Last Sunday, hundreds of thousands of Australians from all walks of life came together across the major cities for the March for Australia rally.

Young and old, born here or immigrants, the true-blue Australian battler and patriot. They gathered with a common goal.

They gathered to voice their displeasure at the wayward government at all levels, whether incumbent or opposition.

These people live here, contribute to society, pay taxes, and call this country their home. They are sick of watching their benefits spent here and overseas on things that go against the country’s way of life.

They wanted their voices heard.

It was a bright and sunny day. Spring arrived a day early. I was there with my family in Sydney for the march too. Here’s a photo my wife took of my son, Cyrus, and I, standing among a sea of Australian flags:

Source: Brian W.B. Chu

I was only a year older than Cyrus (he’s 6 now) when I arrived in this country. It’s hard to believe that it has been 36 years next week. The country has transformed a lot since I landed in Sydney and made it my home.

There’s no doubt that Australia is a prosperous nation by global standards with vast mineral wealth, a relatively stable society, and a vibrant economy. That was why my family came here. Like many from all around the world who came, we sought to contribute our lot to live in a country endowed with much blessings.

Australia inherited these blessings over these 230 years from a combination of entrepreneurship, geographical advantage, astute trade and foreign relations, and luck that came in spades. We are truly a lucky country.

However, we have seen in the past decade how we pushed our luck. We’re now at risk of running down the accumulated capital and goodwill thanks to a combination of corrupt governments, a failing financial system, unscrupulous business practices, and public complacency.

I’ve written in the recent weeks about the troubles plaguing our country, which have resonated with many of you.

Today I want to talk about something that might shake you to the core.

It’s nothing inflammatory or controversial, so don’t worry!

What is it? Read on…

The living wage spinning out of orbit

I was scrolling through a few news headlines yesterday and I came across this article headline ‘Huge minimum salary Australian job seekers are searching for in 2025’.

It enticed me so I clicked on it to find out.

The article explored the trends and preferences of Australians searching for jobs on SEEK. An interesting finding was how much these users set their minimum salary/wage. The results showed the most common minimum salary were $150,000 (13.8%), $100,000 (13.55%), and $120,000 (12.04%).

To give you context, the average national annual income is around $104,000 as at May 2025, while the median annual income of around $90,000.

Clearly people are setting their standards quite high.

There are two ways to interpret these results, with completely opposite conclusions.

The first is what the staff at Seek concluded. Living costs have increased so much that they drive people to search for jobs offering higher pay.

The second is that those searching for jobs are in over their heads, looking for work that they might not be qualified to do. You may be aware of the trends on Tiktok and Instagram showing how young graduates come out expecting outlandish salaries for doing literally no work. The consumerist society and social media influencers have poisoned their expectations. They could apply for these jobs but end up not getting them.

Which interpretation is correct?

I daresay both have merit.

Desperation or delusion?

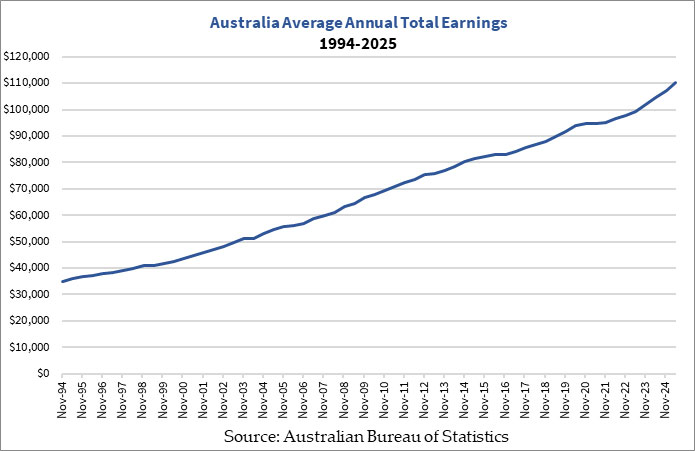

Perhaps it’s worth comparing today with three decades ago to see how much our country has changed economically. Let’s look at the average annual income:

People earned around $38,000 in 1995. It didn’t sound like much but that amount went further. It was enough for many households of 4-5 people to live off. And on a single income, mind you.

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

Those earning $70,000 a year in 1995 could afford to live in luxury. It would be the equivalent of earning $700,000 today, more than our Prime Minister’s salary ($530,000).

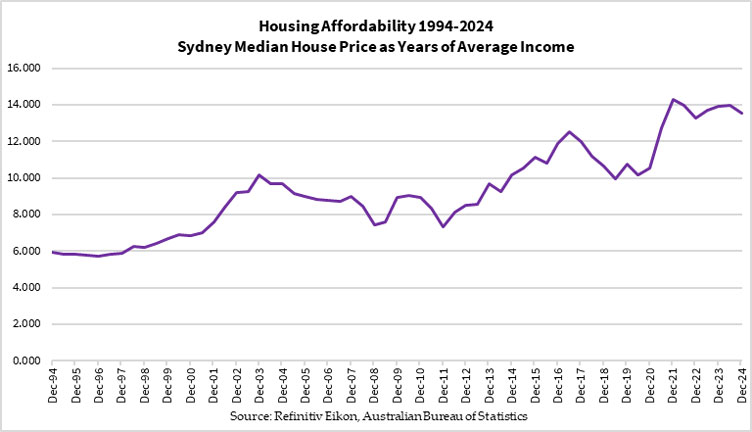

Moreover, house were more affordable. Here’s a figure showing how many years of average annual income a median house in Sydney was worth:

Notice how a median house was worth 6 years of average annual income back then. Today it’s almost 14 years.

Those wanting to buy a home may have to pay a higher interest rate on their mortgages. However, they could pay off the home loan in 10-15 years and invest in another if they like. These days, the average mortgage borrower is staring down at the prospect of 25 years or more.

The average Aussie back in the 1990s may call themselves a battler. But they were winning battles.

Today, the same battler is getting their backside handed back to them. And their children, if they have any, may have to pay the victor too.

What a prospect to live for!

Your equaliser in this campaign

So it shouldn’t surprise you that many are sick of the government, corporate leaders, academia, and the media for holding them down. Given that the government is contemplating raising taxes, maintaining current immigration levels, and expanding the bureaucracy, these mark the last straw.

They marched on Sunday despite the chatter that they are in the company of Neo-Nazis, far-right extremists, and racists. They turned up to flip these people a proverbial middle finger.

This could be just the start.

I certainly hope that these demonstrations won’t descend into anything violent, like what we’re seeing in Jakarta, Indonesia. What’s happening over there is absolutely tragic, with widespread destruction and deaths.

Taking a realistic view, I don’t believe that Sunday’s march will do much to stop our government from pushing their agenda. More marches could potentially change the pendulum but it would need to be more than a symbolic gesture of our dissent.

Given this, it’s important to look elsewhere to equalise the balance to ensure you don’t become another Aussie falling through the cracks.

This equaliser is gold. I’ve held back from mentioning it until now, though most of you would have seen it coming.

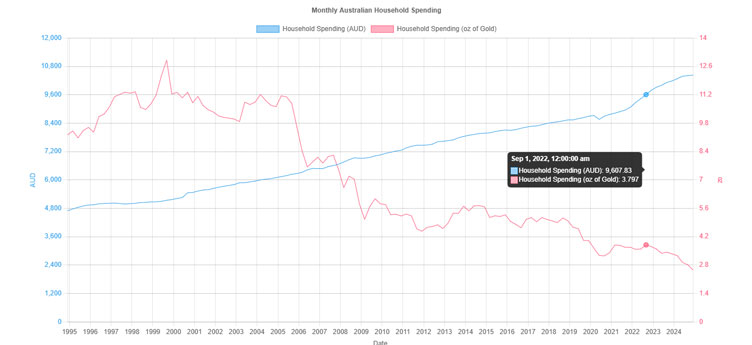

You saw the rising living costs, house prices and the purchasing power of our salaries/wages falling behind. Gold beat them all.

Have a look at how gold compared to living costs:

Source: GoldHub Australia

[Click to open in a new window]

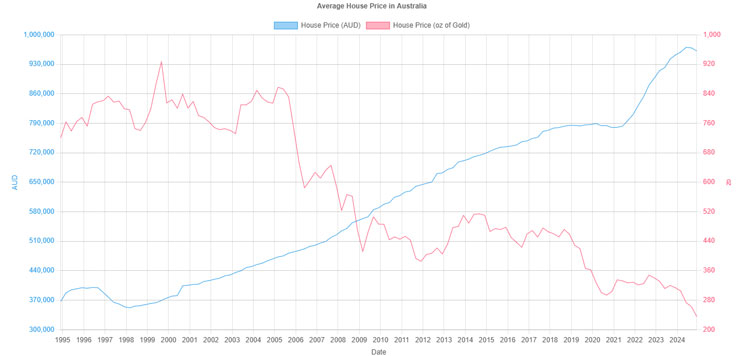

Here’s gold vs a median house:

Source: GoldHub Australia

[Click to open in a new window]

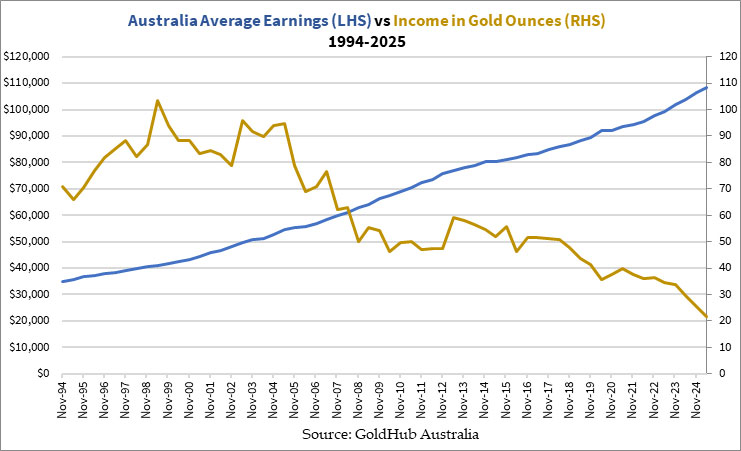

And here’s gold vs one’s salary/wages:

Notice how everything plunged when you express them in terms of gold?

That tells you one thing:

Earn and spend in dollars, save in gold.

To find out more about how to put that into action, check out The Australian Gold Report, my precious metals investment newsletter.

That’s it from me today. Enjoy the rest of the week!

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

Comments