The Lake Resources [ASX:LKE] share price spiked 15% today following a non-binding MoU with Hanwa for up to 25,000tpa of lithium carbonate.

LKE shares were up 15% in afternoon trade, at one stage trading as high as $1.98 a share, an all-time high.

After a lull to start the year, where LKE stock traded for around 95 cents, Lake Resources shot up over 100% in the last month alone.

LKE has gained over 590% in the last 12 months, as the ASX lithium sector continues to enjoy momentum.

The question is, how long can this momentum last?

Source: Tradingview.com

Lake’s MoU with Hanwa

Lake Resources has signed a Memorandum of Understanding (MoU) with Japan-based major trading company Hanwa to provide for an offtake of up to 25,000 tonnes per annum of lithium carbonate (LCE) over 10 years.

The proposed LCE load will be priced at average quarterly benchmark market prices.

LKE said the MoU also leaves open the possibility for Hanwa to provide…

‘Financial support mechanisms such as a meaningful equity investment, potential prepayment on offtake, and trade finance facilities in order to secure a long-term agreement and build up a sustainable partnership with Lake.’

LKE commented that partnering with a A- credit rated partner such as Hanwa could ‘de-risk the project for financers and investors.’

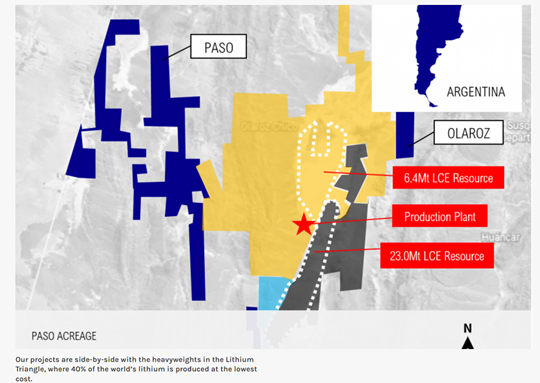

Source: Lake Resources

Lake Resources share price outlook

Under the MoU, LKE and Hanwa have agreed to negotiate in good faith to secure a legally binding agreement.

Lake Resources also said Hanwa is willing to…

‘Coordinate a strategic partnership between not only Hanwa and Lake but also companies in the downstream of the battery supply chain to jointly develop a unique and effective supply chain.’

Lake’s chairman Mr Stuart Crow commented:

‘This MoU and finalisation of a binding offtake agreement with Hanwa will allow Lake to stay an independent supplier into global lithium supply chains and ensure security of supply to the market and potential customers.

‘Increasing customer and consumer scrutiny around the environmental credentials of lithium production and concerns about security of supply has given us the confidence to enter into this partnership with Hanwa.’

Lake’s ongoing negotiations with Hanwa are promising — but investors will likely look to see if the terms considered under this MoU become binding as part of any legally binding deal.

As the run-up in LKE’s share price shows, lithium is still a hot investment theme.

But as always, we must ask how much of the growth is already priced in.

How long can this lithium boom last?

We ponder these questions in our latest research report on ‘Three Overlooked ASX Lithium Stocks That Could Soon Rocket Higher on the Fast-Growing EV Revolution’.

Well worth a read!

Regards,

Kiryll Prakapenka,

For Money Morning