Lake Resources [ASX:LKE] requested a trading halt on Tuesday to respond to a negative report from short-seller J Capital.

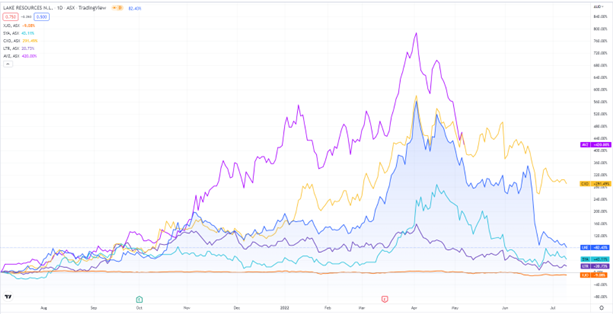

LKE — one of the most shorted stocks on the ASX before J Capital published its report — has been in a steep correction in 2022.

LKE shares are down more than 70% since April as the stock deals with a wider lithium sector sell-off and management upheaval.

Now, it will have to deal with J Capital’s report, just like fellow lithium stock Vulcan Energy [ASX:VUL] did last year.

Source: Tradingview.com

J Capital’s report on LKE

In its report titled ‘Remote Chance’, J Capital cast doubt on the prospects of LKE turning its lithium project into an economical and productive lithium mine.

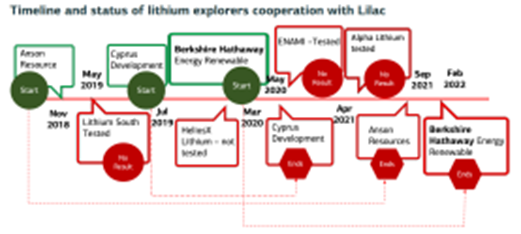

JCap questioned LKE’s key technological partner Lilac Solutions and its ability to execute its direct lithium extraction technology.

According to JCap, several companies had partnered with Lilac and ended operations without providing test results:

‘Lake has hitched its cart to Lilac’s yet-to-be-proven technology. Investors still have no evidence that the Lilac DLE technology works at scale, and if so, at what cost.’

Source: JCap

JCap also questioned LKE’s practice of offering stock options to research companies in return for favourable research reports.

According to JCap:

‘Lake has granted various financial services companies, who produce research in respect to Lake, with 41.5 mln in options (which, converted at today’s share price, would equal stock to the value of $62 mln).7 These research companies have published favourable research on Lake, some without disclosing any conflict of interest at the time of publication.’

JCap also argued that LKE has broken promises regarding its pilot lithium plant.

The short seller said a working pilot plant — which is key to the Kachi Project’s success — is three years behind schedule.

While Lake Resources has dispatched a pilot plant in recent months to the Kachi site, JCap remains sceptical:

‘Lake has now dispatched a pilot plant which has yet to arrive and which has yet to be demonstrated that it works on-site. Given the delays over the past three years we expect the pilot plant will also take time to be commissioned and may take longer to work if it will at all. The crucial question will remain how many cycles Lake will be able to get from its medium operating the pilot plant on site.’

Now, while lithium stocks have been hit hard lately, none more so than LKE, the world where most of us drive EVs is still ahead of us, meaning the world will need plenty of battery materials to get us there.

Our small caps expert Callum Newman recently penned a report on battery material stocks.

He thinks there are ASX stocks flying under the radar who could be the next ‘chosen ones’ — stocks tipped by Tesla to be their battery materials supply partners.

Callum thinks that one of the three battery stocks in his latest report ‘could be one of the most exciting nickel projects in the world. I’m not kidding’.

To find out more, read Callum’s latest battery materials report, ‘Elon’s Chosen One’, here.

Regards,

Kiryll Prakapenka,

For Money Morning