Dear Reader,

Well, that’s it then.

Last week I wrote that here in Melbourne we were — maybe — halfway through the lockdown. Then on Sunday we tacked on another six weeks and increased it to Stage 4…

And, we are three days into Australia’s first ever curfew.

It’s not my first curfew though.

The last one I remember was in 1989. I was living in Argentina back then.

The country was going through a bout of inflation that had escalated out of control. That is, there was hyperinflation, which reached a high of 5,000%. Yep, you read right, 5,000%.

It was madness.

As soon as people got their salaries on the first day of the month, they would rush to queue at exchanges to trade their Australes for US dollars to keep the value of their salaries.

You see, every hour that went by their money was worth less. When people see the value of their money erode, they will look for an alternative store of value.

But this led to the currency devaluating against the US dollar even more.

Hyperinflation meant that the central bank-issued notes in the value of 1, 5, 10, and 50 Australes weren’t doing the job.

To keep up with hyperinflation, the government had to print larger and larger value notes: 1,000, 5,000, and 10,000.

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

I’ve even kept one from that time. Here is a picture of it:

|

|

|

Source: Selva Freigedo |

At one point, they had to issue notes of 500,000 to keep money circulating. People were carrying millions in their wallets.

Prices changed constantly. You would buy a coffee in the morning and by the afternoon the price had changed.

Supermarket employees — or most retailers for that matter — spent their time restocking the shelves AND repricing items. Some just didn’t even bother with prices anymore.

Others closed because by the time restocking came around prices had increased so much the money that they had received for their sales didn’t cover the amount needed to buy more stuff.

To keep up with inflation, salaries were indexed to the previous inflation rate. That is, people got salary increases every month…but they still would lose money.

All the media talked about was inflation numbers and price expectations.

It’s probably why I try not to bother too much with that today. It’s a good time to spend more time with those around you, reach out to friends and family…do things you may have been putting off instead.

But back to the story. This uncertainty led to shortages and lootings. That’s when the curfew came in. Schools and banks closed; people couldn’t move around.

[conversion type=”in_post”]

Those were extraordinary times, much like today.

In 1989, hyperinflation robbed us of our money.

This time it’s a virus that’s frozen up society and that’s changing our standard of living.

These moments are life-changing events. How you position yourself to handle this crisis will likely change your future wealth.

Since Victoria went into lockdown, the S&P/ASX 200 has increased by 1.8% to reach above 6,000 points. Around the same level it was trading in March this year before all of this started.

There’s clearly appetite for risk

Crises can be huge wealth-making opportunities if you are positioned right and have the cash.

But I don’t think we’re there yet.

These moments can also bring in massive wealth loss.

Markets seem to be completely ignoring the fact that close to 25% of our economy is in lockdown for another six weeks.

That small businesses are in a lot of pain…

Unemployment is at 7.4% and likely rising. This number would be much larger if it wasn’t for JobKeeper.

And things are changing quick.

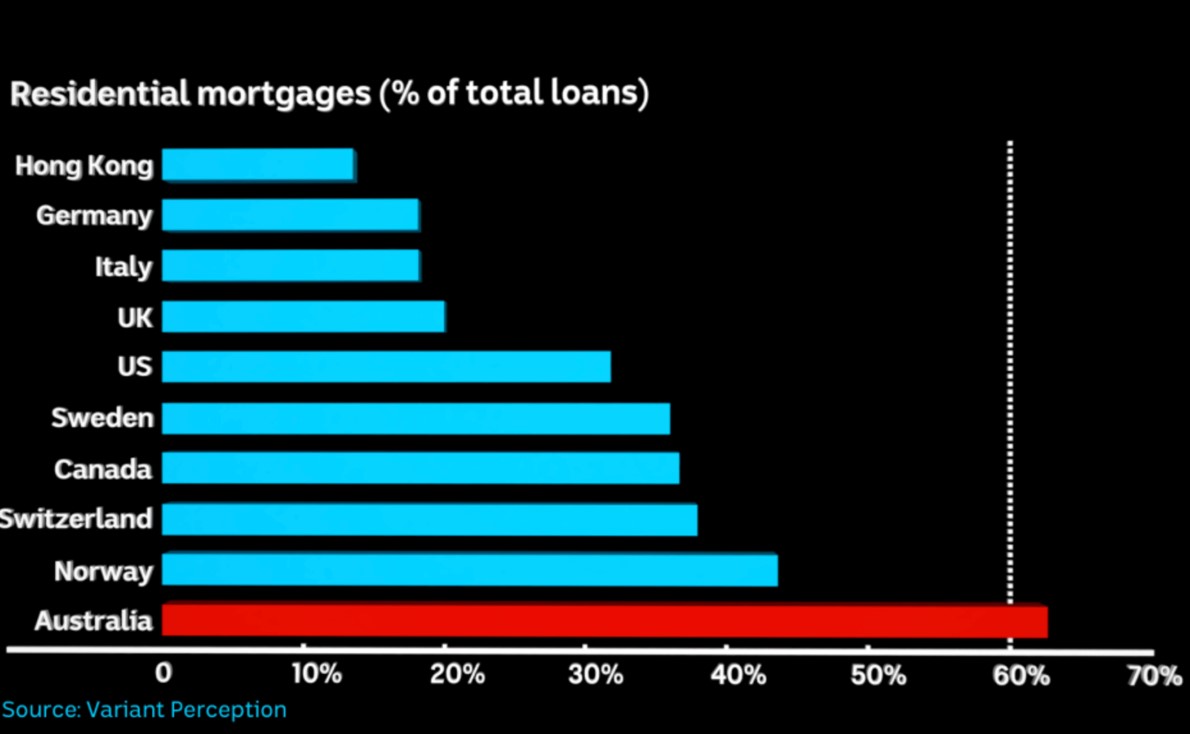

The big Achilles’ heel here I think is property with unemployment rising. Our banks are quite exposed to property, as you can see below.

|

|

|

Source: ABC |

The Reserve Bank of Australia left rates on hold during this week’s meeting, but they are looking at government bond purchases to keep interest rates low.

At the same time gold is rising, showing that there is a lot of uncertainty out there.

We may be in a lull now, but sit down, because this is going to be a long road to recovery.

The coronavirus has brought to the front everything that was failing in the system. I think Jim is right when he says that there’s a big reset coming. One that will rearrange the world monetary order as we know it.

To read more on Jim’s prediction, click here.

It’s time to be cautious.

Best,

|

Selva Freigedo,

For The Daily Reckoning Australia