The most shocking story last week came from Fed chief Jerome Powell.

Speaking at an IMF conference in Washington, the usually mild-mannered lawyer was engaged in a bout of Fed-speak.

The topic?

Inflation.

But no one expected what came next…

Only human

At first, it was business as usual:

‘We expect that the process of getting inflation sustainably down to 2% has a long way to go. The labor market remains tight, although improvements in labor supply and a gradual easing in demand continue to move it into better balance. GDP growth in the third quarter was quite strong. But, like most forecasters, we expect growth to moderate in coming quarters.’

Powell was suddenly interrupted by three climate change protestors who joined him on stage.

The encounter escalated:

‘Jerome Powell, by refusing to treat climate change like the systemic risk–’

‘Ok, thank you,’ Powell said calmly.

‘You are putting us at risk of economic disaster,’ she continued, as the camera feed was turned off.

‘Thank you very much,’ Powell reiterated off-camera before apparently addressing an aid. ‘Thank you. Just close the fucking door. Close the door.’

Powell dropping the f-bomb!

World markets weren’t prepared for this!

We’re so used to seeing our central bankers mechanically doling out bland statements, that to see the human side of someone like Jerome Powell was quite the shock.

Some enterprising entrepreneurs are already making hay:

|

|

|

Source: Etsy |

This mug will set you back $33 on Etsy.

And it’s a timely reminder…

Central bankers, government officials, and other powerful people are only human.

They’re not all-knowing.

They frequently make mistakes (ahem, remember our own ex-RBA governor, Phillip Lowe, stating confidently in 2022 that interest rates wouldn’t rise until at least 2024…).

And they can be as selfish or greedy as anyone else in society too.

We can’t just assume benevolent intent from our rulers as per some Platonic ideal.

The 20th century Libertarian author Murray Rothbard certainly didn’t think so.

He said it wasn’t just greed or incompetence you had to look out for either.

It was way worse:

‘Advocates of a limited government often hold up the ideal of a government…’umpire’ arbitrating impartially between contending factions in society. Yet why should the government do so? …the State and its rulers will act to maximize their power and wealth, and hence inexorably expand beyond the supposed ‘limits.’’

This is worth bearing in mind when you hear about some of the creeping agendas pursued in recent times by the political class.

Things like Central Bank Digital Currencies and the gradual stripping of any individual rights to privacy, are two areas that look like blatant power grabs to me.

But I digress…

Before he dropped the f-bomb, Powell was speaking on the hot topic of inflation.

He was saying it was still higher than they wanted to see it.

But to me this was just a bit of late-stage jaw boning. An attempt to keep the ‘higher for longer’ psychology in place.

You see, a slew of data from last week suggests otherwise…

Oil falls fast along with global freight

Last week, oil prices fell to their lowest price since July.

They’re already 17% down from the recent October high.

Commbank’s market research division noted that:

‘The US Energy Information Administration (EIA) now expects total US petroleum consumption to fall by 300,000 barrels per day (bpd) this year, reversing its previous forecast of a 100,000-bpd increase.’

In a related item, a tweet I read from an aviation blogger, said the mighty logistics company FedEx [NYSE:FDX] was encouraging pilots to switch to a regional carrier because there wasn’t enough freight demand to fill in everyone’s schedules.

A story in Freight Waves also reported that:

‘Global air cargo volumes are down more than 8% since the first quarter of 2022 and rates were 40% to 50% lower for most of the year versus 2022 — a function of weak manufacturing, a slow drawdown of excess inventories, retailers’ reluctance to restock because of uncertainty about consumer behavior and macroeconomic crosswinds.’

Not a good sign.

And if it continues, it’d certainly feed into lower inflation figures — and potentially higher unemployment — in coming months.

Indeed, some sources of unofficial price data I look at already have US inflation back within the target 2–3% band.

See it here:

|

|

|

Source: Truflation |

If this is true, then it seems clear we’re at the end of the tightening cycle.

At least one major borrower — the US government itself — could certainly do with lower interest rates!

Late last week, ratings agency Moody’s downgraded the US AAA credit rating from ‘stable’ to ‘negative.’

This was on the back of an auction of 30-year US debt that met with dismal demand.

Reuters reported that:

‘A U.S. government auction of 30-year bonds met a dismal reception on Thursday, driving down bond and stock prices and raising fears the United States may face difficulty financing spending to stimulate the economy.’

There’s a lot to unpack in this.

But the simple answer is that lenders are a lot more nervous about US credit than they’ve been in recent times.

It’s no surprise really…

Call their bluff

The US government has racked up an astonishing US$1.5 trillion deficit in the first 11 months of 2023.

The Federal debt has past US$33 trillion for the first time ever.

To make things worse, the higher interest rates go, the more the US government charges itself.

Rate rises are like pouring gunpowder onto a ticking time bomb…a bomb sitting under your own house!

And the clock is definitely ticking…

By the end of 2025, roughly half of all US Treasuries will have matured. Meaning, even older debt will roll over at higher interest rates.

At this point, a US administration would likely have to slash spending or hike taxes. Neither is likely to be politically possible.

Instead, we’ll continue to see more debt, deficits, bail outs, interest rate reductions, and other sneaky tactics of monetary debasement.

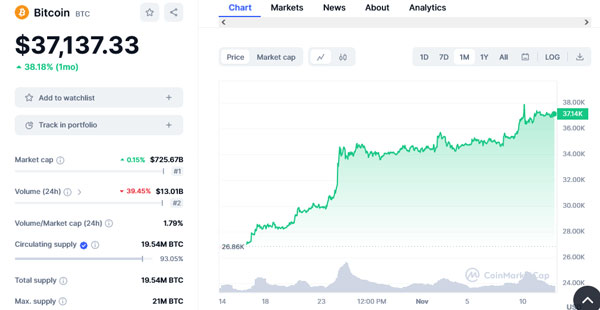

Bitcoin [BTC] has a nose for such things.

It surged from US$3,500 all the way up to US$69,000 on the back of the Covid-era largesse.

And it seems to be sniffing it out once again.

In 2023 it’s up 120% already — 39% of that coming in the last month alone:

|

|

|

Source: Coinmarketcap |

While some of this surge is based on talks of an imminent spot Bitcoin ETF approval, my take is it’s also based the conclusion that there’s no viable route out of the US debt spiral.

We’ll just get more of the same until something really breaks.

So, higher for longer?

I doubt it.

You might want to consider some Bitcoin, just in case…

Good investing,

|

Ryan Dinse,

Editor, Fat Tail Daily

PS: While freight may be down, the digital economy is still going strong. Microsoft [NASDAQ:MSFT] shares hit a new all-time high last week on the back of their fast-growing AI (artificial intelligence) tech. Earnings results surprised investors by almost 20%. A bunch of cloud computing stocks such as Snowflake Inc. [NASDAQ:SNOW], MongoDB [NASDAQ:MDB] and Digital Ocean Technologies [NASDAQ:DOCN] jumped close to 10% last week too. I think we’ll see a slew of tech company surprises in the AI space over 2024. This is a lot more than just a fad.