The Kogan.com Ltd [ASX:KGN] share price is down 13% today after overestimation of inventory and rising warehouse costs prompted KGN to issue downgrades.

The Kogan share price was exchanging hands for $8.80 per share at time of writing, well off its 52-week peak of $25.57.

This year’s selling pressure reflects Kogan’s challenges with sustaining and dealing with the rapid growth it recorded during last year’s lockdowns.

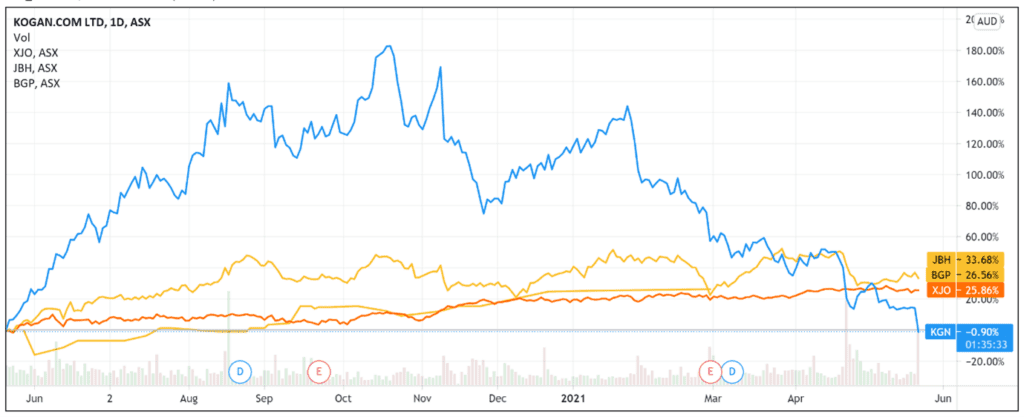

KGN shares gained more than 160% between May and October last year, but the sharp sell-off in 2021 saw all those gains wiped out.

Over the last 12 months, Kogan stock is down 7% and down more than 50% year-to-date.

Kogan’s April foreshadowing

In its April 2021 business update, Kogan admitted that in the three months to March 2021, customer demand fluctuated ‘below the levels seen in the prior nine months to December 2020.’

That led to KGN storing more inventory than it wanted or expected, incurring ‘high storage expenses and demurrage fees.’

In that release, the retailer assuaged concerns by noting it was ‘progressively working towards optimising the inventory position to reflect current market conditions by increasing its promotional activity.’

Today’s downgrade update, however, suggests Kogan’s inventory efforts are taking longer than planned.

The costs of growth

Kogan’s ASX update today took a reflective tone when discussing the costs that come from doubling in size in a year.

The retailer admitted it has had to ‘progressively resolve the operational challenges that come with this growth.’

KGN significantly expanded its inventory and grew its logistics footprint to 31 facilities, many of which were only established in the last five months.

Such frenzied expansion resulted in ‘near-term supply chain inefficiencies and inventory planning challenges.’

Echoing its April business update, Kogan acknowledged that customer demand in April ‘remained consistent with the levels seen in the three months to March 2021.’

These levels were below those recorded in the nine months to December 2020.

Kogan again reiterated its preferred strategy to battle this trend, with the retailer set to increase promotional activity.

This, of course, will eat into its gross margin and elevate marketing costs.

Kogan did note that the demurrage costs it flagged in April are now resolved.

Demurrage imposed ‘significant abnormal costs on the business over the past five months’, but Kogan does not expect ‘any material demurrage issue to arise in future.’

Kogan share price outlook

KGN expects to return to normal inventory levels and marketing spend ‘as the current inventory is progressively reduced over the coming few months.’

But to get there will mean a revised outlook.

Kogan now forecasts operating performance to ‘continue to be challenged in the near-term.’

The retailer expects its adjusted EBITDA for FY21 to be in the range of $58 million to $63 million. This would represent an 11% to 18% miss to market expectations.

RBC Capital Markets analyst Tim Piper said Kogan ‘significantly overestimated’ customer demand and are now facing the repercussions.

Piper stated that Kogan’s projections imply the retailer will be break-even on an underlying EBITDA basis in the fourth quarter.

On top of that, Piper declared that ‘some of the issues impacting margins and costs are transitory and will be resolved, however, we remain of the view FY22 earnings expectations are too high and expect material consensus downgrades.’

The analyst also worried that KGN’s ‘current level of demand being seen has moderated through recent months despite the heavy price discounting, promotional activity and elevated marketing costs.’

It is worrying, too, that these downgrades come just as the Australian Bureau of Statistics reported solid retail turnover.

Australian retail turnover rose 1.1% in April (seasonally adjusted), a 25.1% increase from the same period last year.

The monthly increase was better than the 0.5% rise expected by economists and was also the second highest such reading on record.

Indeed.com economist Callam Pickering commented that ‘with JobKeeper finished, and JobSeeker reduced, we believe that retail spending could moderate over the remainder of the year.’

However, Pickering also noted ‘there was certainly no signs of that during April, with spending remaining at an impressively high level.’

If you think the momentum for ASX retail stocks is waning and are searching for a new sector with potentially larger upside, then I suggest reading our free report on the renewables revolution.

The report outlines three ways you can invest to capitalise on the $95 trillion switchover from fossil fuels to renewables.

Regards,

Lachlann Tierney,

For Money Morning.

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.