It took me more than an hour to fill out my postal vote the other week.

In case you’re wondering why, I was busy looking up the policy platforms of all the minor parties and independents.

Numbering every single box to place the majors last!

First time I’ve gone to so much effort to be honest.

But two years of mandates and lockdowns (at least for those of us living in Melbourne), coupled with the biggest protests in Australia’s history — ridiculed by both major parties and the MSM — you have to at least speculate that this year there’s energy for change?

I mean, honestly, what’s the difference between Labor and the Libs?

Each can scream that they’re going to make Aussies better off, but that’s impossible while both are doing their darndest to inflate the price of land ever further.

John Howard once said he’d never been stopped in the street by anyone who complained about their house going up in value.

No kidding.

Owners love high rents and rapidly rising land prices. It’s nature’s free lunch.

It’s also the reason the ALP whisked away their mandate to scrap negative gearing and capital gains benefits for investors after their last election fail.

As it is, the Coalition’s Super Home Buyer Scheme lets first-home buyers withdraw up to $50k of their superannuation balance for a mortgage deposit ($100K for a couple).

That’s a good way to gift a boomer a nice windfall when they downsize and funnel the money back into their own well-furnished super savings!

The ALP’s shared equity plan involves the government ‘going in’ with 10,000 homebuyers per year.

The problem with both platforms is that they put more money in buyers’ pockets and do zip to add to supply.

Let’s face it — low interest rates, high interest rates — low immigration, high immigration, etc. The boom/bust cycle will play out regardless.

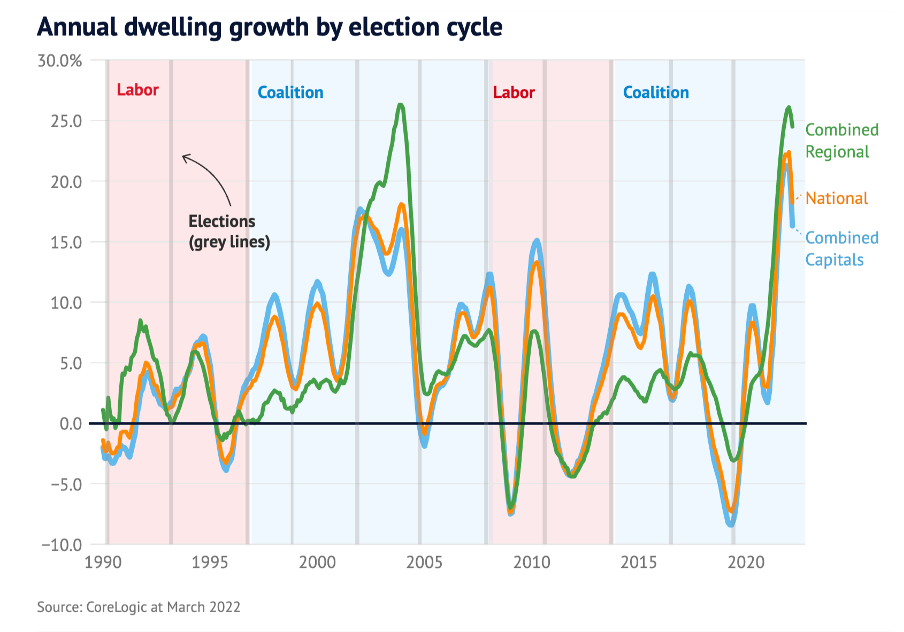

Take a look at some research put together by CoreLogic:

|

|

|

Source:CoreLogic |

CoreLogic’s head of research, Tim Lawless, said:

‘Contrary to popular belief, federal elections don’t have all that much impact on housing cycles.’

Why would they?

Land values rise at a faster pace than general economic growth, for two main reasons:

1. Land is not produced; its supply is fixed. Yet we need it for everything we do!

We live on it, sleep on it, work on it, play on it.

We derive all our sustenance from it.

Look around you and try and find one thing that’s not made of the product of land? You’ll pull up short!

2. The market for land is conducted like a game of Monopoly!

Landowners are rewarded with a great windfall dollop of unearned income (economic rent) from speculating that someone will rock along in the future and pay more.

The financiers sit at the top of the pile — they mortgage the earth. Reaping a continuous stream of interest to trade on a multitrillion-dollar derivatives market.

Until we strip the incentives away from the land market that reward this behaviour, we’ll continue to experience the boom/bust housing cycle ad infinitum!

This is why, folks, my best advice to you is buy land!

Why bet against a sure thing?

Once the election results are in, we can expect a rush to market either way.

That’s not to say the whole house of cards cannot come tumbling down.

At some point, the debts will rise above the productive capacity of the economy to pay.

But that’s not now!

Find out why here.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia