No doubt, gold is grabbing all the headlines.

And it’s completely understandable.

But I want to piece together a few data points today that suggest you should be casting your eyes towards other resources.

Fair warning: today’s piece is chart heavy.

But I think the charts I am about to show you paint a compelling picture of what’s happening in Aussie mining today.

I’m talking about the resources that no one is thinking about right now.

This isn’t contrarianism for the sake of it — it’s about avoiding the herd in a potentially profitable way.

Commodities are comparatively cheap

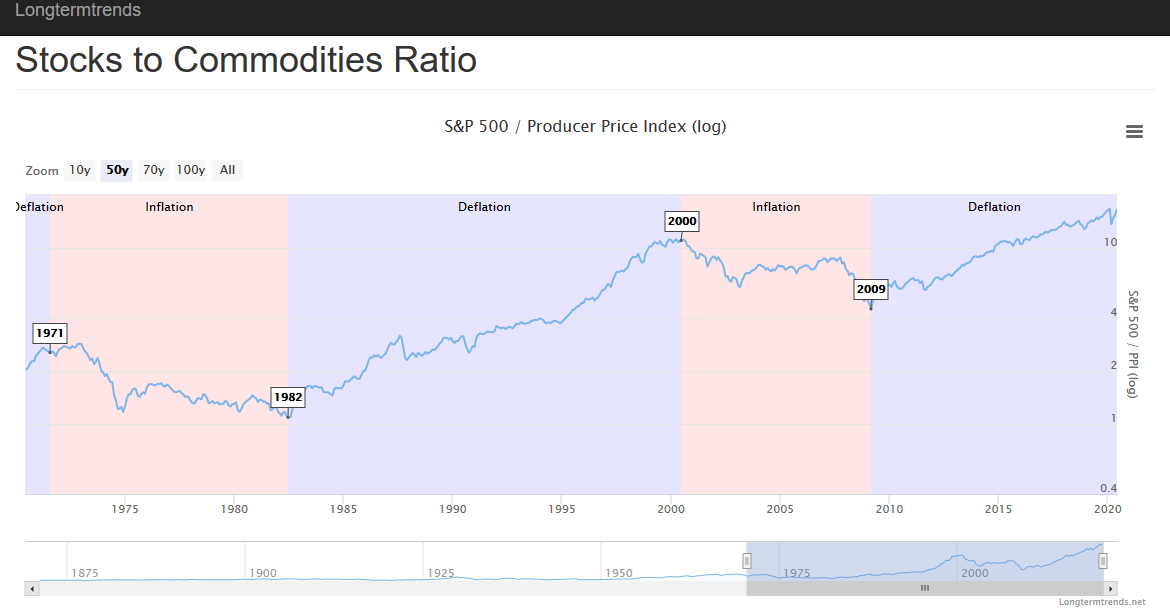

I’ll start with a chart my colleague Ryan Dinse showed you last week:

|

|

| Source: Long Term Trends |

Ryan said this about the chart:

‘It shows that, in terms of commodity prices, the stock market has never been so expensive. The ratio has even surpassed the 2000 dotcom boom.

‘But it’s the other side of this coin that interests me.

‘Because commodity-related companies are now trading at record lows compared to the rest of the market. Which means one of two things…

‘Either stocks are far too expensive and will fall soon…

‘Or, we’re gearing up for a new commodities boom cycle…’

If it’s going to be option number two — then what are mining companies saying about their cash reserves?

You can’t underestimate the need for cash in the fallout from the pandemic…

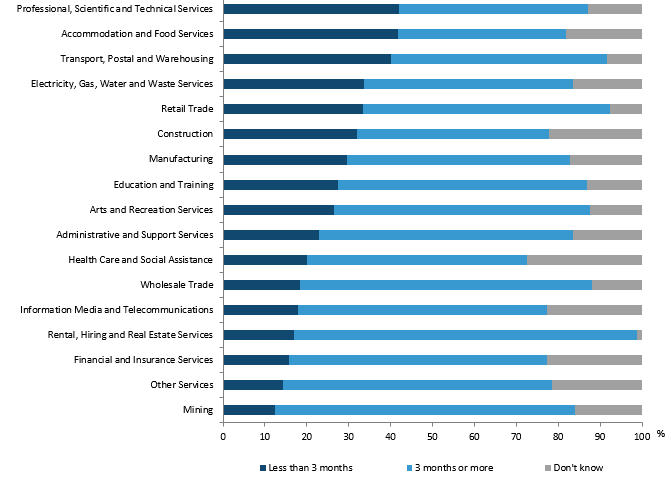

You can see in the chart from Thursday that they are perhaps the best positioned of any industry:

|

|

| Source: ABS |

So, the mining industry could be better positioned for growth than other industries.

What specific commodities though?

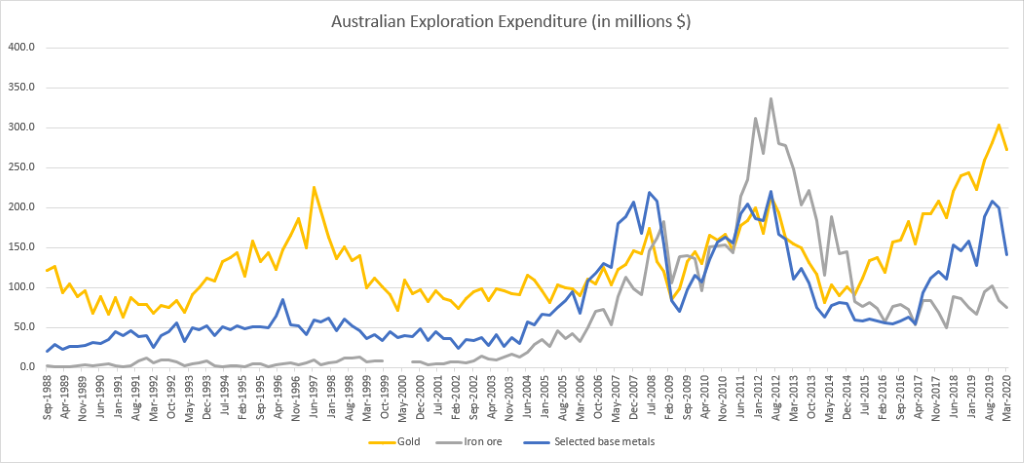

I recently pulled the latest ABS exploration spend data for non-petroleum resource companies and it confirms what we know already:

|

|

| Source: ABS |

Gold is all the rage.

The precious metal now makes up more than a third of the non-petroleum exploration spend.

That’s huge.

And Aussie gold stocks are poised to lead the charge on production, with a report by Resources Monitor outlining how Australia is about to overtake China and become the number one gold producer in the world by next year.

[conversion type=”in_post”]

Iron ore prices and base metals prices in context…

But what of the other two lines on the chart?

Iron ore exploration fell off a cliff after the start of 2012.

And iron ore prices fell sharply from 2011 through to 2016.

|

|

| Source: Business Insider |

It’s all cyclical, really.

Higher prices make new projects more attractive which when they come online (depending on the number of new projects) increase supply driving down prices.

And so on and so forth.

I’ll be the first to admit that I’ve made some wrong calls on iron ore prices.

It’s such a mammoth task wrapping your head around the myriad of factors at play.

Here are some of the factors I have looked into:

Weather patterns in the Hubei province, global growth, WA capex, automation of mines, Western demand for finished goods, and Chinese domestic construction demand.

These are but a few factors involved in the overall picture.

I discovered I probably can’t ever beat big data, satellite imagery, and a host of algorithms when it comes to iron ore.

That’s why I want to draw your attention to the blue line on the chart of exploration spend I just showed you.

That’s selected base metals which is comprised of copper, silver, lead-zinc, nickel, and cobalt.

Cobalt is unloved, nickel recently had some hype around it following an Indonesian export ban and its use in EV batteries.

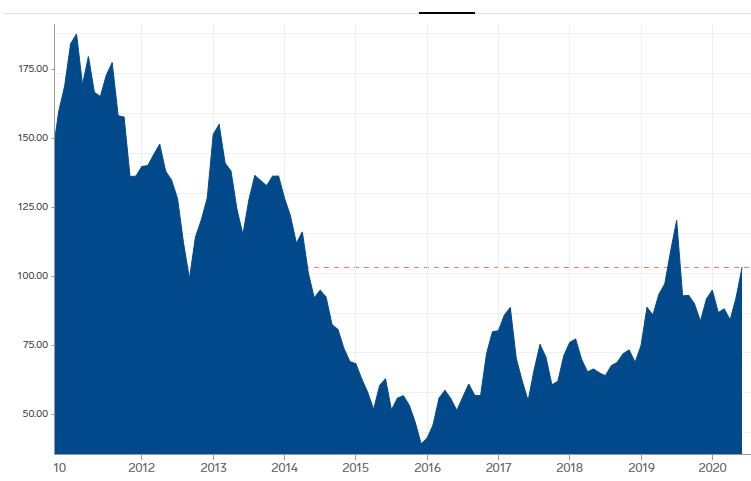

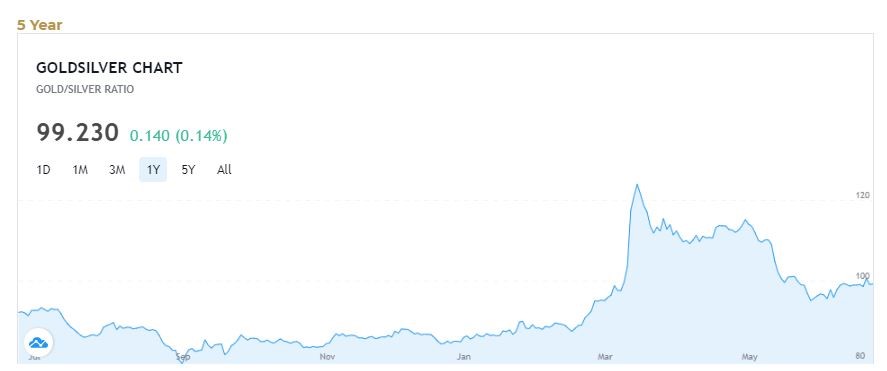

Silver is stuck in a rut and the gold/silver ratio blew out in March:

|

|

| Source: goldprice.com |

Why?

Because silver is actually more of an industrial metal than anything else — more than half of its demand in 2019 came from industrial fabrication.

I’ll ignore lead and zinc for today.

Leaving just one base metal.

Copper.

This chart indicates that this metal could be due for a resurgence if…

So, what’s so interesting about copper?

It’s used in a huge array of things.

And EVs and EV charging stations could play a significant role in future demand.

You can see the copper/gold ratio below:

|

|

| Source: Long Term Trends |

In my eyes, that’s looking oversold.

Factor in the huge stimulus being rolled out across the globe, the role this could play in propping up the housing market (remembering that building construction accounts for nearly half all copper demand) and you have a more compelling case for this currently unpopular metal.

I’m not saying a copper renaissance is guaranteed, it’s just a theory.

But it’s something to keep your eyes peeled for.

Regards,

Lachlann Tierney,

For Money Weekend

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments