Despite the jump today, shares in the giant retailer have been flat over the last 12 months.

As a result, JBH is underperforming the ASX 200 by 9% over the year:

Source: Tradingview.com

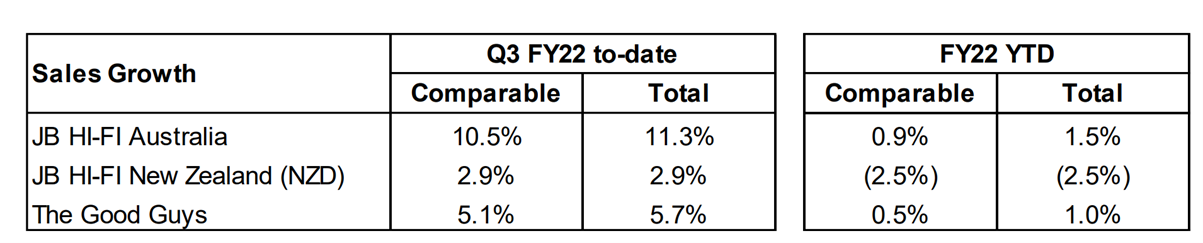

JBH sales growth

JB Hi-Fi reported that customer demand has been high, with strong sales growth for the period of 1 January to 23 March 2022.

The retailer said the sales growth — coupled with ‘disciplined cost control’ — led to ‘strong operating leverage across the Group.’

Source: JBH

JBH’s Australia segment performed best, with comparable store sales up 10.5% in the quarter. Total JB Hi-Fi Australia sales rose 11.3% quarter to date.

Year to date, this means the Australia segment has grown total sales by 1.5%.

In New Zealand, the results were also favourable to begin with: comparable store sales rose 2.9% quarter to date, with total sales up 2.9%.

Year-to-date comparable sales, however, were down 2.5% for the New Zealand segment.

For JBH’s The Good Guys segment, comparable sales went up 5.1% quarter to date, with total sales up 5.7%.

In an interesting development, JBH did not provide FY22 sales and earnings guidance, with macro uncertainty impeding projections:

‘Whilst the Group is pleased with the start to the second half, in view of the ongoing disruption arising from Covid-19 and other local and global uncertainties, the Group does not currently consider it appropriate to provide FY22 sales and earnings guidance.’

JB Hi-Fi share price outlook

JBH shares have had a turbulent 12 months, trading as low as $43 during the period.

But does the reported sales growth instil confidence in the company’s long-term outlook?

Forecast analyst estimates have JBH making $9 billion in sales in FY24.

For reference, JBH posted revenue of $8.9 billion in FY21.

While sales growth is important, it may be equally vital for JBH to maintain its ‘disciplined cost control’ as it seeks to improve margins and overall profitability.

Now, whether JBH is a good investment partly depends on how much one thinks the stock is worth.

But how do you come up with a fair valuation? What do you base it on?

If you’re interested in finding out how to approach valuing businesses, I suggest checking out our free report on just that.

Access our ‘How to Find Bargain-Priced Superstars after a Big Sell-Off’ here.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia