This chart has me worried. Was leaving Australia a mistake?

|

|

| Source: In Gold We Trust, Incrementum, 2020 |

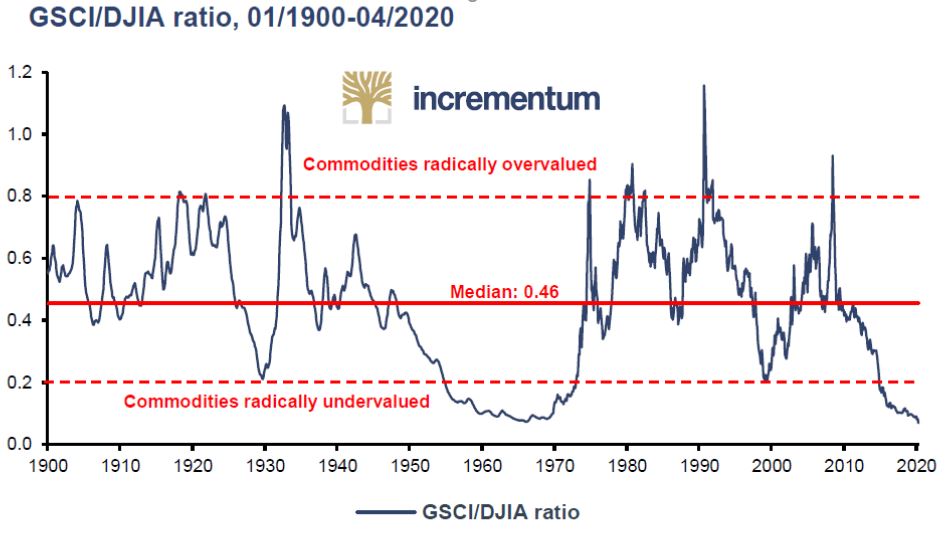

It shows the Goldman Sachs Commodity Index divided by the Dow Jones Industrial Average.

Yes, I know what you’re thinking. What sort of twit thinks this best determines where to live…?

But, consider my explanation. In plain English, the chart suggests that the stock market has never been so overvalued relative to commodities. In plain Australian, it means that our dirt is dirt cheap.

The ultimate moment to invest…

Now cheap dirt is no good for the Aussie economy. Having Aussie exports languish in price on global markets is a squeeze on the whole nation. Our GDP, our Aussie dollar, our wealth, tax revenue, jobs, and plenty more.

But investors don’t care much about what’s happening now. They care about where things are going next. And there’s nothing like ‘incredibly cheap’ to catch an investor’s interest. It suggests a turning point — the ultimate moment to invest.

Specifically, the chart above suggests now is the time to buy into commodities and their related investments. Assuming you’re planning on holding those investments for a decade at least. The chart is far from a reliable indicator in the short run. But when it comes to deciding where to spend the next few years of your life, well, I wish I’d seen it three years ago.

There’s another caveat to the chart. A lot of the GSCI is oil. And oil has been in an unusual situation of late thanks to a one-two punch of OPEC price wars and COVID-19.

Things aren’t as bad as they look for commodities

So, things aren’t quite as bad as they look for commodities. And whether oil has a bright future is yet to be settled by the climate crowd. It may never stage a comeback in the way the chart above suggests. But, either way, other commodities are still cheap, relative to stocks.

If I’m right about a commodity comeback, that also implies an Australian boom generally. The sort of boom which my mentor Dan Denning moved to Australia for, around 2003, to set up the publishing business whose newsletter you’re reading. The idea was to help readers make hay from the coming commodity boom.

The commodity boom that began in 2002, up to the 2008 crisis, was impressive. A fourfold increase in the GSCI. And it was impressive for Australia too. I remember that almost anyone could get a six-figure job for working one week on, one week off, in the mines.

Just before I walked into my final university exam, I asked a fellow sufferer about his plans after graduation. He was going back to the mines, he told me. To his old job as an explosive’s expert. I joked this qualification and background should’ve gotten him a job in finance too…but he pointed out he’d earn less for working twice as much.

But the real point is that the commodity boom was awesome for Australia. Our Aussie dollar even went above par to the US dollar, absorbing much of the economic boom in the form of overseas holidays.

Good times. Followed by bad times since, for commodities at least. Again, with the Aussie dollar taking most of the hit.

But that underperformance also signals the prospect of good times to return. And now may be the buying opportunity.

Which begs the question of why I left Australia for Brexit Britain and the impending doom of its euro-bound neighbours, just when the chart above looked to bottom out?

It’s time for Aussie commodity investors to come out of hibernation

Well, writing about crises is more interesting, if you ask me. And being near them adds a bit of local flavour. Crises don’t seem to happen in Australia, the Aussie dollar just absorbs any shocks by plunging.

But crises do happen elsewhere. A new friend lives in Argentina for the same reason I moved to Europe. To experience the challenges of what happens when things go wrong.

Now there’s nowhere quite as crisis ridden as Argentina. But my friend is expecting the same sort of things to happen to his native Europe soon.

The idea that Europe could turn into the economic basket case that is Argentina seems laughable today. But I think he’s right. The phrase ‘as rich as an Argentine’ used to be used in a non-sarcastic way. These days, Argentina holds a lot of problematic records, including two of the top three largest stock market drops (measured in US dollars). Only Sri Lanka folded faster on a single day, and that’s not a cricket joke.

But surely being in Australia at the dawn of a commodities boom is better than being stuck in dreary Britain, watching things fall apart from the inside?

The chart above is so compelling that even I’m starting to have second thoughts. If the commodity boom takes off now, massively enriching Australia and sending the Aussie dollar soaring over the next decade, it could become expensive to move back…

The good news is that your feet don’t need to be where your portfolio is. My Argentine friend certainly doesn’t keep his money where his shoes are. Although some US dollars might be hidden in them…

I think it’s time for Aussie commodity investors to come out of hibernation. At least, that time is close.

But how?

| Until next time, |

|

| Nick Hubble, |