Investor-assisting global asset manager Janus Henderson Group [ASX:JHG] released its fourth-quarter results for the end of the calendar year 2022, revealing assets under management (AUM) increased 5% to the total of US$287 billion compared with the prior quarter.

Despite the increase in AUM, the equities and debt management group posted diluted earnings per share (EPS) of 39 US cents in the fourth quarter, which was less than the previous quarter.

Nevertheless, investors in the financial platform were supportive of the company’s steps to improve by issuing a higher share price to the stock by 13%.

Over the last year, the stock has gone down 20.5% and 27% under the wider market benchmark.

Source: tradingview.com

Janus Henderson’s AUM rises 5% on markets and US currency

Friday morning in Australia, the US-based financial group issued a press release that reported financial results for the fourth quarter and full 2022 year.

AUM increased by 5% to a total of US$287 billion when compared to the previous quarter, thanks to well-received market performance and depreciation of the US dollar.

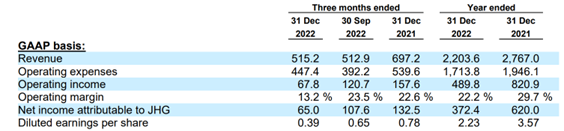

Operating income in the fourth quarter totalled US$67.8 million — much less than the US$120.7 million reported in the third quarter and even lower than the fourth quarter of 2021 (US$157.6 million).

Revenue was $515.2 million for the quarter ending 31 December 2022, down from the $697.2 million earned at the same time the year before.

Janus was undeterred, boasting a sound balance sheet with cash generation of US$1.2 billion in cash and equivalents and US$146 million cash received in its operations in the last quarter.

A quarterly dividend of 39 US cents a share came short compared with the third quarter’s 65 US cents and the fourth quarter of 2021’s 78 US cents. However, after adjustments were made, diluted earnings per share bumped to 61 US cents for the fourth quarter, which matched the third quarter, yet was still lower than the fourth quarter of 2021 (US$1.05).

The company returned US$358 million in capital to investors through dividends and share buybacks throughout the year. The company’s CEO, Ali Dibadj, spoke of benefits and strategies to oversee the coming year.

Mr Dibadj stated:

‘The global market volatility and headwinds in 2022 created one of the most challenging investment backdrops in history.

‘During the year, we created a strategic roadmap, added extraordinary talent and leadership, including on our Board of Directors, and started implementing cost efficiencies to provide the “Fuel for Growth” to reinvest in the business for growth…

‘The current environment remains uncertain. Our focus will be to control what we can control and position Janus Henderson for growth. We have a strong balance sheet, good cash generation, disciplined investment teams and processes, and tight cost management, which are essential to delivering superior outcomes for our clients, employees, shareholders, and other stakeholders.’

Source: JHG

Five bargain stocks for your portfolio

We’ve well and truly entered 2023, and many are optimistic that the challenges faced last year will soon be over.

But we’re not quite out of the woods yet.

With the tailwind effects of the pandemic still lingering, the continuation of inflation, the war in Ukraine, continually rising rates and tough cost-of-living conditions…households and businesses are still feeling the pinch.

The silver lining is that it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning