At time of writing, the share price of Kogan.com Ltd [ASX:KGN] is up 1.94%, trading at $20.00, on the announcement of a new partnership with Beam Communications Holdings Ltd [ASX:BCC].

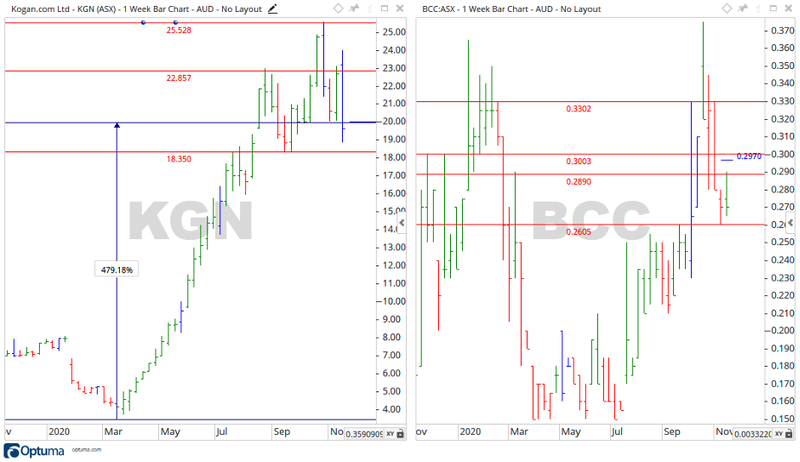

Source: Optuma

Kogan keeps marching forward

This year saw the online retailer record huge profits and user growth as people that were stuck at home due to COVID-19 turned to online shopping.

As you can see below, from the low in March the Kogan share price saw a run up over 479% to where it trades at the time of writing.

Along with 11 million monthly website visitors and over 2.2 million active customers.

Source: Opumta

Kogan is now partnered with Beam communications and will sell their ZOLEO.

ZOLEO connects with your phone or tablet to provide seamless global messaging that follows you in and out of mobile coverage

Beam’s managing director and chief executive officer, Michael Capocchi, said:

‘Our partnership with Kogan will give us access to a wider group of consumers ahead of the important Christmas shopping period. “Many more Australians will be heading to regional and remote holiday destinations during the summer break and with 80% of Australia’s land mass not covered by mobile, consumers will benefit from having uninterrupted and reliable connection.”’

This partnership might be coming at just the right time, with the lockdown restrictions lifting, people will be looking to get out and about again in nature — I know I am!

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Who stands to benefit the most?

Kogan is experiencing an exceptional year and everything seems to be pointing up.

For Beam, the partnership with Kogan is a great building block.

Source: Optuma

In the charts both companies saw some volatility creep in over the last few weeks.

I see Beam as the big winner out of this deal. Kogan will give them more exposure to customers and more unit sales to complement their already established sales channels.

If the share price pushes to the upside, then the levels of 30 and 33 cents may become the target for Beam.

Kogan on the other hand grew most of the year, but over the last few weeks looks to have tapered off.

Coming into Christmas would usually be a great time for retailers, but in the year of COVID-19 anything can happen.

Should Kogan fall back, then the level of $18.35 may come into focus. Conversely, if it moves to the upside, then we may be looking at $22.85.

2020 is the year of the online, but I don’t think this can last forever and could be due to come down soon.

For a small company like Beam, adding another sales channel like Kogan will just help to spread the word of who they are and add more sales. This could be a good company to watch in the future.

Regards,

Carl Wittkopp,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.

Comments