Lake Resources [ASX:LKE] shares are down by 19.47% — trading at 38 cents a share today — after the company’s latest announcement reduced production estimates that were promised last year and delayed production from its Kachi Project.

LKE currently sits in the top 10 most shorted stocks of the past week — with 8.9% of its shares held in short positions.

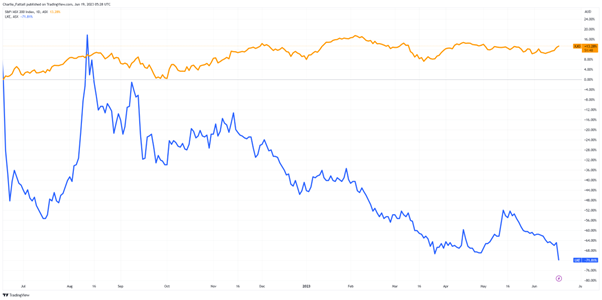

It’s been a tough year for the Australian lithium producer — with shares down by 74.6% in the past 12 months.

What’s next for the company?

Source: TradingView

Lake Resources underwater

Lake Resources’ announcement today has sent shares tumbling after the company pushed back its production estimates by three years.

Today’s statement claims the company has a clear path to battery-grade lithium carbonate production by 2027.

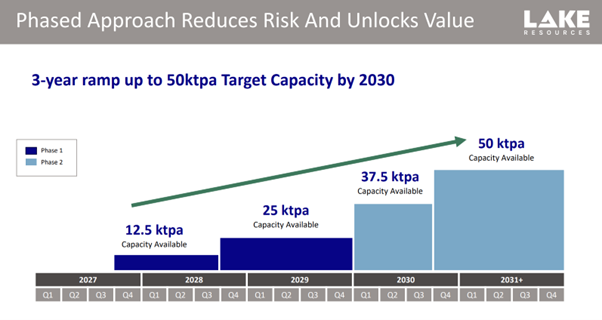

Investors are not impressed by LKE’s updated plan. The new plan deviates from the early 2022 ‘Target 100’ objective of achieving a production capacity of 100,000 tonnes of lithium by 2030.

These goals were then pulled back in September 2022 to 50ktpa by 2024.

The new planned two-phase development will create two 25Ktpa plants within the company’s Kachi brine project in Argentina.

The planned modular plants will see production ramp up over time, eventually hitting 50ktpa by 2030.

Source: Lake Resources

Lake CEO remained positive with today’s announcement, stating:

‘The plans announced today to the ASX show a clear path to battery grade lithium carbonate production in 2027 and phased expansion to a target of 50ktpa by 2030.

‘Our new, phased approach de-risks project execution while ensuring battery grade lithium carbonate comes to market in a cleaner, efficient way.’

It appears investor patience has run out for LKE management. However, here’s why the move might still be worth looking at.

Outlook for Lake Resources shares

Lake Resources faces an uphill battle from here.

Production concerns may extend beyond pushed timelines as LKE and partners Lilac Solutions attempt new production methods.

Backed by the Bill Gates-led fund Breakthrough Energy Ventures, the hope is to create a more sustainable lithium production.

However, these methods have yet to be scaled to the production levels Lake Resources has promised from the Kachi Project.

The proposed plans need a lot to go right — but hopes may lay in future demand.

Lithium prices have yet to break out this year — with the price top of CNY¥597,500 per tonne (AU$122,000) reached in November 2022.

Producers at the time were taking advantage of government subsidies and ramped up production until the end of 2022, creating unsustainably high inventory levels.

As China slowed and demand cratered, we saw a 20-month low of CNY¥165,500 (AU$33,800) at the end of April this year.

But things are starting to turn around.

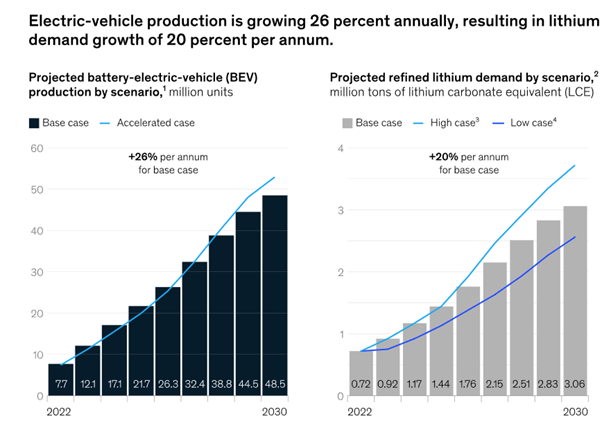

As net-zero policies and subsidies kick in, we are projected to see EV production and lithium demand growth of around 20% per year.

Source: McKinsey & Co

The coming breakout

But it’s not just lithium that could see a huge rise in demand with EVs on the road.

Industry studies have shown that the average EV requires at least 80 kilos of copper.

Certain copper stocks are making big moves in 2023.

Want to know where to find the hidden gems?

If you subscribe to Fat Tail Commodities, you can instantly download the most recent insider report on the subject from James Cooper — all for free.

James will give you instant tips on three of the latest top stock picks for the copper industry. He’ll also cover the copper supply crisis and how best to take advantage — right now.

Interested in jumping at a potentially lucrative opportunity reserved for the shrewdest of investors?

Find out more and click here today.

Regards,

Fat Tail Commodities

Comments