ASX BNPL newcomer Laybuy Group Ltd [ASX:LBY] entered a trading halt today pending a capital raise announcement.

A cash injection to fund its expansion may well be what Laybuy hopes can arrest its negative momentum recently.

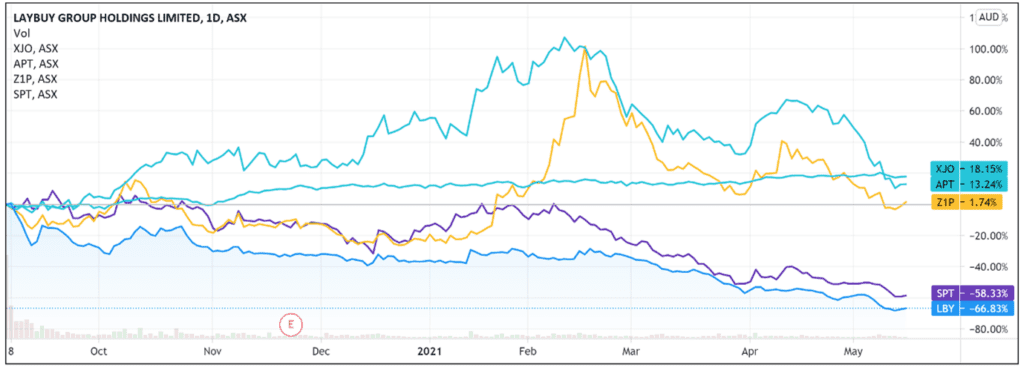

The Laybuy share price have struggled since debuting on the ASX last September.

Shares in LBY’s IPO went for $1.41 but after a brief spike Laybuy’s share price has been on a downward trajectory ever since, trading at 68 cents prior to today’s halt.

Reflecting a subdued climate for the previously frenzied BNPL market, LBY is currently down 45% year-to-date and 65% over the last 12 months.

Laybuy flags capital raise

According to The Australian Financial Review, LBY called on Bell Potter, Canaccord Genuity, and E&P to oversee a $35 million placement.

AFR reported that shares in the deal were being sold to funds for 50 cents per share, representing a 26% discount to the company’s pre-halt price of 68 cents.

Potential investors were pitched that the proceeds will fund Laybuy’s BNPL activities.

While paling in comparison to the funds raised by its bigger rivals, $35 million would be a substantial boost to LBY’s bank balance.

Laybuy’s March 2021 quarterly revealed the BNPL provider had NZ$15.49 million in cash and cash equivalents.

The March quarter saw LBY post NZ$953,000 in net cash inflows from operating activities on total available funding of NZ$18.92 million.

Seemingly quite positive.

However, year to date (12 months) Laybuy posted a net cash loss from operating activities of NZ$45.12 million.

LBY recorded NZ$449.87 million in receipts from customers year to date but saw NZ$450.71 million leave as payments to merchants.

So, zooming out, a capital raise may give Laybuy more breathing room as it seeks enough growth to stem the cash bleed.

Raise now, earn later

Capital raises are a regular phenomenon for BNPL providers.

LBY’s upcoming placement entrenches a tradition recently upheld by the likes of Sezzle and Afterpay.

In July 2020, Sezzle raised $79.1 million to ‘accelerate growth’ via an institutional placement, with a further $7.2 million raised from retail investors.

In the same month, Afterpay successfully raised $650 million via a fully underwritten institutional placement at $66 per share, with a share purchase plan raising a further $150 million.

And ASX’s second-largest BNPL provider — Zip — also recently tapped the market for capital to fund its growth schemes, successfully pricing a $400 million senior unsecured convertible note in April 2021.

Zip’s initial conversion price was $12.39, representing a 35% premium over the Reference Share Price of $9.18.

At least $2.3 billion has been raised by the likes of Afterpay, Zip, Sezzle, Splitit, Openpay, and Humm over just the second half of 2020 when including shares sold by insiders, according to the AFR.

Commenting on these capital injections, head of Australian equities at RBC Capital Markets Karen Jorritsma noted the ‘reality with all these names is they require capital to grow. They’re very much in growth mode, so the expectation is there’s more raisings to come, for sure.’

Andrew Brown of hedge fund East72 agreed that the market will see more capital raisings in 2021, pointing to BNPL’s capital-intensive business model:

‘None of these companies make a cashflow profit, so they’re leaking cash. In that situation they’re going to need more money irrespective of what sort of company they are.’

In his view, the lack of profitability so far in the sector means more capital calls are likely.

‘You’d have to be mad if you’re the principals at these kinds of companies not to raise equity at these prices.

‘There’s nothing untoward about that at all. It’s a function of their immature business models and fact they’re not cashflow positive.’

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then I recommend reading this free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning