Australian neobank upstart Judo Bank [ASX:JDO] has captured traders’ attention today after posting its unaudited 1H24 results.

Investors bought heavily today as Judo rapidly expanded its lending book and maintained strong margins. Its shares are up by 17.65% this afternoon, trading at $1.10 per share.

Launched in 2018 as the brainchild of former NAB executive Joseph Healy, Judo Bank was purpose-built for small and medium-sized businesses.

It opened with a furore as the first bank float in 25 years, with an initial price of $2.10 per share.

Despite some success in taking customers away from the Big Four, the company failed to maintain its return on equity and interest.

Judo was then pushed to raise capital at the end of last year, further leaning on the share price.

The company’s shares are down by -23.3% over the past 12 months and -52% since its debut.

Source: TradingView

Judo trading update

Judo has reinvigorated traders’ interest in the bank in its first trading update for the year.

The six months ending 31 December 2023 showed marked improvement from the prior period.

Total income for the half year was $200 million, up from $188 million in the prior corresponding period (PCP).

The company also managed to maintain its expenses despite climbing wages, with a 5% increase in total costs to -$106 million for the half.

This resulted in profit before tax (PBT) of $67 million, up 24% from PCP and ahead of analyst consensus.

The bank said the PBT growth was ‘driven by continued above-system lending growth, strong net interest rate margins, continued investment in growth, and minimal write-offs.’

‘Above-system lending’ means its loan portfolio expanded faster than the industry average.

For the first half of FY24, the company’s net lending grew ~$800 million.

Throughout the period, Judo also saw sustained increases in its lending margins.

In the December quarter, its average gross lending margin on new lending was 464bps.

That was up from 398bps in the September quarter, and similar growth was seen in prior periods.

While these all point to much healthier books, Judo’s market share is still slim.

As of June 2023, its total banking market share was less than 2%, and its footprint is slim, at only 18 locations.

So what’s next for this neobank?

Outlook for Judo Bank

The company’s outlook for the second half of 2024 showed a slightly lower PBT.

Judo expects a PBT of $40–45 million for 2H24. This would mean a total year profit before tax of $107–112 million.

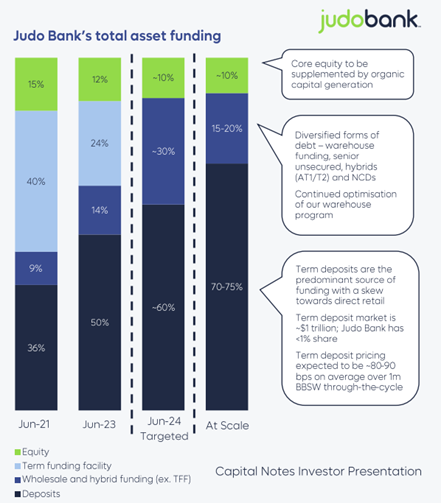

But the more significant concern for investors will be Judo’s funding.

The parent company, Judo Capital Holdings, said it was on track to repay all of its term funding facility (TFF) by June 2024.

Here is what that funding split looked like before the last capital raise.

Source: Judo Bank

This payback will mean its net interest margins (NIM) will continue to moderate from 3.02% as it repays its loans.

Where that NIM settles will be significant for Judo’s next move. The company expects its total FY24 NIM to be between 2.85–2.90%.

However, the 2H24 NIM will likely see a much lower point in the run-up to the repayment goals.

Thankfully, these lending factors should settle as the bank takes on more low-cost term deposits in the future.

Another large factor in the company’s trajectory is the current macro environment.

While strong growth was seen in business credit, other sectors have seen shifts away from borrowing.

Consumer discretionary spending and market sentiment are still down, making things uncertain for further lending goals.

From here, the bank expects economic conditions to stabilise and targets a 15% or higher profit growth in FY25.

For Australians, those sunnier days and rising lending demand may depend on the next move by the RBA.

Guessing the next cut is a much harder thing to predict.

Considering the state of the broader economy, I might hazard a guess and say August — at the earliest— but more likely September.

Whenever it comes, Judo Bank will be an interesting one to watch as interest rates fall.

Big News at Fat Tail

Before you go, we have big news here at Fat Tail.

Ryan Dinse and I are launching Alpha Tech Trader, a new tech-focused service.

We will be exploring the fastest-moving sector in the world right now: tech.

Whether it’s the latest AI, cloud computing or biotechnology, we have spent the past year finding some of the best opportunities for our readers.

With the explosive growth of Nvidia last year, everyone has been looking at the megacaps.

But what about the rest of the sector?

Who are the smaller players that you should consider today?

If you are unsure and want to learn more about the technology that runs our lives…

Then join our hotlist here.

By joining, you’ll get access to ‘AI Alpha ‘24’ where we will give you our top five AI stock picks to consider for 2024.

You don’t want to miss this opportunity as AI reshapes the world around us.

Regards,

Charlie Ormond

For Fat Tail Daily