I interviewed Louis Christopher last week on his latest ‘Housing Boom and Bust’ report.

Contrary to other data agencies, Louis sees a modest recovery in the housing market next year, led primarily by Sydney and Perth.

The reasoning includes an increase in immigration, a return to the office, our exposure to Asia, and the mining boom…among others.

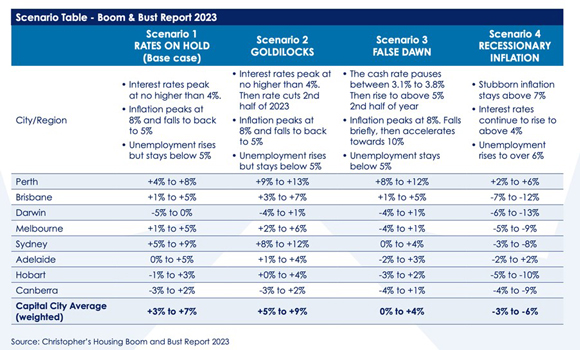

But his forecast for Darwin is pretty dire.

It suggests prices could struggle to inch into positive territory (-5–0% through 2023):

|

|

| Source: Christopher’s Housing Boom and Bust Report |

SQM has been very accurate with its yearly forecasts to date, but I wonder why Darwin is getting such a bad rap in the latest report?

The 2022 SQM forecast for Darwin (released at the end of 2021) underestimated the gains the territory would experience.

From this year’s report:

‘…we thought Darwin would experience price falls when it appears the market will record a modest rise for the year, even while falls were present in the final quarter.’

Rents are rising, vacancy rates are close to record lows, and through the year to November, Darwin’s dwelling values are up by 6.2%.

Agents on the ground are reaping hay…

From a recent report on ABC news:

‘Darwin real estate agent Derek Hart said those conditions meant the local market was “absolutely booming” at the moment.

‘“It’s been the best I’ve seen in 14 years of selling, where you’re getting more sales, more activity all through the market,” he said….

‘CoreLogic head of residential research Eliza Owen said the city was attracting strong investor interest, including from interstate, with units especially in demand.

‘“It’s kind of an investor’s dream — to not only be getting capital growth in the value of the home, but rising rental income from that home as well,” she said…’

So why the doom and gloom forecast from SQM?

It’s hard to say.

Unlike previous reports, Darwin doesn’t get much of a mention. Every capital city has a chapter, but Darwin misses out.

(I’ll reach out to Louis at some point to gain clarity.)

The forecasts we gave for Darwin over at Cycles, Trends & Forecasts back in 2019, for the second half of the real estate cycle to 2026, show Darwin’s property market booming.

(Active Cycles, Trends & Forecasts subscribers can revisit those forecasts here and here.)

To date, it’s played out.

The key driver here is that Darwin’s population is only 165,000.

So a small shift of the needle can produce big gains in the property market.

COVID played into this.

The Northern Territory was perceived as a safe and free region attracting interstate migrants, and today, land values continue to gain from supply/demand dynamics.

Still, there’s a cautionary note here.

Darwin is a boom/bust economy, and therefore the downturns can be just as sharp as the upturns.

Back in 2020, the NT Treasury made the following comments regarding Darwin’s economy:

‘As a small open economy heavily reliant on resources and historically driven by major projects, the economic cycles in the NT tend to be more pronounced than in other jurisdictions in Australia.

‘Over the last 25 years, the NT has experienced growth cycles averaging six to seven years where expansionary economic conditions have been experienced.

‘These expansionary cycles have been followed by periods of cyclical contraction…

‘The highly transient nature of the NT’s population is a significant factor in these movements, as economic and particularly employment conditions influence people to come to or leave the NT. Hence, population growth is generally in line with growth in the NT’s state final demand (SFD).

‘Since employment is a key driver of net interstate migration, its movement is generally consistent with population growth.

‘The recent period of economic expansion, which peaked in 2012–13, was driven by the Ichthys liquefied natural gas (LNG) project, which had an unprecedented effect on the NT economy…’

The period of economic expansion referenced saw Darwin’s median property price hit an all-time high in May 2014.

Yet, despite the recent boom, median dwelling values remain -10.1% below that peak.

Are we likely to see that peak exceed through the remainder of this cycle into 2026?

Our forecasts over at Cycles, Trends & Forecasts suggest we could.

Another who is very bullish on the outlook for the Northern Territory is Warren Ebert.

Ebert is the head of Sentinel Property Group, a commercial property funds management company.

Over the last 10–15 years, he’s made himself and his investors a lot of money. Needless to say, he’s currently buying up big in the Northern Territory.

Sentinel owns the biggest shopping centre, Casuarina Square, purchased in March of this year. It was the biggest transaction in Australia for more than a decade.

Sentinel is also the largest owner of offices in Darwin and retail in the Northern Territory.

Callum Newman, who works with me for Cycles, Trends & Forecasts, interviewed Warren earlier this year. He made a strong case for investment into the NT.

Here’s a little of what he had to say:

‘We just had 50 investors up in Darwin and they can now see why we’re investing up there.

‘Most people are too lazy to get off their bum, Callum, and really go and have a look at things.

‘They want to sit in their office and read the research, which is old.

‘We go up there and we speak to the retailers.

‘You speak to all the people, you speak to the government.

‘So not only do you have real time research, but you can see what’s coming up in the next month, few months, 12 months, rather than waiting for it to happen…’

So what’s coming?

‘In Northern Australia, they’re developing more LNG for contracts to Europe, which will go on for decades and decades.

‘It’s the same with the rare earth minerals. 90–95% of rare earth minerals come out of China.

‘Now, America and those type of countries, they need rare earth minerals.

‘Well, where do they get it from?

‘They’re looking at it from Australia.

‘For the new, green energy, hydrogen, we’ve got the gas.

‘More gas than anyone else.

‘Nickel, copper, zinc, palladium, lithium, Australia has it all.

‘We have the ability to not only mine it, but to process it.

‘In addition to that with what’s happening in the South China Sea, that’s been going on for 5,000 years.

‘It’s not something happened over the last 12 months. At the recent NATO summit, where our Prime Minister Albanese was, NATO was talking about how do they combat the China influence from the Pacific?

‘Well, by having a base in Australia, that’s what they’ll have to do. How else should they combat it?

‘They just can’t combat it by sending out emails every day in Twitter.

‘Well, they have to be here.

‘So, when you look at the population, the whole Northern Territory, Callum, has 270,000 people, only 150,000 people in Darwin.

‘You’ve got 300,000 people in Newcastle.

‘So, when you start putting tens of billions of dollars into that economy, what does it do to it?

‘Head north young man, that’s where the real opportunities are, and they will go on for decades. This is not a flash in the pan…’

As I said, it only takes a small shift of population into the region to produce a significant boom in its real estate values.

If Warren Ebert’s forecasts play out — the recent inflationary period in Darwin’s land values (since 2020) has only just commenced — I suspect SQM’s 2023 forecasts will underestimate the gains in their ‘Housing Boom and Bust’ report once again.

You can check out Warren’s interview with Callum here.

Until next time.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments