Building services group Johns Lyng [ASX:JLG] has today confirmed its agreement with NZ Insurance provider Tower [ASX:TWR]. JLG provides building restoration services after damage by insured events.

The deal follows the opening of a head office in Auckland by JLG and investments into NZ’s Mainland Building Services. JLG has been busy, completing six acquisitions over the 2023 financial year.

JLG is now extending its footprint into NZ and stepping up its efforts to assist in the rebuild following Cyclone Gabrielle in February.

Shares of the JLG are up by 1.36% today, trading at $5.98 per share. Shares are down 14.45% for the past 12 months, dropping in late June as it raised acquisition funds.

Source: TradingView

JLG footprint expands

John Lyng now manages a portfolio of over 30 brands across 150 subsidiaries. Its revenue base exceeds $1.2 billion and employs 2,300 people across Australia, NZ, and the US.

This is the first contract signed by JLG with a major national insurer in New Zealand.

On 1 May 2023, JLG acquired an 80% interest in Christchurch-based Mainland Building Services.

12 years after the massive earthquake in Christchurch, rebuilding continues. 80% of buildings were destroyed during the quake and projects there continue.

In the aftermath of Cyclone Gabrielle, which affected North Island communities, rebuilding efforts will continue well into 2024.

Tower has been operating for over 150 years and has borne the brunt of the rebuild costs along with the NZ government.

CEO Nick Carnell said JLG was happy to be included within Tower’s supplier network:

‘Tower has a laser focus on the customer and ultimately delivering a positive experience. That is something we absolutely identify with.’

‘We are delighted to work with one of New Zealand’s premier insurance brands and this is a further demonstration that our business model can be implemented seamlessly across the Tasman and beyond,’ said Mr Carnell.

JLG’s global footprint now includes 109 locations in Australia, two in NZ, and 51 in the US.

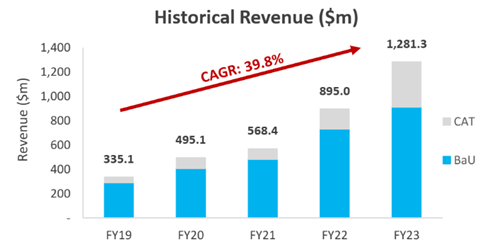

With the scale of disasters across the three countries in 2023, JLG has had a record year. Reporting a 43.2% increase in revenue to $1.28 billion.

Its statutory NPAT was up 64.3% to $62.8 million, mostly from rebuild contracts.

Outlook for John Lyngs

The company has made a solid start to FY24 and has reconfirmed its earnings guidance. JLG expects group revenue of $1.17 billion, with EBITDA of $128 million.

The impacts of extreme weather have seen longer-tailed recovery efforts. These have secured the company with a pipeline of work that is likely to continue.

Seen here as ‘CAT’ events in grey, these natural disaster repairs are likely to continue to be a strong contributor to future revenue.

Source: JLG

In addition to expanding its offices, JLG has also made strategic investments in home services.

The acquisition of Smoke Alarms Australia and Linkfire are two examples this year. Combined, they are forecasted to be 5% EPS accretive for JLG and fit well with its strata management business.

Another recent acquisition, A1 Estimates, should also match well. The service provides insurance repair estimates and helps speed up their efforts.

Its growing portfolio of defensive growth businesses should make it more immune to any economic headwinds seen in the new year.

The company will likely look towards organic opportunities within Australia and the US for future growth and could be one to watch.

Is growth the thing to look for?

With the stressful state of the market, growth isn’t many people’s priority.

The ASX 200 finally broke into the green today, up 0.81% for the past 12 months— not exactly booming.

But regardless of the benchmark’s poor performance, people are still making investment income.

That income is from dividend companies that don’t require you to speculate on ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers of a market going sideways.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily