The share price of ‘buy now, pay later’ firm IOUpay Ltd [ASX:IOU] has jumped on the announcement that they have partnered with Malaysian e-commerce platform EasyStore.

At time of writing the IOU share price is up 3 cents, or 15%, to trade at 23 cents per share.

Shares opened at 25 cents this morning, putting IOU in range of its 52-week high of 28 cents per share.

Source: Trading View

IOU had a breakout year in 2020 as investors went in search of not only the next Afterpay Ltd [ASX:APT] but also a stock that could thrive in a more online world.

IOU puts its foot in the door to booming Asian e-commerce

Today IOU announced it has entered into a Merchant Referral Agreement with EasyStore to enable e-commerce platform’s merchants and end-user customers to utilise IOU’s BNPL payment services.

While there is no consideration paid by either party in the partnership, the agreement provides IOU access to a growing portfolio of merchants across Southeast Asia and the US.

EasyStore has more than 7,000 merchants across SEA and, in 2020, processed over 20 million transactions with a total transaction value of approximately $435 million.

The e-commerce platform is different from single store e-commerce platforms, like Amazon, in that it provides merchants with one single integrated platform to manage their business across multiple online sales channels.

The agreement, which will span only one year, will refer EasyStore’s merchants to onboard and utilise IOU’s BNPL payment service.

IOU did not provide an estimate of the value of the newly minted deal.

However, with the rapid rise of new internet users throughout the area, predominately on mobile devices, BNPL has seen a rapid adoption in SEA.

It’s not full steam ahead

Although today’s deal provides a significant boost in exposure for IOU in one of the world’s fastest growing regions, the economic development of the SEA area could be stalled by COVID-19.

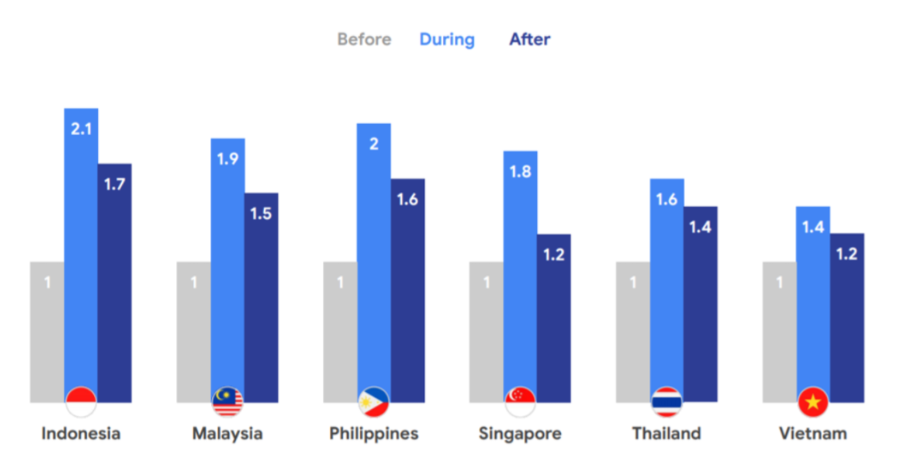

While e-commerce usage saw a strong growth in usage during the height of the pandemic, the numbers have now begun to decline.

Though they are still at elevated levels.

Source: Deal Street Asia

IOU is not the first BNPL service to set up shop in Southeast Asia either.

The region already has a host of established service providers, some of whom are heavily funded through their cashed-up parent corporations.

And there is even competition from IOU’s Aussie counterparts.

Splitit Payments Ltd [ASX:SPT] has partnered with merchant acquirer GHL, offering services to more than 2,000 online merchants in Malaysia, Thailand, Indonesia, and the Philippines.

But there are other Aussie fintechs out there that do offer some unique investment opportunities, which you might not have heard of. Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Regards,

Lachlann Tierney,

For Money Morning