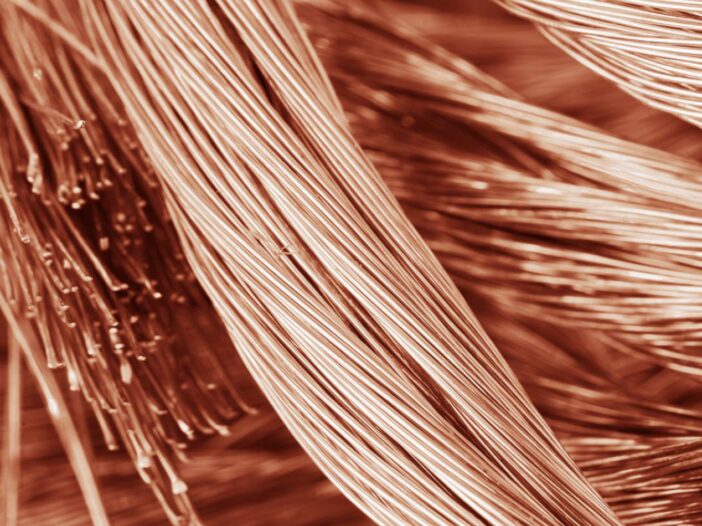

It seems KGL Resources Ltd [ASX:KGL], like many others, has been captivated by Dr Copper.

The base metal that is renowned for its ability to pre-empt economic booms.

The Share Price of KGL are up 4.35% at time of writing. Climbing on the back of a series of big announcements from the company today. All of which revolve around a substantial capital raise, and plans for their much-anticipated Jervois copper project.

Let’s dive into the details, shall we.

$23.77 million to fund feasibility study and more

As KGL declared this morning, they’ve already tapped strategic and sophisticated investors for $12 million. Cash that will help the company fund its upcoming endeavours.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

However, on top of this, KGL is hoping to gather a further $11.7 million from retail shareholders. Extending similar terms from the strategic placement to regular investors. Albeit with a cap in place.

If all goes to plan though, it will mean KGL will bank $23.77 million. A sizeable capital injection that will give them the freedom to follow through on some key plans. First and foremost of which is the completion of their Full Feasibility Study.

As Executive Chairman Denis Wood explains:

‘At Jervois the aim is to recommence infill and step out drilling to increase the resource base and extend the current mine life and project economics.

‘We will also seek to leverage the strong correlation observes between DHEM analytics and mineralisation, as evidenced from the work done in recent years. As such some of the proceed will be directed toward additional geophysics and drilling of key greenfield exploration targets at Jervois.

‘KGL’s geological team are excited about the potential exploration success on their tenements given their improved understanding of the areas structural and geological setting, and ability to use technologies to better target mineralized zones.’

No doubt the surge in copper price and demand is also pushing KGL to act faster. As they will want to capitalise on this boom while it is in full swing.

And for shareholders, this is no doubt why the KGL share price is on the up today. Despite the fact that capital raisings usually have a dilutive effect on existing stock.

A sign that KGL may have more good signs ahead.

What’s next for KGL Share Price?

Looking ahead, the clear focus for KGL is obviously conducting and finalising the last of its investigation: A process that has no real deadline or end point.

KGL simply has to do what it needs to in order to make Jervois a compelling project. One that, should it go ahead, will likely require a lot more capital.

In order to reach that goal, management will need to do their best to present an economically attractive proposal. A goal that should be made easier by the aforementioned rise in copper’s price.

However, the more pressing issue for KGL is that of a CEO.

Right now, the company is on the hunt for a suitable leader to helm their operation. Someone who will be able to advance the company’s current goals and deliver the Feasibility Study.

As such, they will want to act fast. Because the longer it takes to find someone, the more it will likely cost the company in valuable time and money.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

PS: For more copper and nickel stock ideas, check out our brand new report. Taking a detailed look at the current commodities boom and what may be next in this current ‘supercycle’. Plus, three of our favourite miners that you need to know about today.

Get all the details in the full report, right here.