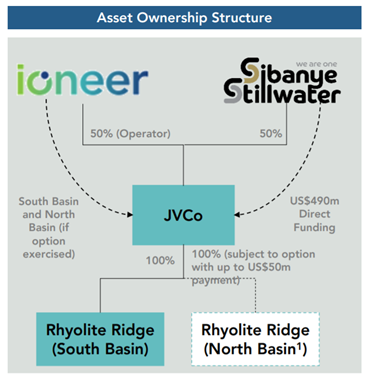

The Ioneer Ltd [ASX:INR] and multinational miner Sibanye-Stillwater will form a joint venture to develop INR’s Rhyolite Ridge project.

For its 50% share in the JV, Sibanye-Stillwater will contribute US$490 million, with Ioneer retaining the other 50% stake.

The deal will also see INR raise US$70 million via sale of new shares to Sibanye-Stillwater at the 10-day volume weighted average to yesterday’s close.

The market did not react well to the development. Currently, INR shares are down almost 20%, trading at 60 cents a share.

INR share price is closed at 74 cents yesterday.

Despite the dip today, the lithium-boron developer still managed to raise funds at a 70% higher price than when it undertook a capital raising via a placement in March.

And the INR share price is still up 445% over the last 12 months.

Ioneer enters joint venture with mining giant

Sibanye-Stillwater, the South African mining giant, is set to form a Joint Venture (JV) with INR to develop INR’s flagship lithium-boron project in Nevada, US.

According to the terms of agreement, Sibanye-Stillwater will have a 50% interest in this newly formed JV, while the remaining 50% interest and operatorship is to be held by Ioneer.

Sibanye-Stillwater aspires to be a major player in the battery metals supply chain, although its success historically has been in precious metals.

The joint venture presents Sibanye-Stillwater the opportunity to flex its muscles in the hot lithium sector.

As mentioned earlier, INR also entered into a subscription agreement with Sibanye-Stillwater for a strategic placement of US$70 million of Ioneer’s ordinary shares.

Sibanye-Stillwater will subscribe for 145.9 million ordinary INR shares at a price of 65.5 cents.

Executive Chairman of Ioneer James Calaway said:

‘We are extremely pleased to welcome Sibanye-Stillwater, a leading international mining company, as a strategic partner in the Rhyolite Ridge Project.

‘Sibanye Stillwater, with its proven track record of developing and operating major mining projects including operations in the United States, its commitment to developing and maintaining an inclusive and sustainable culture, and its determination to become a major force in the battery materials supply chain, is an excellent partner for ioneer to jointly realize the promise of Rhyolite Ridge.’

In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report

Ioneer share price outlook

INR plans to use the proceeds from the Sibanye-Stillwater placement to fulfill its development capital requirements, medium-term working capital needs, and fast-track long-lead items to shorten time to production.

Sibanye-Stillwater — a US$10 billion global mining company — has a track record in executing large-scale mining projects.

So it could serve as an experienced and trusted hand in developing the Rhyolite Ridge project.

However, this would not be an easy journey for Ioneer.

Being the operator of the project, INR will be responsible for the development and subsequent operation of the project.

And, of course, Sibaney-Stillwater’s large investment will come with expectations of proportionate returns.

Meaning INR’s stake in Rhyolite’s profits will be cut.

Investors probably had this in mind when selling off Ioneer shares.

But today’s announcement highlights a firming trend.

Money is flowing into the lithium sector.

Serious money.

A few days ago, for example, Vulcan Energy Resources Ltd [ASX:VUL] completed an institutional placement to raise $200 million with a planned share purchase plan slated to raise a further $20 million.

If you are interested in the lithium industry and are looking for companies investing aggressively in its development and growth, I suggest checking out this report.

You will get your hands on three lithium stocks, each with their own unique projects.

A European lithium developer, an established Aussie producer, and a speculative WA miner with a prime patch of land in WA’s lithium district.

Well worth a read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here