Lake Resources [ASX:LKE] resumed trading on Thursday after releasing a response to J Capital’s negative report published on Tuesday outlining its short thesis on the lithium stock.

J Capital (JCap) — known for its short reports on the likes of Vulcan Energy and Nearmap — questioned the economic viability of Lake’s Kachi project and its key technological partner, Lilac Solutions.

On Thursday, LKE sent out its rejoinder, arguing JCap ‘puts forth incorrect information on technical matters and inaccurate assertions’.

LKE shares slumped as much as 17% in early trade before rebounding somewhat by the afternoon.

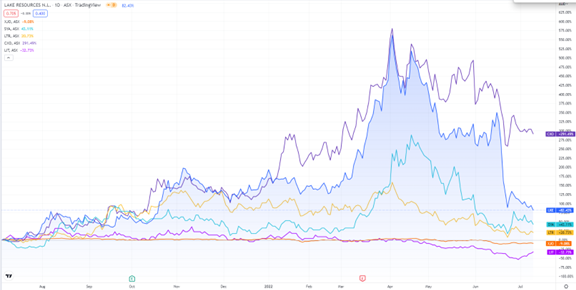

At the time of writing, LKE shares were down 5%:

Source: TradingView.com

Lake Resources addresses JCap claims

Lake dove straight in, stating JCap’s information is incorrect and holds ‘inaccurate assertions on Lake Resources’ progress to-date’.

In its report, JCap questioned the direct lithium technology of Lake’s key partner Lilac Solutions.

JCap noted that other lithium developers — like ASX-listed Anson Resources [ASX:ASN] —trialled and ended their relationship with Lilac.

JCap also noted that Warren Buffett’s Berkshire Hathaway Energy Renewables parted ways with Lilac earlier this year.

Lake countered by claiming the JCap report’s ‘description of DLE processes does not pertain to Lilac’s ion exchange technology. It is criticising the wrong process’.

Lilac itself responded, with CEO David Snydacker tweeting on Thursday:

‘The short seller attack on Lake Resources misses the facts.

‘Lilac’s IX beads deliver 500-1,000+ IX cycles, not 100-150.

‘Hatch engineering shows opex around $4/kg, validated by >10,000 hours of test work, not $30/kg. And Lilac’s 40 tpa-lce plant is in Argentina and ready to go.’

In regards to JCap’s argument that Lake is putting all its eggs in the Lilac basket, hitching its fortune to the success or failure of Lilac’s DLE tech, LKE had this to say:

‘There are over 50 direct extraction processes in use across industries and Lake examined a number of different processes in order to select Lilac Solutions. With Lilac’s proprietary ion exchange chemical process, Lake intends to efficiently deliver the large volumes of high-quality lithium chemicals needed by battery makers. Lilac has worked extensively with Kachi brine, generating the data needed for engineering studies.’

Lake then released a photo of the warehouse that will house the demonstration plant that’s currently being built, saying the plant modules will be delivered on site by 20 July.

Source: Lake Resources

Needless to say, J Capital wasn’t impressed, tweeting:

Source: Twitter

What about LKE management selling their shares?

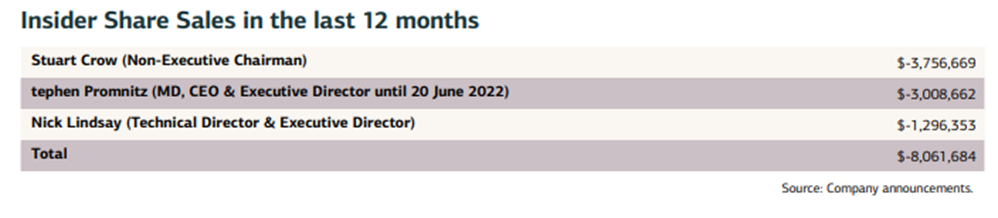

JCap’s report also focused on LKE directors selling their shares in large numbers over the last 12 months, including some transactions that seemed unmet in meeting disclosure obligations.

J Capital’s point about management selling their shares was exacerbated by outgoing CEO Stephen Promnitz’s abrupt resignation and selling of his LKE stake.

Source: J Capital

In response, LKE focused on its corporate and compliance frameworks, undertaking a review to ensure ‘all directors and senior management are both fully away of the various statutory and ASX Listing Rule duties’.

However, LKE did not address the reason behind the recent selling of its directors.

Now, while lithium stocks have been hit hard lately — none more so than LKE — the world where most of us drive EVs is still in the future, and the world will need plenty of battery materials to get us there.

Our small-cap expert Callum Newman recently penned a report on battery material stocks.

He thinks there are ASX stocks flying under the radar who could be the next ‘chosen ones’ — stocks tipped by Tesla to be their battery materials supply partners.

Callum thinks that one of the three battery stocks in his latest report ‘could be one of the most exciting nickel projects in the world’.

To find out more, read Callum’s latest battery materials report, ‘Elon’s Chosen Ones’, here.

Regards,

Kiryll Prakapenka

For Money Morning