Earlier this week, I issued an important update to my paid readership group at Diggers and Drillers.

It addressed the doom and gloom narrative on China and the seemingly inevitable demise of Australia’s iron ore market.

Given China’s crucial role in the resource sector, I think it’s important we address this critical topic today… Is the iron ore boom over?

But before we do that

Cast your mind back to the Evergrande panic from this time last year… It marked the culmination of bearish sentiment in China’s economy.

Imminent fears of a liquidity crisis in the country’s real estate market sprang up after Evergrande suddenly folded under heavy debt.

According to media, it was set to become: ‘China’s Lehmann Brothers moment.’

An event so severe it would parallel the subprime crisis and deep global recession of 2008.

And as you might recall, I disagreed and challenged that narrative, as you can see here.

At the time, I put much of the negativity down to the West’s biased attitude toward China’s closed economy.

So, what happened after the deep pessimism began to fade last year?

Iron ore rallied from around US$100/tonne to over US$130/tonne, while Australia’s pure-play iron ore giant, Fortescue [ASX: FMG], surged more than 40% (post-Evergrande lows).

Far from collapsing, China’s GDP grew an impressive 5.2% in 2023; by contrast, the US’s grew just 2.5%.

So, what should you make of this

latest bearish action?

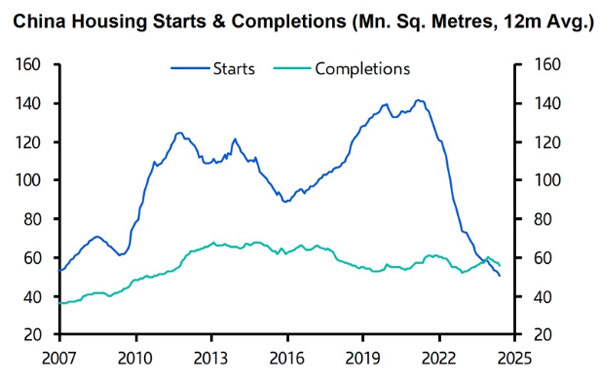

Over the last month, a big deal has been made over the lack of new housing starts in China’s real estate market.

As you can see, new constructions (blue line) fell precipitously during the 2022 pandemic lockdowns and have failed to recover since:

| |

| Source: Capital Economics |

However, despite weakness over the last two years, iron ore prices have been incredibly resilient.

The reason for that might be the shifting demand dynamics in China’s steel market.

While real estate construction remains an important driver, it’s not what it used to be.

Throughout China’s rapid growth phase in the early 2000s, construction (including housing, office, and industrial buildings) accounted for almost half the country’s steel demand.

Today, it’s less than a quarter, or just 24%.

Interestingly, machinery construction is now the single biggest driver; that includes machinery for mining, agriculture, tools and the millions of parts shipped worldwide for vehicle manufacturing.

Yet, according to most China bears, steel demand and China’s real estate market go hand-in-hand.

But the reality couldn’t be any different; demand drivers today are far more diverse compared to the country’s growth phase from the early 2000s, as you can see below:

| |

| Source: Visual Capitalist/BHP |

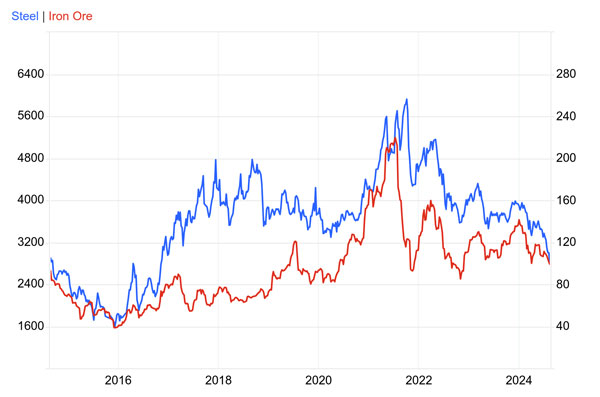

But with that said, we can’t ignore the carnage happening across the world’s largest iron ore producers in 2024.

Fortescue [ASX: FMG] has fallen 25% over the last four weeks or almost 40% year-to-date. Meanwhile, the Brazilian iron ore giant, Vale, has shed around 22%:

| |

| Source: TradingView |

Despite real estate’s diminishing role, the stock market continues to price in risk.

And with Chinese steel makers announcing output cuts last week, the situation looks even more dire for Australia’s iron ore miners.

Today, pessimism is reminiscent of the Evergrande blues from 12 months ago.

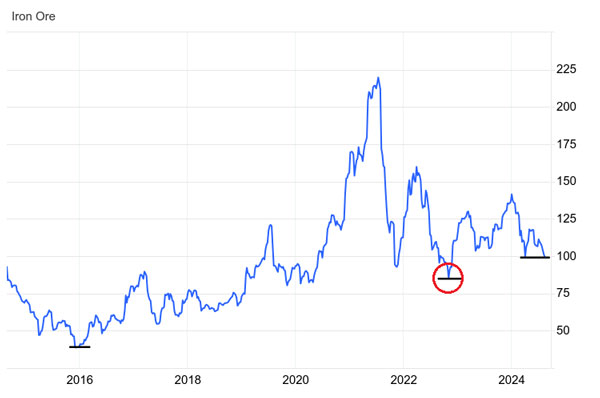

Iron ore’s spot price is now threatening to break decisively below the key psychological barrier of US$100/tonne:

| |

| Source: Tradingeconomics.com |

Why iron ore matters for resource investors

Iron ore serves as a critically important barometer for the broader resource market… The canary in the coal mine if you like.

Given the deep selling that’s taken place over the last week or more, there’s valid cause for concern.

On the surface, it’s difficult to be optimistic… Australia’s largest mining firms have reacted severely to poor news stemming from China’s economy.

And given steelmakers have announced significant cutbacks in recent days, it’s easy to accept further falls are on the way.

But it might not be so simple.

The West holds a very superficial view of China’s economy… The narrative is overwhelmingly bearish and usually defaults to weakness in the country’s real estate market.

But consider this: China holds a long track record of manipulating commodity prices to its advantage. It’s hard to criticise that strategy. If you’re a major buyer, why not do all you can to limit the price you pay?

As the world’s biggest consumer, China has the capacity to manipulate iron ore prices and fulfil longer-term objectives.

And how might it achieve that?

Given this authoritarian state’s broad reach across Chinese-owned entities, including steelmakers, it can easily collude with them to drive down iron ore prices whenever it is strategic to do so.

Curbing steel production is one strategy. These latest announcements on steel output cuts ‘could’ be part of a coordinated plan by authorities and subservient steel makers to undermine the price of iron ore.

Once the CCP deems prices sufficiently depressed, it might shift gears and ramp up stockpiling efforts, just as it did throughout the pandemic years.

And that was despite minimal demand for steel at the time.

Iron ore import data remains key

Nothing happens in China by chance, which extends to its access to raw materials… That’s why you should be observing iron ore imports carefully.

Strong numbers (in the face of falling steel production) will add weight to the theory that China is perhaps cutting steel production in a bid to drive down iron ore prices.

Paradoxically, that could be good for the iron ore miners over the long term. Who knows where future demand will come from… Stimulus? Perhaps.

But iron ore import figures will be the most useful guide in understanding the future trajectory of China’s economy. Far more than some stats on new housing starts or steel demand.

Again, that seems like a paradox given all the negative sentiment today.

Yet, it’s precisely what a forward-looking authoritarian government will seek to achieve… Driving iron ore prices down and then stockpiling ahead of future demand.

And China has every reason to pile on pressure on the iron ore market, especially if it aims to increase stockpiles in the months ahead.

If I’m right, that limits the downside risk for Australia’s iron ore miners. Once prices have sufficiently eased, China will once again become a ready buyer. But at what point could the market hit support?

For the moment, the key area to watch is US$100/tonne.

That price held during the April lows after panic first set in following the initial announcements of steel cuts among China’s major steel firms.

But if it fails, we could see a sharp fall to around US$85/tonne, the low from October 2022. That marked peak pessimism during China’s pandemic lockdown.

Another key psychological level, red circle below:

| |

| Source: Tradingeconomics.com |

Yes, iron ore remains at an important juncture, but I don’t believe it’s about to fall off a cliff like many in the West fear.

Final note

Another key commodity to watch is copper… Again, a commodity heavily reliant on China growth.

Interestingly, the metal has just started to bounce after falling heavily since its all-time high in May. The metal has recovered almost 6% over the last week.

Will August 2024 mark a major low for copper?

That’s what I’m positioning for right now.

Last week, I issued my first BUY recommendation for copper in 2024.

However, I envision that we will be making our most aggressive move on the copper market over the coming weeks.

Adding several positions to the Diggers and Drillers portfolio, capitalising on copper’s 20% pullback since May.

If you want to be part of that, you can do so here.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments