The Latitude Group Holdings Ltd [ASX:LFS] delivered 1H21 profit at the top end of guidance on strong volume momentum.

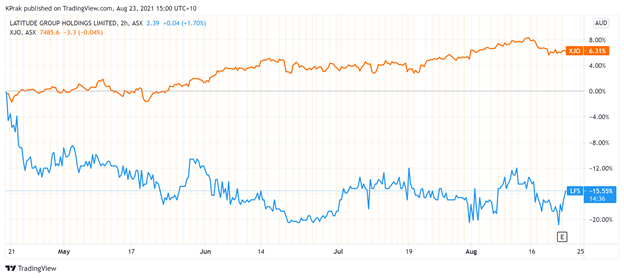

LFS share price is currently up 2.5%, exchanging hands for $2.39 a share.

The modest bump in the LFS share price suggests the market is still gauging the fintech’s prospects.

Year to date, Latitude is down 11%, underperforming the market.

But, do today’s results suggest the fintech can turn things around?

Latitude’s 1H21 performance

Statutory Net Profit After Tax (NPAT) was up a substantial 524% to $89.5 million while the firm’s cash NPAT rose 81% to $121 million.

Rare among emerging fintechs, Latitude also distributed a dividend of 7.85 cents per share, with the distribution totaling $78.5 million.

Return on Equity (ROE) stood at 19.1%, while the Return on Tangible Equity (ROTE) stood at 54.4%.

Latitude’s key operating metrics

It’s not a fintech trading update without a summary of key operating metrics.

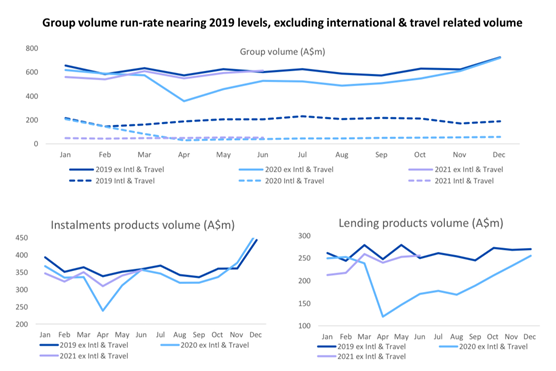

Latitude’s volumes increased 5% on the previous corresponding period (PCP) to reach $3.6 billion.

But Gross Receivables were down 6% to $6.5 billion. The company did say this figure was in line with 2H20.

Net charge-offs declined to 2.54%, down from 3.83% in PCP and 2.66% compared to 2H20.

The group’s risk-adjusted income stood at $344 million, which was down 4% on PCP.

Latitude’s operational highlights

There was steady growth shown in both personal and auto loans origination.

For instance, total personal and auto loan volumes were up 37% on PCP, which included 35% in Australia and 46% in New Zealand.

Latitude also settled the refinancing of the $1.04 billion Australian Personal Loans Warehouse Facility and established a new $1.06 billion Australia and New Zealand Sales Finance and Credit Cards Warehouse facility.

Latitude’s BNPL performance

LatitudePay (BNPL) customer base grew 73% on PCP to reach 458,000 open accounts.

Around 2,000 new merchant partners were activated.

Somewhat vague, LFS also reported ‘significant new merchant growth in the pipeline.’

In an interesting admission, the fintech did report that small ticket BNPL pricing is ‘competitive and supply is saturated in Australia.’

To combat this, Latitude plans to launch LatitudePay+ for big ticket BNPL purchases of up to $10,000.

What next for the LFS share price?

Latitude Managing Director and CEO Ahmed Fahour said that the company is ‘now the number two originator of new personal loans in Australia and one of the leaders in New Zealand.’

Looking out, Mr Fahour said:

‘Latitude is entering the 2H21 with a number of opportunities to grow our core instalments and lending businesses, as demonstrated by the acquisition of Symple Loans.

‘We are accelerating our big ticket BNPL offer LatitudePay+, which allows LatitudePay customers to make purchases of up to $10,000, we have relaunched our insurance product and are well advanced in our plans for Asia.’

LFS is also optimistic that the 2H21 dividend will remain at the 1H21 level of 7.85 cents per share but will be fully franked.

This number is expected to be within the company’s dividend payout ratio policy of 60% to 70% of Cash NPAT.

The rise to prominence of fintechs like Latitude, Wisr, and Afterpay highlight the technologically advanced times we live in.

Technology is lowering the barriers to entry and facilitating further innovation.

As our resident market expert Murray Dawes recently noted, all this is leading to the era of the disruptive small-caps.

Emerging companies that — with nimble business models and innovative tech — have the potential to realign traditional industries.

Now, Murray has recently written a report on seven exciting small-caps with big potential. If you’re keen to read the report, it’s free to view here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.