Australia’s biggest home entertainment products retailer JB Hi-Fi [ASX:JBH] provided a sales update for the three months January to March this year, with a mediocre display in Australian sales.

JB Hi-Fi posted a 0.8% increase in Australia, suggesting moderation in consumer spending during ongoing high inflationary environment. This is not helped by a slipping demand in electronic equipment, office equipment, and otherwise discretionary entertainment goods as workers return to offices.

Results also suggest our cousins across the Tasman Sea may not feeling as much of the strain, with New Zealand sales up by 10.8% in the quarter.

JB shares were still trading for a robust $45 at the time of writing, the retailer’s stock having moved up more than 7% so far this year and 6% in the last month alone, suggesting some love in this stock yet.

In the wider market, though, the same sentiment can’t quite be reiterated, with JBH having bumped down 12% by the two-month average comparison:

Source: TradingView

JBH’s third quarter sales are telling

This morning, the Melbourne electronics and entertainment retail giant posted its latest sales report.

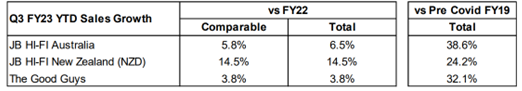

Sales growth for the company’s Australia division had delivered a small increase in comparison with FY22, yet the group did point out that there was a 38.8% increase on pre-COVID sales (FY19).

In New Zealand, sales had increased 10.8% compared with the prior year, and 30.1% more than FY19.

As for the group’s second business, The Good Guys, there was much less fanfare with the company reporting a 3.8% decline in sales year-on-year. However, it’s still an increase on pre-COVID sales of 22.4%.

You can see the group’s overall sales growth in the year so far:

Source: JBH

What JBH’s results say about the macro environment right now

With JBH’s Australian market barely up by a minimal 0.8%, it can’t be argued Australian consumer spending is moderating, discretionary spending in electronic equipment, office equipment and entertainment goods lowering as consumers become more considered about their budgets.

These recent unrelenting interest rate hikes have many questioning the persistence of inflation as it continues to hurt mortgage holders and retail companies.

If we needed any evidence of the impact, we could see some of it in the iconic store’s results today — a different story when compared to JB Hi-Fi’s record sales numbers last year.

JBH’s profits soared when COVID restrictions were first lifted and more shoppers returned to their stores. By July, group revenue had risen 3.5% on the year before to $9.3 billion.

Same-store sales growth went up 10.9% in Australia during the June quarter that same year.

Inflation has been hitting the real wage, and people have been feeling the effects over the past 6–8 months, taking away consumers comfortability with spending money on non-essential items while household budgets continue to be squeezed.

The big question is, how long will it take for the government to realise rate hikes alone can’t solve the problem?

Australia is set for a big change

Australia’s 30 years of abundant, robust trade has broken.

Global supply chains have changed and aren’t the same as what existed years ago.

You may have noticed there’s less on our supermarket shelves….

You may be wondering why inflation is so out of control, why the banks are closing branches, and why packaging is shrinking…while costing more!

Clues and signs are everywhere, but everyday Australians don’t know what it all means.

Jim Rickards, one of the world’s top financial and geopolitical analysts, does.

He says no one is talking about how the Australian economy, as we know it, may soon end.

It could happen as quickly as within the next 12 months, changing the way we all live.

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime, click here for more.

Regards,

Mahlia Stewart

For The Daily Reckoning Australia