Today we’re going to jump into the data that spells trouble for the green energy transition.

We’ll look at the problem, the miscalculations and the single-minded approach that’s put the global economy on a path toward heightened energy volatility.

So, what’s the end game for net zero?

Higher energy costs, an erosion of living standards and much higher inflation!

But for every downbeat forecast lies an opportunity. That’s what we’ll uncover in this piece for those of you who are looking to take shelter from the energy transition fallout.

But first, what exactly is the problem and how did we get here?

It starts with a lack of new oil and gas discovery.

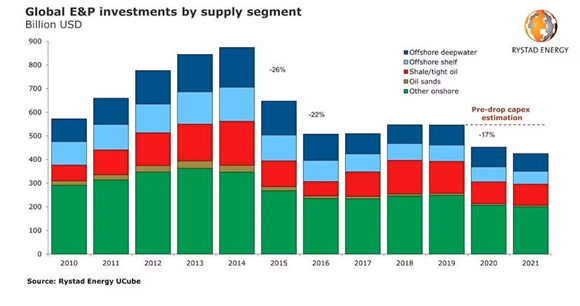

Around eight years ago, discovery for new oil and gas fields began to hit multi-decade lows on the back of falling capex spending.

As you can see below, investment in O&G development started to dry up in 2015 and has steadily declined in the proceeding years…

|

|

| Source: Rystad Energy |

It’s why the research group Rystad Energy started to warn of future supply problems back in 2015… precisely when new discovery hit multi-decade lows on the back of declining investment (the lowest since 1952).

But the warning fell on deaf ears.

Five years later and the energy analytics firm identified that we’d now entered the lowest rate of oil and gas discovery in 75 years.

We’d need to go as far as 1946 to repeat that level.

So why is that a problem?

Well, go back to the 1940s and this post-Second World War era held a global population of around 2.5 billion…

Fast forward to today and the global population stands at around 8 billion.

With many more mouths to feed, homes to heat, and cars and trucks on the road, it’s not surprising that our energy needs have grown exponentially over that period.

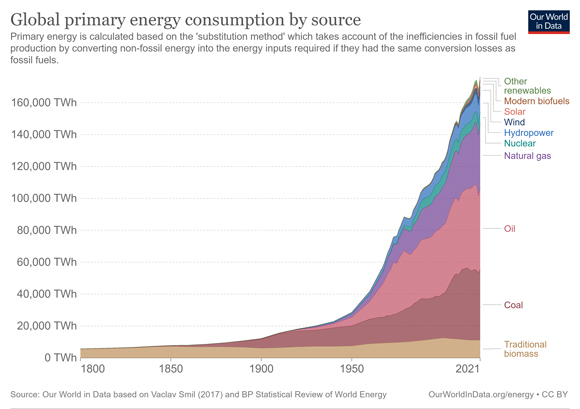

As the graph below shows you, in 1946 energy demand stood at 20,000 TWh (terawatt-hours).

In 2021 demand escalated to a staggering 160,000 TWh.

Same rate of discovery from 75 years ago but an eight-fold increase in energy demand!

|

|

| Source: Our World in Data |

That puts incredible pressure on current reserves and sits at the heart of the looming energy problem…

Rapidly declining oil fields without replacement reserves in sight.

It’s why the world’s largest oil producer is sounding the alarm bells on energy security.

According to Saudi Aramco’s chief, spare capacity for oil and gas supplies now runs extremely tight at just 2%.

Any uptick in demand will likely push prices far higher.

But some would argue the threat of energy volatility is overblown.

China’s re-opening in late 2022 following the prolonged COVID-19 shutdown should have placed enormous pressure on demand…but the supply crunch never happened.

Why?

Well, as the latest data shows, China’s reopening has remained tepid…perhaps deliberately, as it attempts to avoid its own energy crisis and surging inflation.

Industrial production for April rose by 5.6% year-on-year compared to the 10.9% expected by economists surveyed in a Reuters poll.

Well below expectations.

It masks the fundamental problem…supply remains incredibly tight.

Given that it takes up to 10 years from discovery to first production, any pressure on the supply chain could create enormous volatility.

This brings us back to the underlying problem…political leaders have successfully put their stranglehold on oil and gas development. But at what cost?

Stagflation, lowered living standards and economic depravity are all consequences of far higher energy prices. These are the outcomes the global economy experienced back in the 1970s, albeit relatively brief.

In reality, no government would purposefully evoke energy volatility.

It builds civil dissent and brings into question a government’s ability to lead.

But what this current looming energy crisis does achieve is a steadfast global push to bring about renewables BEFORE oil and gas depletion rears its ugly head.

The impetus to do so has been brought forward thanks to a decade of underinvestment in the fossil fuel industry.

With that in mind, are we going to create the vast solar panels, wind farms, and electric vehicles in time to avert the looming ‘supply gap’ in our energy needs?

According to some high-level academics, the problem is not so much a supply gap, but rather a permanent shortfall of energy supply.

You see, when it comes to transitioning away from fossil fuels, the key issue is the availability of critical metals.

The supply of which is dictated by new mineral discovery and mine expansion…both capital and time-intensive undertakings.

A copper mine for example can take up to 15 years from discovery to maiden production.

Barrick Gold’s [NYSE:GOLD] Reko Diq project on the border of Pakistan and Afghanistan is one of the world’s largest copper developments but has taken more than a decade to move beyond feasibility.

But it’s not just the time lag in bringing new mines into production — it’s also the sheer quantity of critical metals needed to end fossil fuel reliance.

It’s why some researchers have questioned our ability to ever reach net zero.

Looming oil and mineral shortages mean that you must own resource stocks to protect (and grow) your wealth.

Brace yourself for extraordinary demand.

Regards,

|

James Cooper,

Editor, Fat Tail Commodities

PS: Due to the King’s Birthday public holiday, there will be no edition of Fat Tail commodities on Monday, 12th June. We will return to our regular publishing schedule on Wednesday, 14th June.

Comments