The dispute between lithium developer Lake Resources [ASX:LKE] and technology partner Lilac Solutions has finally come to an end, with both parties signing an amended contract and putting the issue of conflicting milestones to bed.

Lake’s shares were rising around 4.5% earlier today, to a steady 2% increase by the early afternoon.

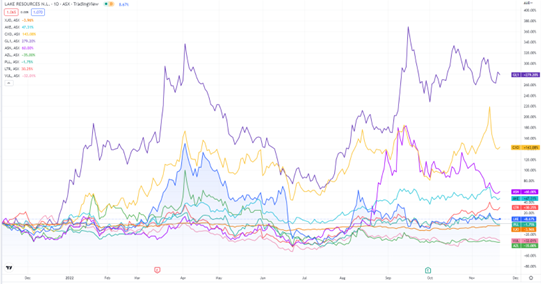

Over the past 52-week cycle, LKE’s share price has increased by 25%, 14% higher than the sector average.

By comparison, miners Global Lithium [ASX:GL1] and Core Lithium [ASX:CXO] have surged 301% and 150%, respectivley, over the last 12 months, while more established developers Vulcan Energy [ASX:VUL] and Arizona Lithium [ASX:AZL] have dipped 29% and 28%, respectivley.

Source: TradingView

Lake and Lilac resolve their dispute

The project partners have resolved their dispute over performance timelines first flagged in September and realigned shared goals by entering an amended contract.

These differeing views were evidently not outlined in the initial agreement signed a year ago.

While Lake was holding Lilac to deliverabilty targets in September, Lilac had the impression it had until the end of November.

Now the two parties have reached a shared resolution, ‘resetting’ the relationship and adopting a ‘one team’ approach to the project once more.

Both parties agree the new timeline is achievable, though, if Lilac does not meet the agreed testing criteria within the new time frame, Lake will be ale to exercise specific buyback rights.

Kachi Plant operations

The Kachi demonstration plant has been operating at a continuous 90% ‘steady state’ for the past 600 hours, on track to reach the planned 1,000-hour target.

Three weeks ago, Lake announced the first ‘at spec’ lithium produced at the plant, at an 80% lithium recovery rate.

The plant continues to produce lithium chloride concentrate at specification, in keeping with previous test results.

LKE stated the plant has now produced more than 15% the forecast output since coming online —20,000 litres lithium chloride and counting.

This is consistent wth the company’s planned operational schedule. Lake stating:

‘The Kachi Demonstration Plant continues to produce in-spec LiCl solution between 1900 and 3800 mg/L.

‘Previous testing on Kachi brines at Lilac’s California headquarters Oakland delivered 1400-2354mg/L.’

Full steam ahead

Hatch engineers will travel to Argentina to validate operations in coming weeks, and Lilac is now prepping samples for shipment to Oakland, where the product will be converted into EV-battery-quality lithium carbonate.

Lake’s CEO David Dickson commented:

‘We are fortunate to be working with Lilac as our partner, who is equally interested in doing things differently so we can efficiently deliver the large volumes of high-quality lithium chemicals needed by battery makers.

‘Lilac has worked extensively with Kachi brine since 2020, generating the data needed for engineering studies. These next steps, along with the strong alignment of our companies, are quite encouraging.’

Lake’s open praise of its tech partner’s work is a stark contrast to defamatory comments made by short-seller J Capital in July, when Lake’s choice in Lilac’s extraction technology was challenged.

Lilac Solutions’ CEO David Snydacker states:

‘Lilac and Lake are working together closely to set a new standard for pace of project development in the lithium industry. Progressing the on-site plant from completion of construction to shipping of on-spec bulk samples of lithium chloride in just two months is significantly faster than conventional projects move, where commissioning of evaporation ponds typically takes many years.

‘We expect to continue to improve upon the traditional project development timeline as we advance toward commercial production, ultimately bringing the Kachi project on-line years ahead of competing projects.

‘This will put the Kachi project in an excellent position to supply the lithium raw material urgently needed by automakers and capture the high prices we see in the market due to the failure of conventional approaches.’

Booming commodities

Forget lithium for a second.

There are plenty of other commodities investors have been overlooking.

Our resources editor and geologist and commodities expert James Cooper believes Australian resources are soon to enter a new commodities boom.

He calls it the ‘Age of Scarcity’.

And the best part is, Australia (and ASX stocks) are lined up to benefit.

Read James’ extensive report on the topic, accompanied by a compelling ‘plan of attack’ — both of which you can access right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning