The Ioneer Ltd [ASX:INR] share price is flat today after announcing the award for the sulphuric acid plant contract to DuPont Clean Technologies.

This announcement comes after the company has recently provided an update on the Rhyolite Ridge Project.

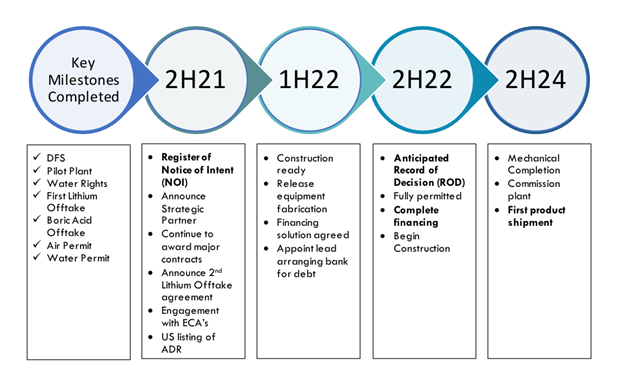

The company noted that the ‘Strategic Partner’ announcement is expected in the third quarter of 2021, which will help INR to stack up capital for the project.

In addition, INR is under a formal evaluation process to pursue secondary listing of shares on a major US stock exchange.

Lastly, the binding lithium offtake with EcoPro Innovation is completed and the company is advancing towards additional offtake discussions for the rest of Rhyolite Ridge lithium production.

All these developments bring us to today — the awarding of the sulphuric acid plant contract to DuPont.

INR shares are currently exchanging hands at 64 cents per share, down 1.23% at time of writing.

Over the course of 12 months, INR stock has increased by 550%. This shows the penchant that investors have for the lithium industry on the ASX at the moment.

Let’s take a look at today’s announcement in detail.

This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.

INR awards DuPont sulphuric acid plant contract

DuPont will get a licence, take care of engineering, and will supply proprietary equipment for the planned sulphuric acid plant at ioneer’s Rhyolite Ridge Project based in Nevada, US.

DuPont will be working together with engineering partner SNC-Lavalin on the plant design with the aim to provide ‘best-in-class’ MECS® sulphuric acid production technology for a plant capable of handling 3,500 tonnes per day.

However, the contract is conditional as of now and is awaiting a final investment decision on the project by the Board of Directors.

The plant will meet strict NV Class II air quality standards and water pollution control backed by DuPont’s supply of the latest generation MECS® Super GEARTM catalyst and other critical proprietary equipment.

The primary goal of this plant would be to convert sulphur into commercial grade sulphuric acid.

In order to make the plant sustainable and cost-effective, the heat released would be used to produce steam for electricity.

The plant is expected to generate an initial 35 MW of electricity — enough to power the entire Rhyolite Ridge Project.

As they would not be using electricity from the grid, Rhyolite Ridge will be an ‘energy-independent’ operation, using primarily co-generated, zero-carbon power.

The excess heat would then be used for evaporation and crystallisation processes required to produce lithium carbonate and boric acid.

Global business leader of DuPont Clean Technologies, Eli Ben-Shoshan, shared his thoughts:

‘We have worked in close partnership with ioneer and SNC-Lavalin to be able to guarantee the precise performance and emissions control ioneer needs for its Rhyolite Ridge project to meet stringent environmental standards and production objectives.

‘We are excited to be part of a project that helps ioneer cleanly produce lithium essential to advancement of electric energy markets and to be able to support it with our many decades of expertise in sulphuric acid plant technology.’

What’s the outlook for INR shares?

Today’s minor drop in share price should not negate the fact that the company is making significant developments in their operations.

Once everything is in line and operational, Rhyolite Ridge is predicted to produce 20,600 tonnes per annum (tpa) of lithium carbonate.

This number is expected to rise to 22,000 tpa of battery-grade lithium hydroxide, and 174,400 tpa of boric acid in the fourth year.

As the project is still pending final federal US Department of the Interior (DOI) approval of the Plan of Operation, Rhyolite Ridge is expected to begin production in the second half of 2024.

Ioneer believes that the timeline for the permitting and development of Rhyolite Ridge overlaps ‘extremely well’ with the exponential rise for lithium globally.

If you are interested in the lithium industry and are looking for companies investing aggressively in its development and growth, then I suggest checking out this report.

You will get your hands on three lithium stocks, each with their own unique projects.

A European lithium developer, an established Aussie producer, and a speculative WA miner with a prime patch of land in WA’s lithium district.

Well worth a read.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here