In today’s Money Morning…why work when handouts pay more?…end of the line for the US dollar…don’t get left behind…and more…

[Editor’s note: Lachlann Tierney sits down to chat with Murray Dawes, who is an absolute chart guru. They talk about the most common mistakes that traders make and how Murray limits risk in his trades. They finish the chat with a capstone discussion of what they are seeing in the market at the moment as the S&P 500 approaches new all-time highs. Filmed on Tuesday, Murray’s comments were borne out last night as the major US indices sold off on inflation fears. It’s fascinating stuff! Watch it here on our YouTube channel.]

As you’ve probably already heard, inflation is the talking point for all investors today.

Overnight it was reported that the US CPI rose by 4.2% during April. The biggest surge in inflation data since 2008.

Putting the stark reality of loose monetary and fiscal policy in the spotlight.

For Wall Street, it incited a blood bath. Both the S&P 500 and NASDAQ sold off heavily. Down 2.2% and 2.7% respectively.

But, how did the White House respond?

They tried to brush it aside as a totally fine and expected result, of course. Stating that this was simply a ‘normalisation’ of prices as the economy continues to recover.

I can tell you right now that there is nothing normal about what is happening.

This isn’t a price rebalancing, it’s price destabilisation. Fuelled by reckless and unabated money printing and government handouts. As well as being exacerbated by supply chain flash points; brief but damning issues that have been responsible for more sudden price rises.

US lumber prices are a prime example, up nearly 400% over the past year due to strong demand but weak supply. A consequence of domestic lumber mills being restricted (by force) to curb output in order to mitigate the pandemic.

But while these supply chain issues will resolve in time, the bigger issues won’t. And we’re seeing that unfold right now with one of the biggest US labour shortages ever…

Why work when handouts pay more?

Aside from inflation numbers, earlier in the week another damning statistic was US job demand.

According to Labor Department reports, 8.1 million new jobs were listed in March. The most on record since December 2000.

Seems like that should be a major win for the US economy right?

After all, more job listings mean less unemployment, and therefore a stronger economy. At least in theory.

Trouble is, just because these jobs are being made available doesn’t mean people are taking them…

Despite all these new positions, only six million people in the US were hired in March. And while that may seem like a decent take-up, the shortfall is clearly biting certain sectors harder than others.

For instance, a survey from the National Federation of Independent Business revealed that 44% of small businesses had positions they couldn’t fill. Another recordbreaking stat to add to the mix.

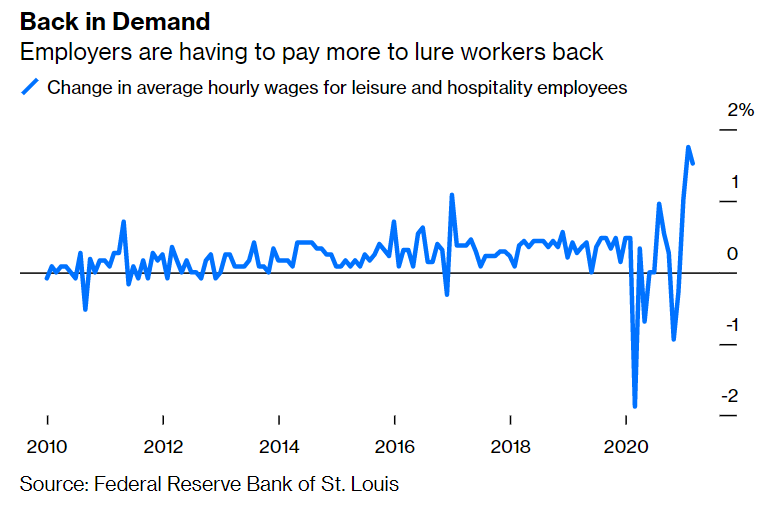

Indeed, it is clear that service workers — particularly within the leisure and hospitality sectors — are needed the most. As can be seen by back-to-back increases of wages in these industries of 1.5% or more in both February and March.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Which, as Conor Sen points out in a Bloomberg opinion piece, hasn’t happened since 1981. Just take a look at this chart to see the sharp turnaround:

|

|

|

Source: Bloomberg / Federal Reserve Bank of St. Louis |

As for why this has happened, well there are a few major reasons.

There is obviously still the ongoing threat of the pandemic. Leaving more wary workers to refrain from taking a job that forces them to interact with a multitude of people on a daily basis.

Not to mention the possibility that many workers would probably rather take a job in other industries, if available.

But perhaps most importantly of all, why would you work for less pay when the government will give you more money being unemployed?

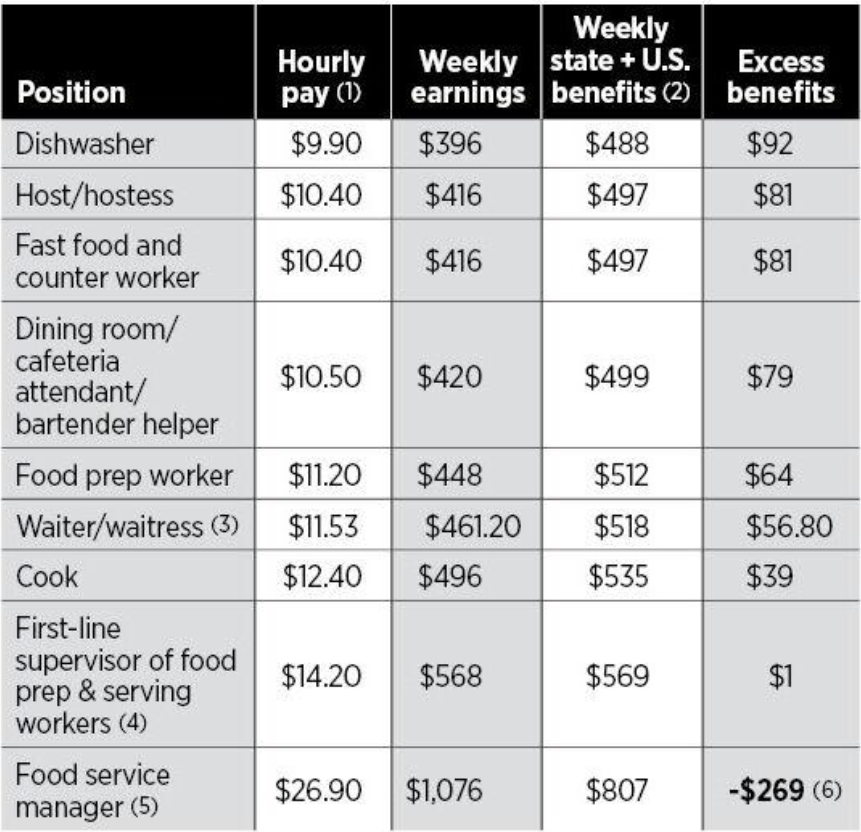

Don’t believe me, well just look at these findings from local reporters in Lancaster County, Pennsylvania:

|

|

|

Source: Lancaster Online |

Every position, bar the higher paid managerial role, would earn more money from government handouts. A pretty strong incentive to not to go to work, wouldn’t you say?

So, the only logical solution for these businesses in desperate need of workers is to pay more. And that, dear reader, is more than likely to be the real slippery slope that leads to the inflation time bomb that so many are worried about.

Because while tinkering with prices of goods and services is somewhat possible, it is much harder to take away wage increases from people.

End of the line for the US dollar

Now, how all of this plays out remains to be seen. Especially seeing as many of these ‘benefits’ will come to an end around September.

But by then the damage may have already been done.

Like I said, if wages keep rising in these service sectors, it is going to be damn near impossible to start cutting pay once the benefits go away.

More importantly, it also feeds into a longstanding issue in the US which has a fairly low minimum wage compared to other developed nations. Especially when compared to Australia’s fairly progressive stance toward this policy.

But I digress.

The point is the US is headed towards a labour crunch that will only spur inflation further. All of which will likely put further pressure on businesses and the broader economy.

And what is the Fed and White House doing about it?

Pouring more gasoline on the fire, of course!

Because even if the Fed raises interest rates at this point, it will be far harder to rein in the behind-the-scenes quantitative easing (QE). Spending that continues to fuel the asset price bubble.

Meanwhile, Biden in his benevolence, continues to increase debt and throw free money at whatever he pleases. All in the name of recovery, despite the fact that the US economy is now showings signs of running too hot.

As billionaire investor Stanley Druckenmiller puts it:

‘I can’t find any period in history where monetary and fiscal policy were this out of step with the economic circumstances—not one,

‘I think it is more likely than not within 15 years [the dollar will] lose reserve currency status.’

All thanks to this new wave of inflation that has gone unheeded.

And as for Druckenmiller’s thoughts on what will replace the dollar, well he has been fairly candid in his opinion that some sort of cryptocurrency will take its place.

Whether it be bitcoin, Ethereum, or perhaps even a coin that hasn’t even been created yet. Because as he highlights:

‘The quality of the competition that’s going to come against the incumbents in this space is going to be brutal. That’s why I think it’s just too early to call who is going to be the winner when it comes to the payment system, commerce, that kind of stuff.’

Which is a very reasonable opinion to have. Because right now, despite what we’ve seen from the price of bitcoin, Ethereum, and even oddities like Dogecoin, the cryptocurrency ecosystem is still in its infancy.

The full blockchain revolution is still yet to come, but with each day that passes, it is clear that the world needs it now more than ever.

So don’t get left behind.

Because when the dust settles after this next crash, fiat currencies will be all but obsolete.

You can mark my words on that.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.