You know…sometimes you have to step back from the market…and chuckle at the great cosmic joke of it all.

See it through my eyes. For two years, in fact probably more, I heard practically nothing except stories about lithium.

The future, we were told, was batteries, renewable energy and electric cars.

Lithium stocks, in particular, soared to unimaginable valuations.

Admittedly, by the end, those share prices were ridiculous.

But the general trend of development seemed right.

Then the Ukraine war broke out and Europe was on the brink of freezing.

Meanwhile, the supply of uranium hasn’t nudged for over ten years because capital left the industry years ago. Uranium shares skyrocket.

Coal mines are a sin against God, except most of the emerging markets — and Australia — still get their electricity from burning it.

And gas? Fine if you live in Western Australia, because they at least have the smarts to reserve some of it. Victoria apparently barely has enough in storage to last a cold winter.

Now businesses are openly discussing whether they should leave Australia and go to the USA…because natural gas is dirt cheap there.

They frack so much stuff out of the ground it’s made the USA the indisputable energy champion of the world.

So the USA is happy to drill away, and supply the world with energy.

China and India have no choice but to use fossil fuels because of their gigantic populations.

Australia somehow manages to make a mess of all of it. Hence why smart investors need to get interested. Problem = opportunity!

Think of the abundance of energy resources in Australia…

We’ve got the gas, got the uranium, got the coal, got the lithium…we’ve got it all!

Then why, exactly, aren’t we drowning in low-cost energy?

Here in Melbourne, where I live, generally the “zeitgeist” is to hate fracking, coal, fossil fuels and capitalism in general.

Well…we’re going to get a test of our convictions soon if the energy dynamic continues on its current path.

It’s one thing to dismiss fossil fuels when they’re still heating your home, running your car and ensuring you have a job.

Now…how about when your pay packet – if you have one – is being shredded via energy at double, or more, of the cost?

It’s cold in winter in Melbourne.

We already have thousands of homeless in this state.

Are we going to add freezing conditions to those with at least a roof over their heads?

I’m not kidding. That’s already the reality in the UK for many, many people.

Australians, all over the country, are already getting slammed with the cost of living.

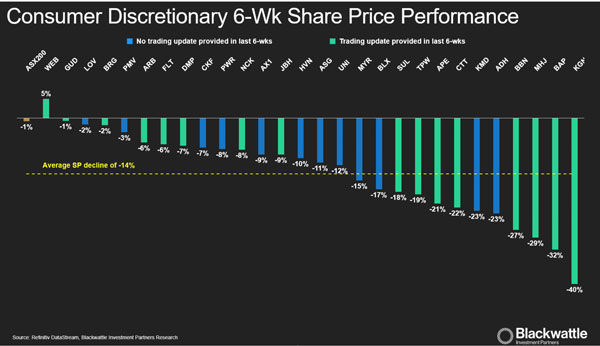

Look at this chart of retail stocks lately…

| |

| Source: Blackwattle |

Investors in the market can see discretionary spending at its weakest point in years.

The coming tax cuts help some…unless the extra money is swallowed in higher energy bills.

We know one thing. Australians are voting with their feet…and moving to Queensland in droves.

Queensland is a big coal and gas producer. There are good wages to be had there…and they don’t look like going away anytime soon.

You need to think like this now as an investor.

What I mean is that the domestic strength is going to appear in WA and QLD more than Vic and Tassie.

Why? That’s where the mineral and energy dominance resides. It’s the high paying, secure jobs…with better weather too.

This is just one angle to the current investment market. Do you want to own Whitehaven Coal [ASX:WHC] — an energy producer — or Woolworths [ASX:WOW] — an energy consumer?

Don’t ask me. Ask the man who’s been tracking this train wreck for years…my colleague Greg Canavan.

Greg made the call to buy Whitehaven years ago. At one point the subscribers who acted on that were up 800%.

And while we don’t know what will happen in the future…

…this story is not over yet. You can’t fix an energy grid like a Siri upgrade, wirelessly and remotely. It’s going to take years to get Australia back on track.

Oh, by the way, did I mention just running ChatGPT — artificial intelligence — might soon need the power grid of a city?

Goodness me.

Find out what’s coming up here.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments