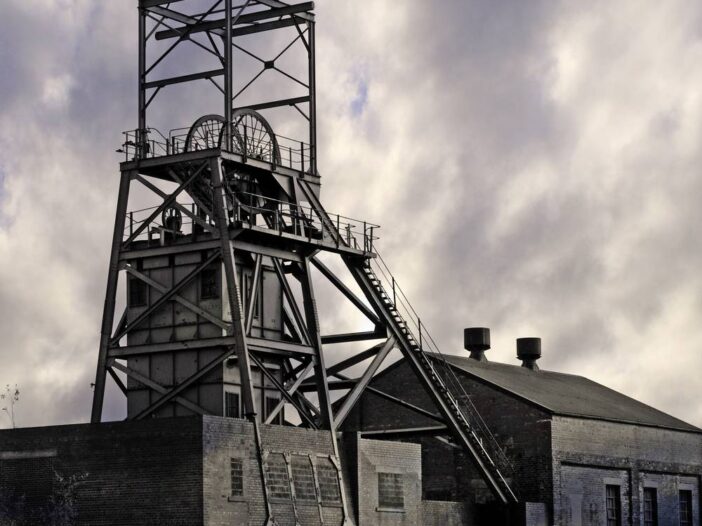

Leigh Creek Energy (LCK) is an Australian business developing an in-situ coal gasification (ISG) project at Leigh Creek, South Australia.

The company is qualified as a signatory to the United Nations Global Compact, the world’s largest corporate sustainability project.

Its flagship project is the Leigh Creek Urea Project (LCUP), which aims to develop low-cost nitrogen-based fertiliser for local and international agriculture markets.

The self-described aim is to ‘store excess CO2 from the production of gas and from the manufacture of urea in the void created underground by the production of gas.’

Today, we’ll go over the highlights of this morning’s announcement and share our outlook for Leigh Creek shares in the days ahead.

What was in the announcement?

LCK revealed today it has achieved yet another milestone:

The viability of its CCS has been confirmed.

Industry expert inGauge Energy made this assessment through completing an independent feasibility study, which investigated all the technical aspects of LCK’s proposed CSS at the LCUP and covered both engineering and geological areas.

According to the results, the initiative was a success.

The study confirmed the presence of critical elements that make large-scale retention of CO2 possible, a key mission for LCK and its fundamental projects.

Some of these critical elements included sufficient reservoir capacity and depth, as well as adequate seal presence, thickness, and integrity.

This is great news for the Aussie energy company, and the share market has responded accordingly.

Furthermore, due to the presence (and on-site manufacturing) of these critical elements, LCK’s CSS proposal is now deemed not only viable, but also commercially feasible.

But do these results alone make LCK a smart ASX buy right now?

What’s next for Leigh Creek shares…

Although today’s announcement suggests positive tidings ahead for LCK, the LCUP project hasn’t broken through the finish line yet.

The next step in the process will be to design above-ground facilities and incorporate front-end engineering into the design of the urea facility.

This is not predicted to take place until 2022.

Nevertheless, Leigh Creek is celebrating today’s results as a crucial stepping stone.

LCK Managing Director Phil Staveley said, ‘All the data and findings will be incorporated in the engineering which will optimise the project from the outset.’

‘Our project strategy is to future-proof our asset by leading a carbon neutral program through our ESG commitments to provide stability, certainty and pricing upside.’

LCK’s carbon consciousness is a powerful indicator of the company’s place in the energy revolution, and there could be fantastic scope for its growth in the years ahead.

For clean energy investors, it’s certainly a stock to watch.

But we believe the clean energy space is ripe with plenty of other opportunities.

One of these companies is a tiny explorer who thinks it’s found a unique way to transform fossil fuel into clean energy — and the price could ramp up wildly if it can walk the talk.

Interested in learning about more high-potential opportunities like these?

Our leading small-cap stock market analyst Murray Dawes has found seven stocks on the ASX today he believes could shoot up in the 2020s.

Download the free report here

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here