News is there’s a supply crisis potentially looming as a significant number of developers go bust.

Hundreds of millions of dollars’ worth of projects have been left in limbo as supply shortages are pushing numerous contractors to the wall.

Building and material costs are going through the roof — and because the increase is coming against contracts where the prices have been fixed in advance, the problem promises to worsen as the inflationary trend continues.

The average cost of building supplies rose 10.2% in the year to September in Melbourne.

Steel product prices grew by more than 25% in Victoria — it’s the state with the biggest inflationary gains.

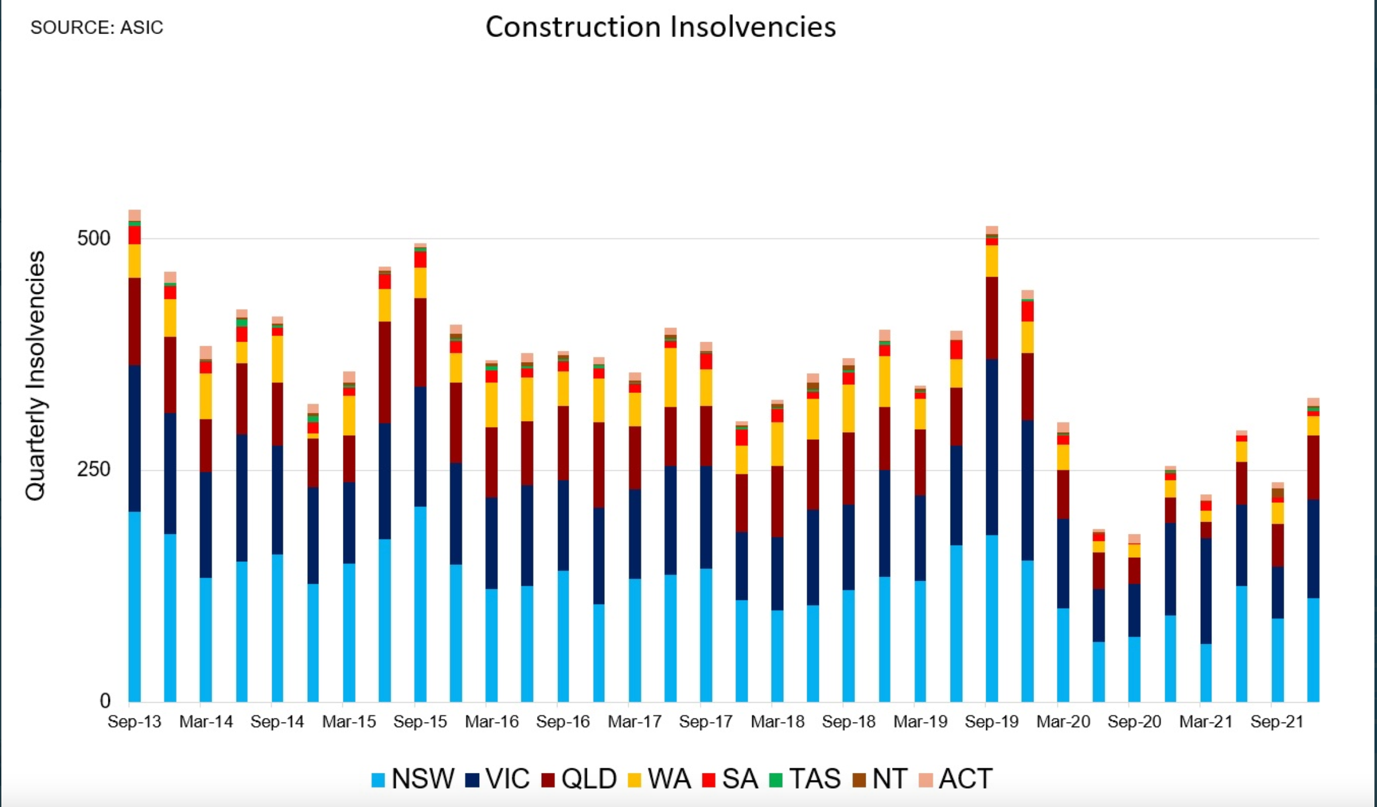

83 construction companies went into administration in September 2021 — a one-third increase in the same period last year.

In January 2022, Tasmanian Constructions (Hotondo Homes) went into administration.

Two Queensland firms, BA Murphy and Privium, have also recently gone into liquidation.

As reported by the ABC, BA Murphy owe almost $11 million to about 550 creditors.

The company has 50 unfinished building projects across Australia.

The amount owed by Privium is reported to be more.

The company has 831 unfinished contracts around Australia, and records show a $28 million loss in the 2020 financial year.

|

|

|

Source: ASIC |

The crisis runs up hard on an inflationary real estate boom such as we’ve never seen in some areas of Australia.

Aussie house prices had their fastest annual growth rate on record last year — rising 21.9%.

More than 446,000 houses and more than 144,000 units were sold in 2021.

‘Days on market’ were the shortest for more than half a decade.

Vacancy rates are at record lows in many of the smaller states by population — with headlines screaming a ‘rental crisis’ every few days.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

I can tell you, that in all my years working in the real estate industry in Australia, I’ve never seen anything like it.

Owners have been able to flip houses in a matter of months and still make a healthy profit after stamp duty and capital gains tax.

In the short term, it means more upward pressure on prices and rents. Marginal increases in the cash rate or lending rates are not going to pull the trend up anytime soon.

That’s not to say that increasing supply quickly to counter available shortages is impossible.

There are many innovations such as 3D printing that are already being utilised in other parts of the world and gaining in popularity.

In Germany, for example, leading formwork and scaffolding firm PERI broke ground in 2020 with the first-ever 3D-printed home to become fully certified under a national government’s building regulations.

A 3D-printed home can be constructed in 72 hours for a third of the cost with less labour and less building materials needed.

The technology also opens the door to the use of alternative building materials such as hemp concrete.

But progress is painfully slow and there will be no change in the shorter term.

The other issue is the abundance of supply that’s currently being held out of use.

Prosper Australia’s most recent Speculative Vacancies report found that 69,004 properties in Victoria alone were likely vacant over 2019, based on water usage data.

Speculative vacancies are when private landlords don’t make their properties available to the market for sale or rent but sit on them in expectation of a continued gains. If the price is rocketing upwards (increasing $660 per day), why sell?

Often, there’s not much need to rent them out — especially if the yields are not favourable or the property requires too much maintenance to get into rentable condition and adhere to new regulations.

It’s estimated that the number of long-term vacant properties could house more than 185,000 people, dwarfing the 80,000 people on Victoria’s public housing waiting list.

And that doesn’t even touch on the large land banks in master planned communities that are held out of use by developers or drip fed onto the market in staged releases.

The Melbourne Urban Development report estimates this to be around 25 years of land supply currently being held out of use.

The bottom line — we have too much housing supply — not too little.

The problem is that it’s not available to the market and hidden from view in the upward phases of a real estate cycle.

The number of hidden vacancies and land banks can be likened to an unemployment rate for land.

The supply does not become visible until there is a significant downturn in economic activity and high volumes of stock hit the market.

We saw this happen most recently during the COVID panic.

Thousands of properties in the inner-city regions hit the market for rent. In the Docklands area of Melbourne, the vacancy rate rocketed to 18%.

We warned our readers years in advance of this downturn — and we’ve already issued the warning for the next.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australi

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.