Junior lithium developer Lake Resources [ASX:LKE] this morning provided an operational update for its Kachi Demonstration Plant in Argentina.

While its dispute with technology partner Lilac Solutions over performance timelines is still ongoing, Lake Resources came out today to say work on the Kachi demonstration plant is still going ahead.

Lake said both it and Lilac are ‘confident on-site operations will be successful.’

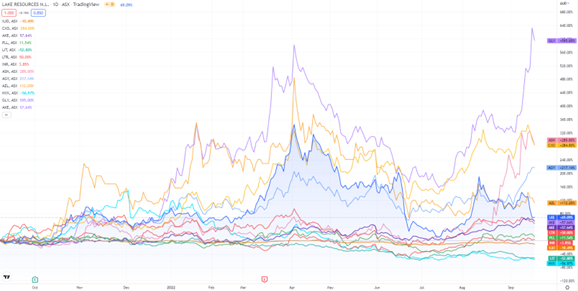

LKE shares were up as much as 19% in early Monday trade but are still down 35% in the past six months.

Source: Tradingview.com

LKE’s Kachi plant update

After sliding in share price last week in the wake of an awkward dispute announcement, the lithium miner today provided an update on its site works and commissioning for its Kachi Project in Argentina.

The miner sought to quell some of that anxiety by asserting both Lilac and Lake are continuing to work together and believe the work at Kachi will be ‘successful’ despite any ongoing disputes.

LKE provided an update on the goings on at the Kachi site, which included:

- The plant facility has now finished constructed

- Dry commissioning began last Wednesday

- Wet commissioning is expected to begin on September 22

- On-site processing of Kachi’s brines is expected in the first week of October

LKE says its test program has been based on an operational goal of 1,000 hours, with the first 2,000 litres of lithium concentrate to be converted into lithium carbonate.

The lithium carbonate will then be appraised by a tier 1 battery quality producer.

LKE appears confident its product will pass the necessary specifications and earn the required validity for marketable EV (electric vehicle) batteries.

On this note, the company stated that it is partaking in offtake talks, which may soon reach final decisions made by Lake’s board members.

Lake confirmed it will provide further updates on Kachi’s testing, works, timelines, and milestones — and, of course, on the ongoing (currently unresolved) dispute with Lilac.

Is it a forked road for Lake Resources?

While LKE did say it continues to work with Lilac on the Kachi Project, the dispute over performance timelines is still not resolved.

Should today’s update that both parties are still undertaking ongoing work at Kachi indicate an amicable resolution is forthcoming?

Will Lake amend its agreement with Lilac and avoid arbitration?

The market will find out one way or another soon enough.

Lithium and its intertwined fate with EV adoption

In 2021, lithium stocks dominated the ASX — eight of the 10 best-performing stocks on the All Ordinaries in 2021 were lithium stocks.

But lithium stocks haven’t fared as well in 2022, with many of last year’s high-flyers trading well below their 52-week highs.

Is it too late to tap into the lithium sector, then?

Not quite.

Money Morning has recently published a research report on three overlooked ASX lithium stocks. Access it for free here.

Regards,

Kiryll Prakapenka,

For Money Morning