We examine SEEK Ltd’s [ASX:SEK] share price outlook after Credit Suisse upgrades SEK’s price.

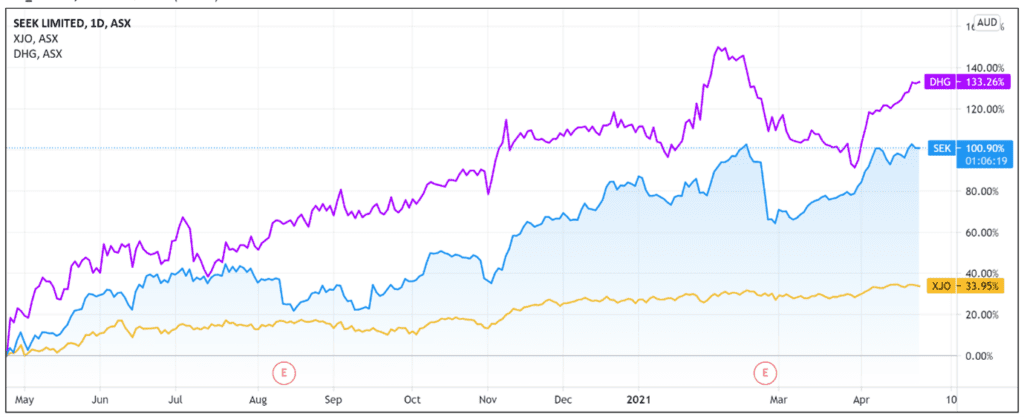

Year-to-date, SEEK’s share price is up 10% and 90% over the last 12 months.

But according to a new price target from Credit Suisse, SEEK’s share price can lift even higher this year.

Rising job vacancies

At the start of April, the Australian Bureau of Statistics (ABS) released its latest quarterly job vacancies survey.

It found that for the February 2021 quarter, total job vacancies were up 13.7% from November 2020.

Zooming out, job vacancies were 27% higher than 12 months earlier in February 2020 — just before the pandemic.

Private sector job vacancies were 29% above pre-pandemic levels of February 2020.

So not only are job vacancies recovering from the impact of COVID, they are now even higher than pre-pandemic levels.

Three Innovative Fintech Stocks to Watch Now. Discover more.

The figures highlight Australia’s strong economic rebound.

Bjorn Jarvis, head of Labour Statistics at ABS, thought the job vacancy numbers ‘reflected the pace of recovery in labour demand over the second half of 2020 and early 2021, and labour shortages in some industries.’

Additionally, the ABS also released figures this month showing that both employment and hours worked in March 2021 were higher than in March 2020, up 0.6% and 1.2% respectively.

As of March 2021, the unemployment rate decreased to 5.6%.

The positive statistics contributed to Credit Suisse upgrading its price target for Seek.

Credit Suisse upgrades Seek price

Yesterday, Credit Suisse bumped up its price target on SEEK shares to $34 from $30.50, citing a better domestic market for job ads that bodes well for the second half of 2021.

The $34 target reflects an 8% premium on SEEK’s current price of $31.40 per share.

Credit Suisse also upgraded its valuations for SEEK’s early stage ventures (known as ESVs).

The broker determined that SEEK’s portfolio should trade at 10 times revenue.

The revision would lift the stock’s implied valuation to $1.12 billion from $587 million.

Credit Suisse Analyst Entcho Raykovski commented that this figure could even ‘arguably be seen as conservative given the multiples implied by tech/online stocks with similar revenue growth rates.’

Regarding SEEK’s Online Education Services, Credit Suisse increased its estimated value to $1.026 billion from $924 million, assuming a multiple of 21 times financial 2022 EBITDA.

The broker conclude that the ‘market should subtract the value of investments from the headline in calculating SEEK’s trading multiples.’

SEEK Share Price Outlook

2020 was tough for SEEK.

Last August, it decided not to pay a final dividend in financial year 2020.

The company explained that it wished to preserve capital during an uncertain 2020 while also funding its long-term growth strategy.

SEEK did pay an interim dividend on 23 July 2020 of 13 cents per share.

But that dividend was nearly half of the 24 cents per share payout investors received the year prior.

SEEK did, however, announce a $75 million issuance of floating rate note last July and pushed back its debt obligations from April 2022 to November 2022.

Now, in 2021, investors will likely be wondering if a strong economic recovery underway in Australia can signal a boost in SEEK’s share price.

If you’re after growth stocks, be sure to check out our report on three innovative, high-growth potential fintech stocks.

Regards,

Lachlann Tierney,

For Money Morning

Comments