Imagine it’s late September 1929. The Dow Jones peaked earlier in the month and is now losing some value.

Do you wonder whether it’s time to take some of the exceptional gains in recent years off the table OR adopt a ‘she’ll be right, mate’ attitude and believe in ‘shares for the long run’?

Your decision on whether to stay, go, or partly cash up might also be influenced by the high-profile economist Irving Fisher who publicly stated the US share market had reached ‘a permanently high plateau’.

Why sell when there was no real downside expected?

For some investors, September 1929 would’ve been a defining moment in their lives.

The choices made in the weeks prior to the 28 October 1929 crash, would change the course (for better or worse) of many lives.

How profoundly people were impacted depended upon where they were at in their life cycle.

Younger investors, punting a few dollars, might’ve been annoyed but not devastated.

Whereas a 50- or 60-year-old with dreams of early retirement would’ve been absolutely gutted to watch their portfolio being decimated by the most brutal of bears.

Where are you in your life cycle?

If we’re building to or on the verge of another once-in-a-lifetime depression, then the critical question is: Where are YOU in YOUR life in relation to this once-in-a-lifetime surprise?

Are you 20 years old, with only a few dollars to your name.

OR 40 years old with a mortgage, kids in school.

OR in your early 60s, on the cusp of retirement.

OR 80 years old and relying mainly on the age pension to cover living expenses?

We all have our own unique set of circumstances.

Different ages.

Different education standards.

Different career prospects.

Different family lives.

Different life experiences.

Different investment experiences.

Different risk profiles.

Different incomes.

Different capital levels.

Different living standards.

Different belief systems.

Different states of physical and mental health.

While there can be some similarities with others, your situation is unique to you.

The ideas and thoughts I share with readers each week are filtered through the lens that applies to my unique situation.

In managing our family money for our personal situation, I chose, based on an assessment of the information on hand, to opt for a defensive asset allocation several years ago.

Wealth preservation carried a far greater weighting to wealth creation.

In the short term, this approach has cost me in RETURN.

However, there has been no major loss of CAPITAL.

Unless cashed out, paper profits are not real. Whereas the loss of CAPITAL can be permanent or, at best, can take a long time to recover.

In my opinion, the conditions were (and still are) more heavily weighted towards risk than reward…there’s far more downside than upside.

The volatility we’re seeing on Wall Street is just a dress rehearsal…the real show is yet to begin…and when it does, it’ll be too late to make a reasoned choice.

A prolonged period of defensiveness can be, and, from experience, I know has been, a source of frustration.

The reason I’m relatively relaxed about accepting lower returns is all to do with where I’m at in my life cycle.

Could you live longer than you plan to?

As absurd and preposterous as this may sound, at almost 63 years of age, I believe I’m only at the halfway point of my life…yes, that means I’m planning on living to 120 years.

Crazy, I know.

But if I’m right, then the capital we have today has to keep my wife and I in the style we’ve become accustomed to for a whole lot longer.

A significant loss of capital at this mid-point stage in our life cycle could have devastating long-term consequences.

As an avid reader on biotechnology, I can tell you with a good deal of confidence, science is making tremendous inroads into the anti-ageing process.

From the Financial Times (emphasis added):

‘Drawing on methods used by NASA and in Nobel Prize-winning research, there’s a world of treatments designed to enhance bioresilience — our physiological ability to withstand threats — and promote “molecular wellness”; in other words, fine-tuning health from our cells up. In boosting cellular fitness, the thinking goes, we enhance everything from immunity to energy and performance, and in turn delay the deterioration associated with ageing.’

Whether you’re consciously aware of it or not, slowing down the ageing process has been with us for a little while now.

Do you remember Wilford Brimley from the 1993 movie The Firm?

He was the fellow in charge of the firm’s security.

This photo might jog your memory:

|

|

|

Source: IMDB |

Guess how old Brimley was when he appeared in this movie?

58 years of age.

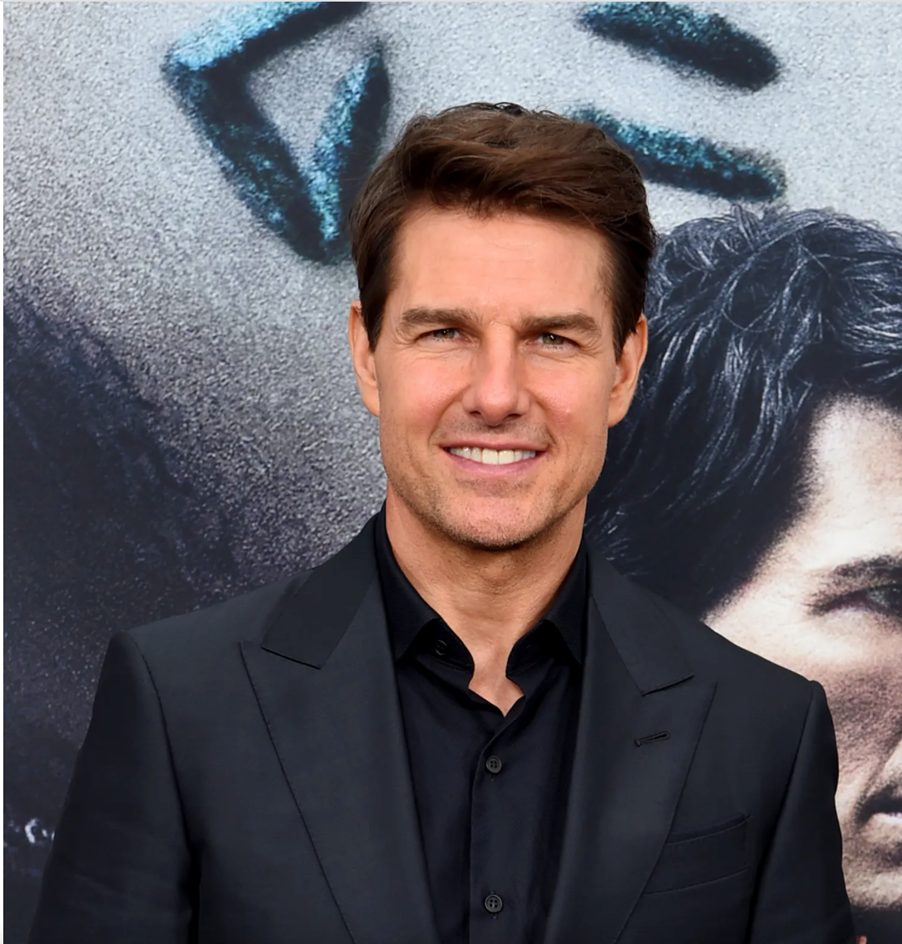

The lead actor in The Firm was Tom Cruise.

He turned 58 a couple of years ago.

This photo was taken in 2020:

|

|

|

Source: USA Life |

Yes, Cruise is a rich movie star who can afford to exercise, eat well, and access expensive treatments and therapies.

However, on a personal level, I’ve seen how the ageing process has changed over two generations.

This is me at age four and my grandmother at age 63 (she was born in 1900)…the same age I am today:

|

|

|

Source: Editor’s photo |

Thanks to healthier diets and modest exercise regimes, I know plenty of my peers who don’t look or feel their age…you might be one of them.

As science pushes further into the frontiers of anti-ageing, the cost of pro-active diagnostic tools and treatments are likely to become much lower.

With each passing decade, we’ll see years added to our life expectancies.

About now, I’m guessing you’re wondering what relevance this has to do with investment markets?

Plenty.

You may have longer (possibly much longer) to live than you think.

Do you have the capital available for this eventuality?

A glimpse into the future

How do you fund an extra 20, 30, or even 40 years more of life than you originally anticipated?

Work longer?

Learn to live on less?

Have a greater reliance on welfare?

Or will you be financially independent?

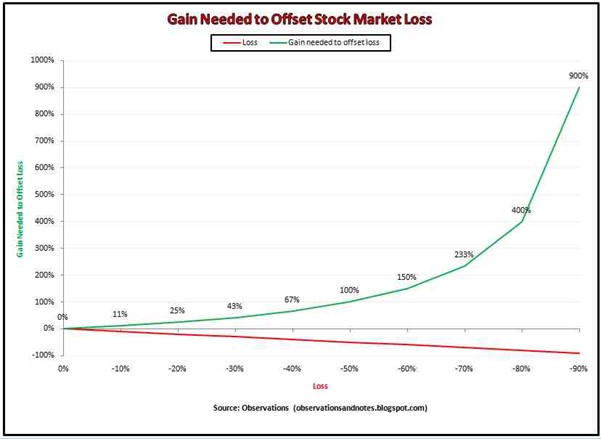

We know markets ‘go down by the elevator and up by the stairs’.

Meaning losses tend to happen far quicker than gains are made.

This chart shows the extent of gains required to offset losses.

The greater the descent into the valley of losses, the steeper the climb out:

|

|

|

Source: Observations |

For example, to make your dollar whole again from an 80% loss requires a 400% gain.

Losing 80% or more can happen quite quickly, but how long can it take to recover from a loss of this magnitude?

In the case of the Japanese share market, it’s been more than 30 years and counting.

In 1929, the Dow Jones fell almost 90% over a two-and-a-half-year period.

Look how long it took to recover…25 years:

|

|

|

Source: Macrotrends |

An appreciation of the potential losses embedded in a market is invaluable in deciding an appropriate asset allocation based on where you are at in your life cycle.

If the market falls 60, 70, or 80% (I know, based on recent history, that sounds absurd, but please don’t discount the possibility), then how many years of your remaining active and energetic life do you want to waste getting back to even?

Five, 10, 20 or more years?

Given the US market is at a level of overvaluation far exceeding the 1929 peak, could this current ‘calm before the storm’ period be today’s investors’ September 1929 moment?

If so, then, depending on where you are at in your life cycle, this could be the most defining moment in your life.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia