Overheard in a conversation between traders this weekend:

‘There’s never just one cockroach…’

Last week, the first cockroach appeared — a plummeting British pound.

Make no mistake about how big this was.

We’re talking about the biggest one-day loss in the pound sterling’s 206-year-old history.

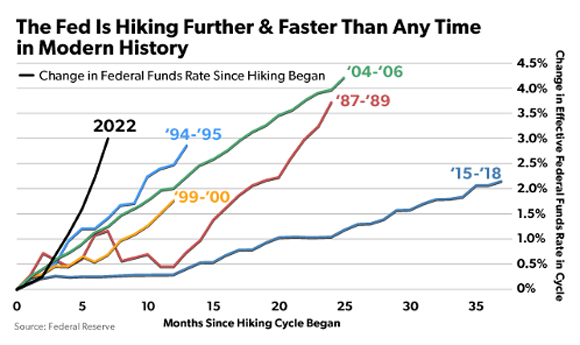

And this isn’t the only history-making move going around.

We’re witnessing the fastest interest rate rises in Federal Reserve history.

Check out this amazing chart:

|

|

| Source: Stansberry Research |

The Fed’s unprecedented hikes are starting to break stuff. And global markets are so interconnected that there’s never just one isolated incident when things go wrong.

This brings me to this week’s new cockroach…

The Swiss banking behemoth, Credit Suisse.

Rumours have begun swirling that the European banking superpower is in big trouble.

Charles Gasparino at Fox Business Network reported on Saturday:

‘Credit Suisse CEO Ulrich Koerner has been meeting with major institutional investors worried the firm is on shaky financial footing and assuring them the bank has strong capital, liquidity etc.

‘One large investor tells me “The bank and wealth management platform are very valuable, but the investment bank is a disaster.” The CDS’s of the bank have been trading as if a Lehman Moment was about to hit. Story developing…’

If this is true, it’s akin to the moment when Lehman Brothers went bust during the 2007/08 GFC.

Stock markets fell by a further 20% after that ‘Lehman moment’ in just three short months.

In an amusing twist of fate, guess what the name of Credit Suisse’s current Chairman is?

Axel Lehmann!

So what happens next?

Stealing from the future

When a financial crisis hits, the truth can easily get lost in the blame game that follows.

The powers that be will try to pin it on anybody else rather than admit it for what it is — a failure of Keynesian economics and the debt-based system we live in.

You see, our 50-year fiat experiment has one big fatal weakness.

It’s this…

Whenever the proverbial hits the fan, central banks always jump in and ‘save the day’ by printing more money.

They’ve done it so many times, and debt levels are now so high, it seems everything is ‘too big to fail’ these days.

Let’s be perfectly clear about this…this isn’t a victimless action.

It’s a transfer of consequences.

From investors (and the funds that invest on their behalf) to the country at large. It’s a socialisation of losses.

Which, in reality, actually means a transfer of costs to future taxpayers.

Behind all the complicated talk of ‘gilts’, ‘treasuries’, and ‘yield curves’ — and all the other mumbo jumbo the industry bamboozles the public with — that’s the way the system works…

Anyone under the age of 45 should be absolutely appalled by this silent theft.

But the mainstream finance industry keeps quiet about it because they — and a substantial number of investors, I should say too — benefit from it.

So it’s why the Bank of England (BoE) played their usual hand last week.

They got out the chequebook.

As this tweet says, it didn’t take much to make them backtrack on ‘tightening’:

|

|

| Source: Twitter |

Although Liz Truss’s budget copped most of the flak for the massive intervention in bond markets, it was actually coming anyway.

A number of big pension funds (like our superannuation companies) in the UK were caught on the wrong side of bond trades and were about to face a margin call.

That is a demand for more money to cover their mounting losses.

As Sky News reported, disaster was imminent:

‘According to those with knowledge of the programme, the Bank’s market operatives had begun to detect a “run dynamic” emerging from yesterday, with a number of pension funds facing mass defaults in the funds they invest in.’

But this also suggests these pension funds were playing with fire.

My guess is they were using ‘safe’ bonds as collateral to leverage up their positions to make higher returns.

But when these ‘safe’ bonds plummeted in value due to the Fed’s sharp interest rate rises, they were caught out.

They took the risk, and they should have been punished for their greed.

But they weren’t.

And this was this same old headline instead:

|

|

| Source: Financial Times |

Incidentally, it reminds me of the famous Financial Times headline imprinted for posterity in the first ever Bitcoin [BTC] block in 2009:

‘Chancellor on brink of second bailout for banks.’

Similar vibes, no?

Anyway, I expect the same thing to happen again with Credit Suisse this week.

If the rumours are true and it is on the verge of collapse, then European bankers will be faced with the same choice as their UK counterparts.

Want to bet what action they’ll choose?

But that won’t be the end of it…

More ‘cockroaches’ are sure to appear in the face of this extreme monetary tightening.

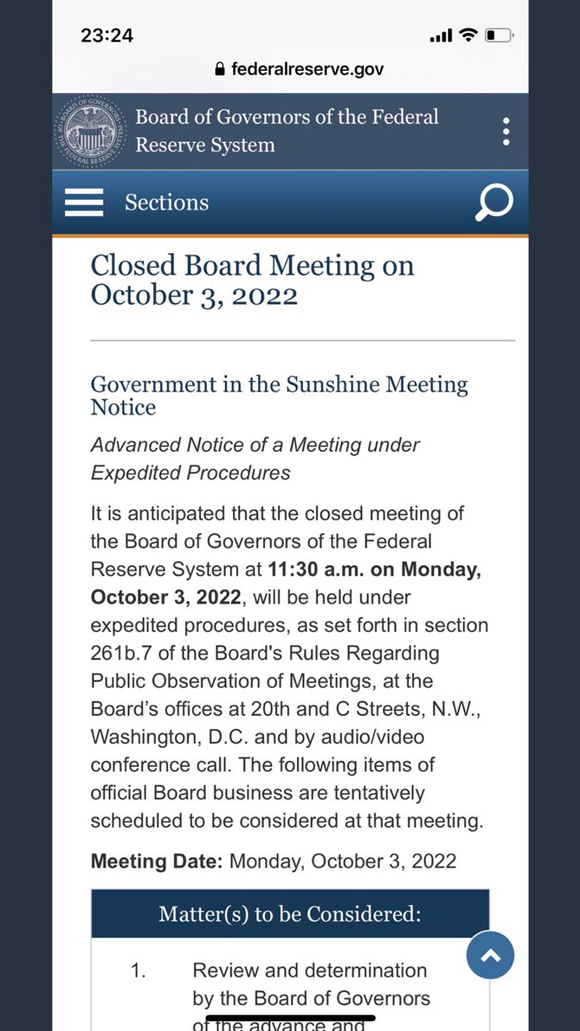

Unless, out of nowhere, the Fed decides to pivot. Could it do so now without losing whatever credibility it has left?

I doubt it…

But interestingly enough, the Fed has scheduled an out-of-session closed meeting for today:

|

|

| Source: Federal Reserve |

It sure feels like something big is up…

Like an arsonist in the fire brigade

My last thoughts…

Are we about to see a 2008-style GFC blow up?

Who knows?

But I can tell you one thing.

Don’t rely on the central bankers of the world to save you.

If anything, they’re the ones responsible for this mess.

Think about it…

Central banks intervened with QE to combat COVID.

Then central banks intervened with QT to combat extremely high inflation and override their first intervention.

Now central banks are intervening for a third time to undo the first two interventions to maintain balance and order.

They’re like that strange type of arsonist who starts fires only so he can take credit for putting them out!

Or as long-time Independent US Presidential candidate Ron Paul tweeted yesterday:

|

|

| Source: Twitter |

It’s going to be an eventful week (or two!), that’s for sure.

And, in my opinion, it’s the perfect time to release a special presentation I’ve been working on over the past month or so.

Let me quickly explain…

THIS WEDNESDAY: A way out of this mess

If the great fiat experiment is indeed doomed, no matter how central banks try and fix it, where do you turn?

Step one is getting out of centralised finance…and instead, getting into the world of decentralisation. It’s becoming more and more clear that this is the only way forward for our monetary system.

And it’s not just me saying it. Big names are catching on.

BlackRock has invested US$1.17 billion in just three crypto firms.

We’re talking about the world’s largest asset manager here.

Samsung has invested US$969 million through this crypto winter.

But the biggest name is Google.

Between September 2021 and June 2022, they’ve invested US$1.5 billion in blockchain companies.

They’re all investing even as retail trading volumes have collapsed.

Why?

Because the story is so much larger than the price of bitcoin, although that is sure to increase over time as more and more people realise this.

It’s about the idea that anyone (anywhere) can participate in a financial ecosystem without fear or favour.

Something we all desperately need right now.

Keep your eyes peeled for a special presentation on Wednesday where I break down this entire concept for you…and give you the case as to how bitcoin could be worth US$1 million by 2030 once this idea hits the mainstream minds.

Good investing,

|

Ryan Dinse,

For The Daily Reckoning Australia