I’ve never thought of gold as an exponential trend.

It’s more a slow burn type asset.

But I’m starting to think that there could be more under the hood for the precious metal.

The long-term chart looks bullish:

|

|

| Source: tradingview.com |

And the chart for the last year looks largely the same.

A mostly steady rise.

The interesting thing about gold is that it has just hit the mainstream properly.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Gold hoarding is now mainstream

A recent Reuters headline read as follows:

‘Stunned by gold’s record rise? There’s more to come, analysts say’

The article in question pointed out the following:

‘A hoarding spree has fuelled the rally, with investors adding 922 tonnes of gold worth $60 billion at current prices to their stockpiles in exchange-traded funds this year, according to the World Gold Council.

‘Investors see gold as an asset that should hold its value as the health crisis and money printing by central banks erode the value of others.

‘Real returns on U.S. bonds — in normal times a much more popular perceived safe asset than gold — have tumbled to minus 1.07% from 0.15% at the start of the year, making bullion look like a better bet.’

Now, I was not stunned, nor do I think the analysts referred to are geniuses.

Gold’s appeal is very simple.

I think gold is the old-timer’s way of exiting the fiat system that has done such a disservice to our wallets.

And crypto is where new younger investors seek to exit the fiat system.

Rooting for collapse

Either option you choose, there’s a way to be bullish on the collapse of the monetary system.

But hold on, recent headlines are saying gold is doomed again…

This from Bloomberg:

‘Gold Posts Biggest Drop in Seven Years on Rising U.S. Yields’

The article continued:

‘Treasury bond yields climbed, cutting into the negative real rates that had supported the metal. The 10-year Treasury yield jumped the most since June ahead of an expected flood of government and corporate debt issuance. U.S. producer prices increased faster than expected.

‘Exchange-traded fund investors also took a breather, seeing back-to-back outflows for the first time since June. On Friday, State Street Corp.’s SPDR Gold Shares, the largest gold-backed ETF, saw its biggest outflow since March. Meanwhile, a Bloomberg Intelligence gauge of senior gold miners dropped the most since March, down 6%.

‘Demand for precious metals as haven assets slipped after the U.S. president’s comment on potential tax cuts, strong Chinese economic data and falling hospitalizations in California and New York.

‘Further eroding support for gold was a Covid-19 vaccine that Russian President Vladimir Putin said was cleared for use.’

So apparently, the gold story could be put to bed by a series of positive signals.

I’m not so sure.

I highly doubt that everything is hunky-dory.

Back to the idea of gold being an exponential trend.

I see it as more an inexorable trend than anything.

Exponential means the gold price would need to go truly ballistic.

‘Gold is medieval’

And it may well do, but if it does, we would be rapidly headed towards the dark ages again.

So, part of me resists this type of thinking, purely because I don’t want to countenance such an event.

At its heart, for gold to go exponential you would need something truly extraordinary.

As a result, I think the gold price especially in USD terms will continue to plug away unless something cataclysmic happens.

For now though, I think equities, particularly small-caps are where the most exciting — though also more risky — action will be.

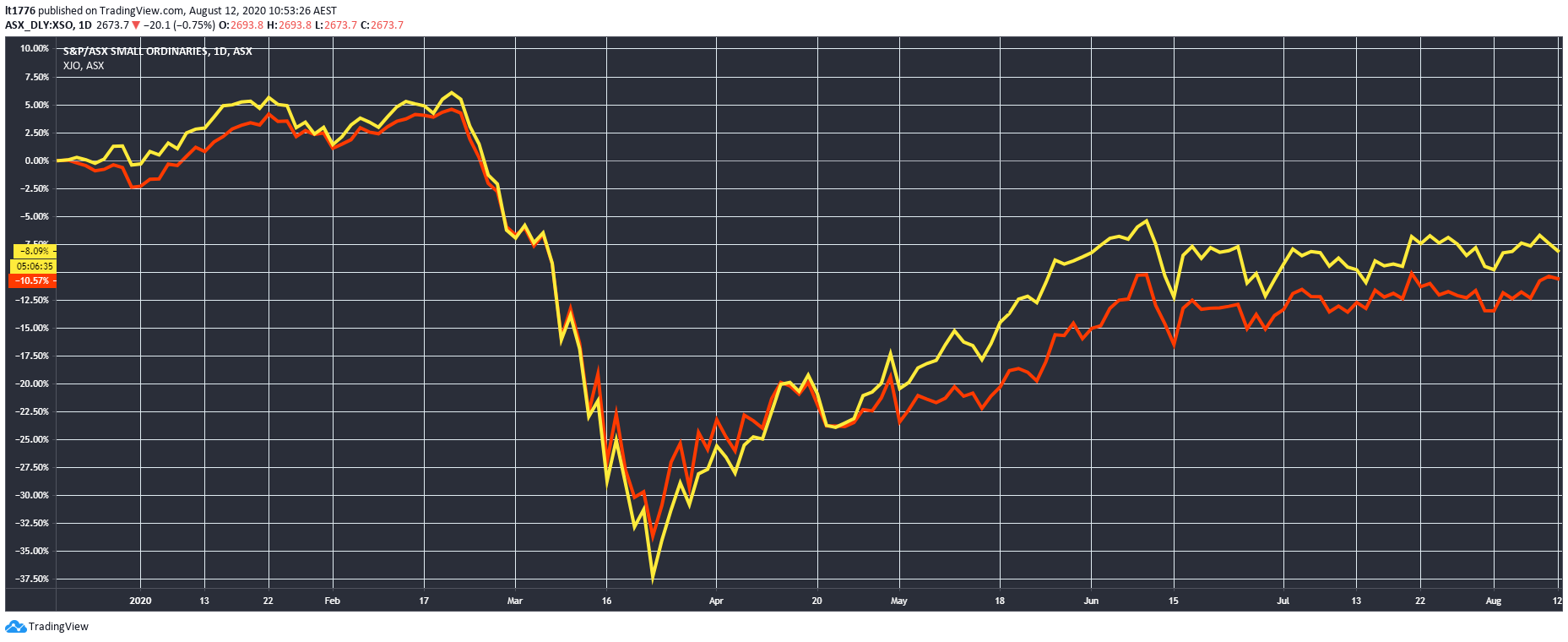

This shows up in the performance of the S&P/ASX Small Ordinaries Index [XSO] versus the ASX 200 [XJO] which you can see below:

|

|

| Source: tradingview.com |

Pivoting away from ‘medieval’ gold for a moment, here are things I think are more exciting:

- The potential for medtech to become a target of FAMGA cash

- Europe’s ‘green’ recovery running through to ASX-listed companies with EV exposure in this region

- The rise of fintechs that are not just BNPL products

These are just a handful of areas that we are looking at, at the moment.

A final word about gold…

If gold turns out to be an exponential trend, we will have some very serious problems on our hands.

Rooting for gold is like rooting for the apocalypse!

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments