In today’s Money Morning…the NASDAQ may push through resistance…it makes sense that Warren Buffett took the plunge on tech back in 2016…what do the signals mean?…and more…

Have you seen the NASDAQ recently?

It’s pushing to all-time highs.

That’s the real story, or part of it anyway.

All of this while a wild, multi-layered US-China trade war backflip is playing out across the media.

Here’s the nitty-gritty:

- White House trade adviser Peter Navarro said of the US-China trade deal — ‘It’s over’

- Subsequent Navarro comments claimed the two words were taken ‘wildly out of context’

- A Chinese foreign ministry spokesman then said, ‘He [Navarro] consistently lies and has no honesty and trustworthiness.’

Providing salve to the market, Trump then said on Twitter, ‘Hopefully they [China] will continue to live up to the terms of the agreement.’

Plenty of bluster on all sides — but here’s three signals which you should keep in mind amidst all this turmoil:

- The NASDAQ may punch through resistance, but tech behemoths are changing quickly

- Buffett’s bet on tech in 2016 was a sign that these companies could now be ‘too mature’

- FAMGA companies are cashed-up

I’ll sum up what these signals are pointing to at the end.

Signal #1: NDQ at all-time highs

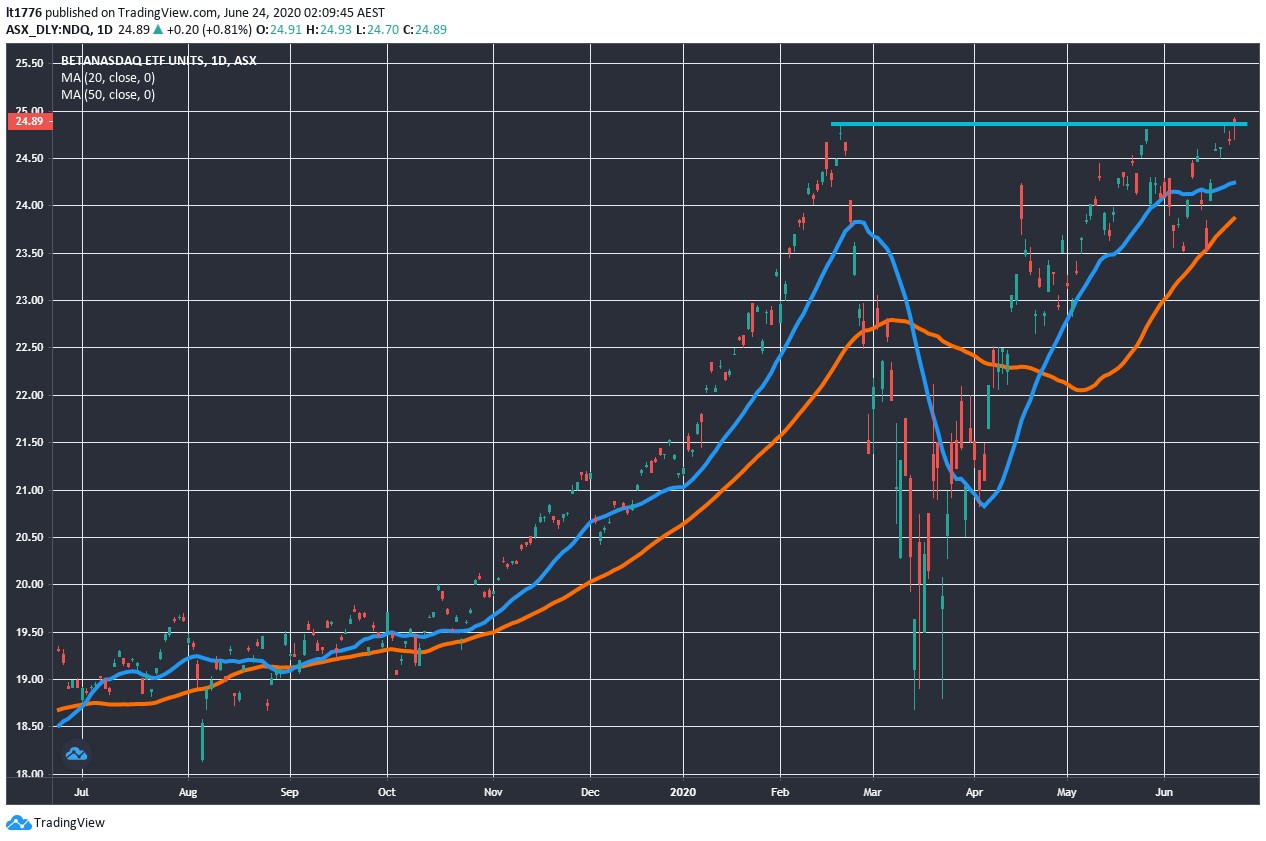

First up though, you can see how all of this is playing out for BetaShares NASDAQ 100 ETF [ASX:NDQ] below:

|

|

|

Source: Trading View |

As you can see there is a bit of resistance at the top which dates back to February.

The companies that make up this particular ETF are changing quickly though, expanding into new markets and parts of our lives.

With this growth, regulatory hurdles may appear in the coming years as governments raise taxes and anti-trust concerns.

The fact that the NASDAQ is just off all-time highs is important though.

This is the first signal for today.

I’ll go through two more signals and what they mean in a bit.

But for now, let’s consider what the world is telling us…

It’s not that surprising, really.

Basically, while the world continues to grind to a halt — those with heaps of capital are betting on tech.

It’s the only perceived way out and an investment bottleneck is forming.

If the coronavirus is the person yelling ‘fire!’ in the theatre, then all the exit signs appear to be emblazoned with the NASDAQ logo.

And if you dig into things, this could be a bit of a blind rush.

Sure, there’s momentum behind the index now, but consider this Aussie NASDAQ ETF.

With BetaShares NASDAQ 100 ETF Aussie investors can get a piece of what’s happening in the tech stock world in the US.

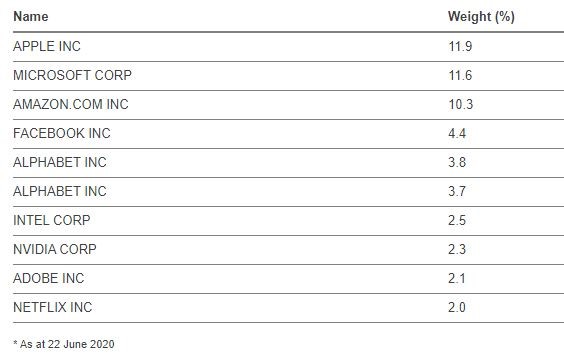

These are its holdings:

|

|

|

Source: BetaShares |

As you can see Apple Inc [NASDAQ:AAPL] leads the charge on the NDQ weighting, coming in at nearly 12% of the fund.

NDQ captures exposure to the top 100 NASDAQ stocks and its push to all-time highs is again, not surprising.

What follows in the weighting of NDQ is a who’s who of the Silicon Valley set.

These companies rocketed up after the 2000 bust as the world went online.

Old news.

But I believe they are slowly morphing into mature companies — some are dividend-paying companies.

These are the new utilities/infrastructure of lockdown:

- Apple phone

- Netflix subscription

- Amazon deliveries

- Facebook browsing

- Google everything

- Microsoft Teams for work

It’s a bit of an oligopoly on digital life to be sure.

[conversion type=”in_post”]

Signal #2: Warren Buffett buys Apple shares in 2016

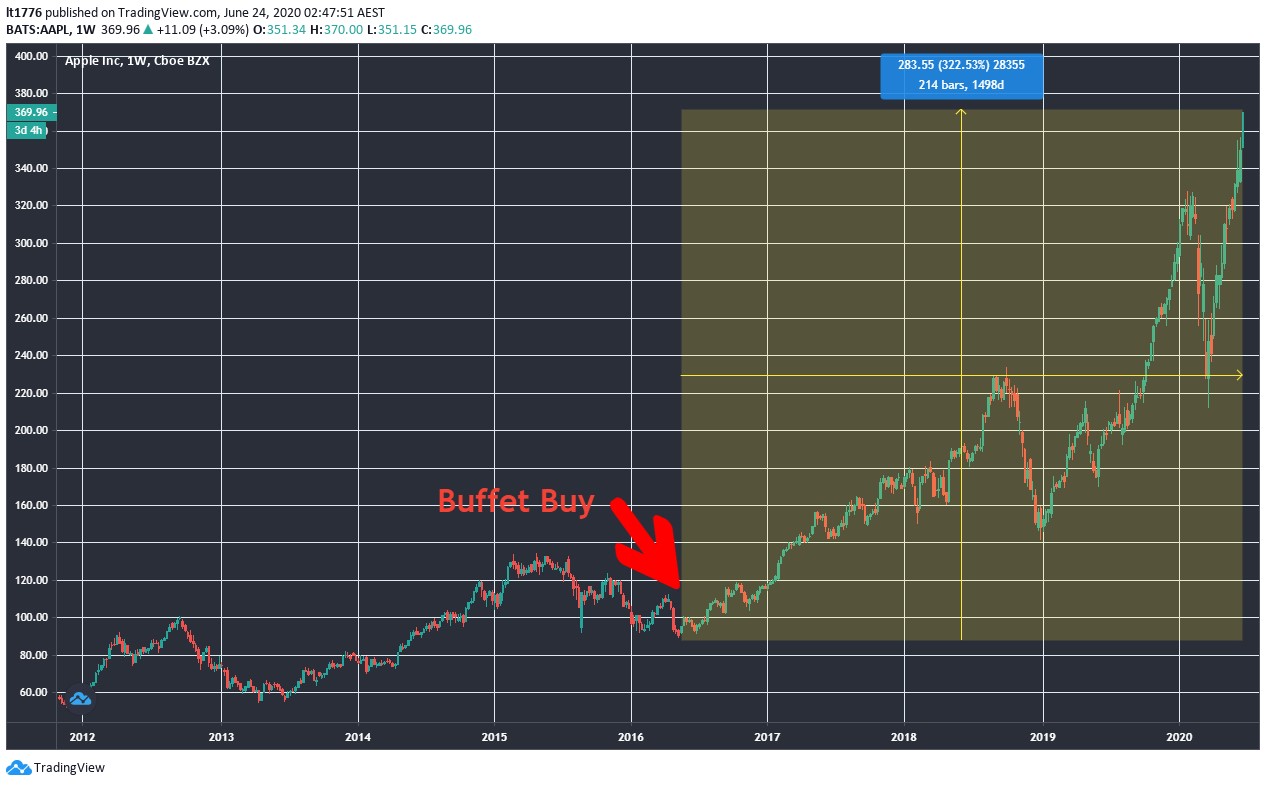

And it makes sense that Warren Buffett took the plunge on tech back in 2016.

In May of that year, Berkshire Hathaway bought its first 10 million Apple shares.

This is the second signal.

Below you can see the chart of Apple Inc [NASDAQ:AAPL], with the point where Buffett’s company bought the shares marked:

|

|

|

Source: Trading View |

Since the first buy, the Oracle of Omaha latched onto a 300%-plus gain on those 10 million shares.

Not bad!

Buffett even swapped the old flip phone for an iPhone.

He says, ‘I don’t think of Apple as a stock. I think of it as our third business.’

And:

‘It’s probably the best business I know in the world. And that is a bigger commitment that we have in any business except insurance and the railroad.’

But hold up.

What if Buffett had the foresight to pick up APPL shares way earlier, before the world went vertical?

A decade before, in 2006.

Berkshire Hathaway would’ve made a monstrous killing.

That’s not the way the Oracle works though.

He likes what I would call ‘future dinosaurs’.

What do I mean by that?

Steady/safe bets on the way the world works (now).

That’s alright for a massive investment conglomerate — whether it’s a sound strategy for a retail investor may be another matter.

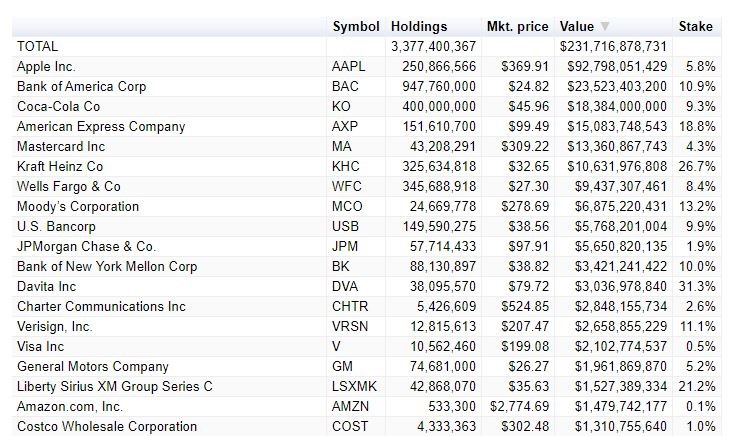

Check out Berkshire Hathaway’s holdings as of 31 March:

|

|

|

Source: CNBC |

Tech is now a big part of the mix courtesy of the AAPL shares.

There is also a swathe of what I would call ‘too mature’ companies.

I’m not saying Apple Inc is a ‘future dinosaur’ either, it’s possibly a stab at injecting some youth into the Buffett portfolio.

However, if you look at the companies on this list you are getting a snapshot of Western life and its constituent parts.

For now.

Many on this list have a nimble set of younger competitors nipping at their heels — particularly the banks.

So, what are the FAMGA (Facebook, Amazon, Microsoft, Google, and Apple) companies doing while Buffett edges towards them?

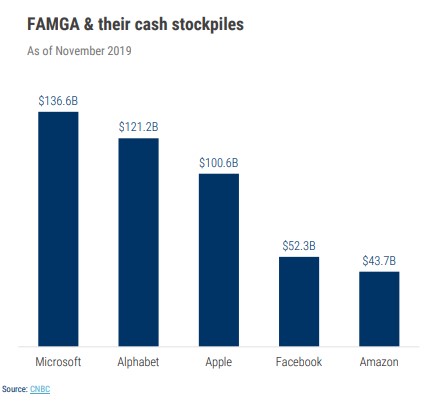

Signal #3: FAMGA cash stockpiles are turning into acquisitions

Prior to the pandemic, you can see the massive trove of cash they stockpiled:

|

|

|

Source: CBInsights |

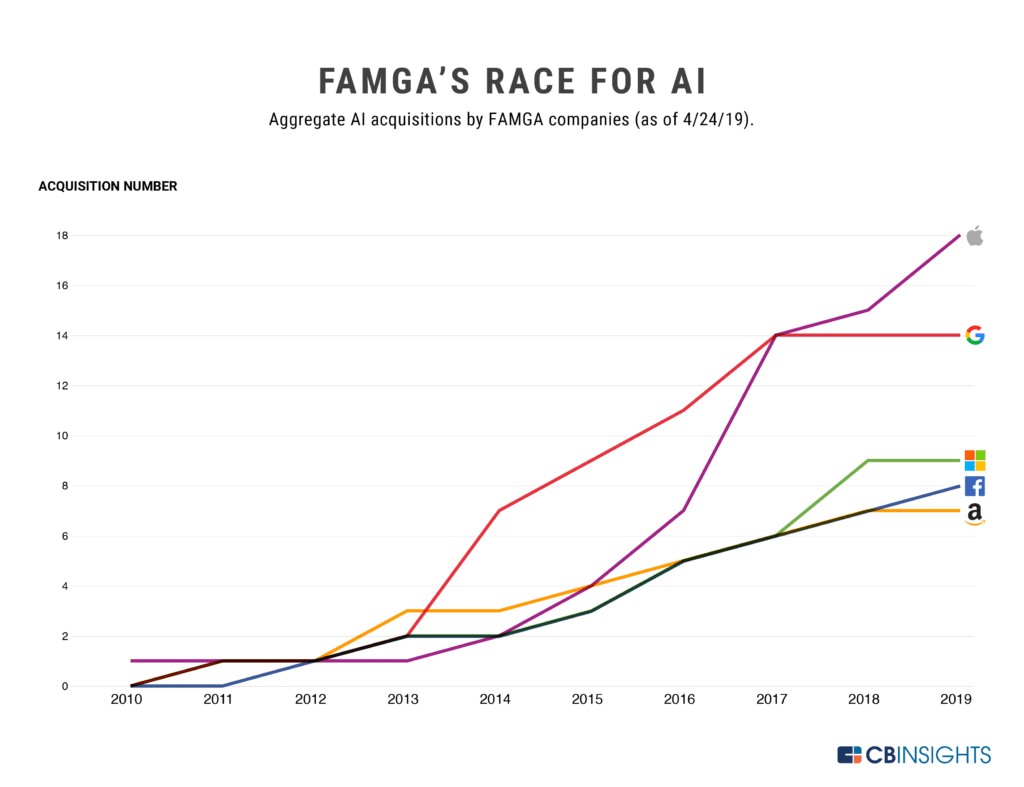

And what are they doing with it?

They are snapping up companies via acquisitions.

Value-accretive companies that can add a string to their bow, particularly in AI.

You can see this trend below:

|

|

|

Source: CBInsights |

This is the third and final signal.

What do the signals mean?

It means the savvy retail investor should probably not try and beat the analysts that work on these massive companies.

If you are buying the big tech stocks in the US, at some point there could be a pivot in the rationale behind these investments.

They could even become defensive plays!

And…

You should keep your eyes peeled for the acquisition targets of FAMGA cash.

ETFs like [NDQ] may well be the new ‘safe’.

Watch out for the words ‘safe’ attached to any investment.

We will see if the tech giants become just as boring as the bank stocks that came before them.

Regards,

Lachlann Tierney,

For Money Morning

PS: ‘The Coronavirus Portfolio’ The two-pronged plan to help you deal with the financial implications of COVID-19. Download your free report.