Kaboom!

Every so often in the market we get a data drop that sets off an explosion.

We got that (overnight) from the USA.

The US number crunchers came out and said prices rises in America are cooling off.

They’re low enough to stop the further interest rate hikes. US stocks roared up, and so did Aussie futures.

Beauty!

That’s exactly what we want to see.

This issue has hung over the market like a black storm cloud for over a year.

All that bad news we’ve been hearing for months is suddenly reversing, alongside the stock market.

Do we have anything else to get pumped about?

Yes! The tale of two commodities is important here: iron ore and oil.

Let’s start with the black stuff first.

Go back to early October.

There was genuine fear that oil would spike over US$100 after the Hamas attack in Israel.

With good reason too!

A major Middle East conflict would be a shocker for the world.

Oil got over US$90 a barrel again at one point in the aftermath.

It’s since retreated about 20%. There are multiple reasons for this.

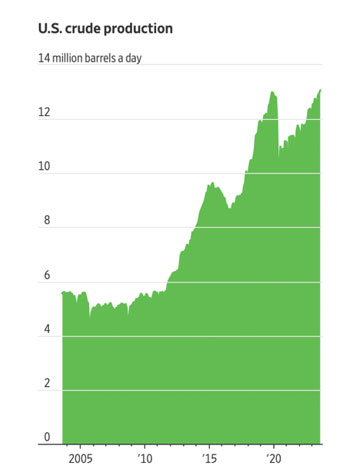

One is that US production is booming. Check it out!

| |

| Source: WSJ |

Here’s another interesting titbit: analysts project US gasoline consumption to go down next year per person.

That could put it at a level around 20 years ago!

American oil is set to flow around the world as US exports boom from this dynamic.

That can help lower energy costs worldwide, including here in Australia.

That’s the basic angle. But oil is a mix of physical trading and trader positioning.

Part of the previous run up in oil towards US$100 was just rank speculation. Those bets are now coming off.

It’s hard for me to see oil rising much in the near future, absent a wildcard.

That’s great news for the general economy.

Lower oil prices keep inflation in check. We could also see rate cuts come in next year if this keeps going.

I’m not saying there’s no opportunity in the energy sector, by the way. It all depends on your timeframe and gameplan.

Right now, oil is moving in the direction that’s good for the general market: that’s down — and it should stay that way.

That brings us to iron ore.

I’ve kept hammering the same point on this in these pages in recent times.

It was this: iron ore trading over US$100 is continuing to surprise everyone.

That is setting up some potentially ripping trades.

It’s just so ridiculously profitable for any miner that can get it to market at this level.

Now what do we see?

Iron is brushing against US$130 a tonne!

This is a boon for the Australian government via higher tax revenues.

It’s great for the ASX in general because BHP, Rio Tinto and Fortescue make up so much of the Top 20.

It’s also great for the small-cap iron ore miners. Back in August I put down five small caps to buy in this presentation.

I wrote in that report:

‘I’m probably the only financial advisor out there excited by an iron ore stock.

‘But nobody makes money following the herd!’

That stock is up 20% since that report went out. I expect plenty more coming up too. It’s minting money.

This is happening at the same time the small-cap sector in general is down.

Let’s combine the tale of these two commodities for the Aussie market.

Oil is not a big sector for the ASX.

You know the old stagers Santos and Woodside. Plus there’s a smattering of much, much smaller drillers and explorers.

For the rest of the market a lower oil price is a boon.

Iron ore, however, is vital to the direction of Australia and the ASX.

It may stay elevated for a lot longer than most people think.

Check out this report on BHP and Rio Tinto from ABC News to see why:

‘Mining analyst Lachlan Shaw said the two giants of the industry could soon see their supplies from existing operations diminish.

‘If we look across the Pilbara in the north of Western Australia, depletion of production from existing mines is becoming an increasingly significant issue for mining companies to deal with,” Mr Shaw, who is co-head of mining research at UBS, told The Business.

‘What we found, in general, is that depletion is likely a larger and more significant factor than has been appreciated in the market.’

Apparently, Rio Tinto need to build a mine every year until 2030 to keep up.

Good luck with that!

There are very good reasons to contemplate that the world could find itself short iron ore.

The big three players can hardly produce any more than they are now.

The global volatility of the last few years batters the junior sector and keeps new mines from going ahead.

Those shares are darn cheap because of this!

Why?

Nobody expected an iron ore bull market.

But we’re in one — just look at the rising price to see it in front of you.

I told you about my iron ore recommendation from August.

It’s just getting started in my book. Of course, junior miners are risky and volatile. Things can go wrong.

That said, I see plenty more potential profit coming up. Check out the story here.

You should be pumped.

Best wishes,

|

Callum Newman,

Editor, Fat Tail Daily

Comments