Electronics and entertainment retailer JB-Hi-Fi [ASX:JBH] saw its shares rise on Tuesday after reporting record sales for the full year.

The entertainment merchandiser was up as high as 5% earlier this morning, before easing somewhat by the afternoon.

While up more than 10% this month, the retail stock is still down 13% year-to-date as investors remain uncertain about how a rising interest rate environment and a slowing economy will affect discretionary spending.

Source: Tradingview.com

JB-Hi-Fi’s record results for FY22

On Tuesday morning, JB-Hi-Fi released a sales update and preliminary FY22 financial results.

Total FY22 sales were up 3.5% to $9.2 billion.

JBH’s FY22 EBIT came in at $794.6 million, up 6.9% on the year prior. However, JBH said 2H FY22 EBIT rose 33% on ‘elevated sales growth and improvement in gross margins’.

The gross margin improvement in the second half of this financial year is likely a positive sign the retailer is managing inflationary pressures.

Net profit after tax rose 7.7% to $544.9 million.

Both the sales and earnings numbers were a record for the company.

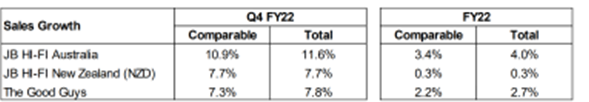

JBH’s Australia segment was again the best performer, with comparable sales growth rising 3.4% during the financial year.

JB Hi-Fi accounted for 67% of JBH’s total sales.

Source: JBH

Online sales remain strong

JBH also reported strong growth in online sales.

The retailer’s online sales rose 52.8% to $1.6 billion.

Online sales now account for about 18% of the group’s total sales.

Online sales represent 17.6% of the company’s total sales.

JBH share outlook

JBH said that it will be providing updated full-year results when it releases its full-year audited statutory results on 15 August 2022.

JB-Hi-Fi’s CEO Terry Smart was pleased with the retailer’s performance:

‘We are pleased to report record sales and earnings for FY22. The benefits of having a strong multichannel strategy were especially evident in the second half as Covid-19 restrictions eased and customers returned to shopping in-store, whilst continuing to shop with us online.

‘It is a credit to our over 13,000 team members who continue to remain focused on providing outstanding customer service and worked tirelessly to deliver this record result.’

JB-Hi-Fi’s record sales for the year came in 5% ahead of analyst consensus while net profit came in a significant 31% ahead of consensus.

So it seems analysts may have overestimated the impact of rising rates and inflation on JBH’s consumer.

Especially when we see JBH’s strong second-half performance.

Does this suggest the doom and gloom of high inflation and rising rates isn’t hitting consumer confidence just yet?

Time will tell…JBH’s next quarterly update will make for interesting reading.

From electronics to electric vehicles

Now, let’s switch from electronics to electric vehicles (EVs).

With the world shifting to EVs, demand for critical battery tech metals is rising.

Now, while lithium stocks have been hit hard lately, the overarching demand story is still there.

Although the easy money isn’t.

Playing the EV theme will take a smarter approach from now on.

Our small-cap expert Callum Newman has just written about his approach in a report on three battery material stocks.

Callum thinks that one of the three battery stocks in his latest report ‘could be one of the most exciting nickel projects in the world’.

To find out more, read Callum’s latest battery materials report, ‘Elon’s Chosen Ones’, here.

Regards,

Kiryll Prakapenka

For Money Morning