In today’s Money Morning… Dr Copper doesn’t mean an index ETF is the play…t ake advantage of market ‘lag’ on smaller ASX resource companies… it could play out differently though… and more…

It’s a common query when valuations get stretched. As in, how much am I paying for a dollar of a company’s earnings?

I’ll cut straight to the chase at the start here — I don’t think the ASX is in a bubble.

At least not in the traditional sense.

That’s because the bubble question implies a false binary — in one or not in one.

Binaries are useful for building narratives, but spectrums or degrees are better.

Sure, things might look ‘frothy’ out there, I’ll admit.

But I’ll also argue in a broad sense, humans entered ‘the bubble’ mentality the moment they left the barter system.

The second the first ancient coins came out, our speculative instincts kicked in.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

Dr Copper doesn’t mean an index ETF is the play

Point is bubble talk isn’t helpful.

The financial media is awash in analysts and fear-mongering pieces that seek to identify the right pin or pressure point that will end the winning streak.

Then you can hold the trophy for being the ‘most correct bear’.

You could worry about the immense global debt build-up, P/E ratios, you name it.

And there are some classic bubble-popping moments throughout the history of markets.

If really you want to dig into it, you can find a history of stock market crashes on Wikipedia.

Yesterday though, Ryan Dinse wrote to you about what he thinks Dr Copper (ie: the copper price) is saying about global economic health right now.

Namely, that things are looking relatively good.

That might sound encouraging and you may think, ‘Great! I’ll go out and snap up some more index ETFs.’

I think this is the wrong strategy if you are serious about maximising returns. You get a lot of dross in an index.

The key is to follow the money into the right sectors.

Here is a pointer as to how you can navigate the market in 2021. Afterall, 2020 looks tame compared to what 2021 is already dishing up.

Take advantage of market ‘lag’ on smaller ASX resource companies

BHP’s record dividend came on the back of a surging iron ore price.

Aside from iron ore, we know the copper price is up in a big way too.

But what Ryan, myself, and many of the editors at the business are noticing is that the smaller end of town of the ASX resources sector is moving far more slowly than many of the big players.

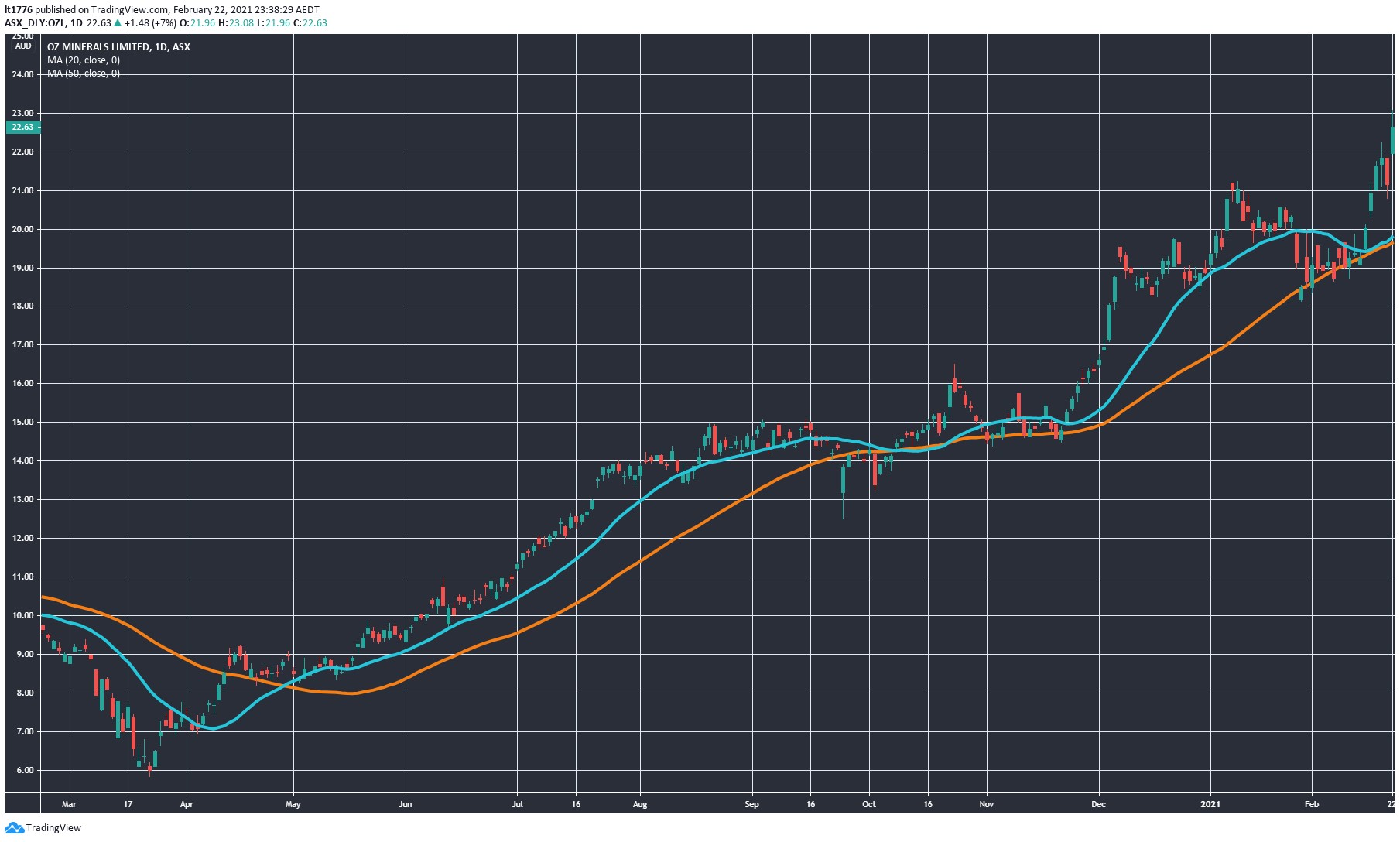

Bigger companies are moving up strongly already, like copper-focused OZ Minerals Ltd [ASX:OZL]:

|

|

| Source: Tradingview.com |

Smaller companies with the same resources are lagging though.

This means that should you select the right projects in this area, you may latch onto some serious winners.

Dare I say it, exponential winners.

Now small mining companies are extremely risky, volatile beasts, I must warn you.

That being said, there’s a window of opportunity to position in this area ahead of the flood of cheap money driving certain resources higher.

That’s because it’s all cyclical.

Lower prices mean exploration spend dries up, investment dies down, development grinds to a halt, and production falls off.

Then…

Higher prices mean exploration ticks up along with investment, development, and production.

Then comes the revenue, then the profits, and finally, the flood of institutional money.

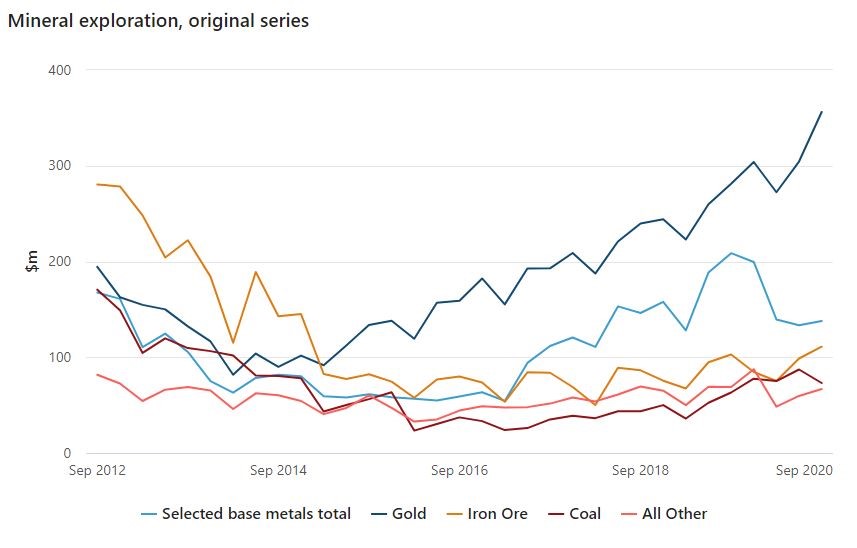

Let’s take a quick look at how exploration spend in Australia looked up until September 2020:

|

|

| Source: ABS |

I’d expect that light blue line (selected base metals) to start to move higher in the next data series.

Meaning, the smaller ASX resources companies should turn up more deposits, get more investment traction, and more mines will go online to chase higher prices.

So, you’ve got some time on your hands as far as investments go.

Just as Nassim Nicholas Taleb says you shouldn’t run after trains; you shouldn’t follow the herd with your investments.

Lucky for you, the train hasn’t left the station just yet.

It could play out differently though

I once remarked to a professor that I could tell him the iron ore price next week.

It was off-the-cuff hubris. He shot back, ‘If you really knew you’d already be very wealthy.’

The same goes here — at Exponential Stock Investor we were onto the commodities story early.

But it could play out very differently should the macroeconomic picture sour in a bad way.

Maybe the money printer runs into a snag? Maybe the launch of central bank backed digital currencies goes awry? Maybe automation and demographics kill off the jobs?

Maybe what we are witnessing right now is really the final fit of madness before the curtain falls on the debt machine?

These are things you should be considering right now.

That, in addition to the bullish sounds that frequently come from this publication.

One thing is for sure though, investing in 2021 won’t be normal.

To find out what the ‘never normal again’ picture looks like, get the lowdown on this particular book right here.

If there’s one ‘macrobear’ to listen to, it’s Jim Rickards.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments