Upstream oil and gas company Invictus Energy [ASX:IVZ] shares are up 6.82% today, trading at 11.75 cents per share after announcing it is on track to spud by Q3 2023. IVZ has also awarded service contracts to several leading international oilfield service providers for the drilling of the Mukuyu-2 well in Zimbabwe.

Invictus will welcome positive news after a year of turbulent share price swings. Over the past 12 months, shares have dropped by 26.56% due to multiple setbacks in exploration, causing a slowdown in the evaluation of the Cabora Bassa Project, of which IVZ holds 80% ownership rights.

The Cabora Bassa Project is one of the most significant onshore oil and gas prospects in Africa. It’s estimated to contain 20 trillion cubic feet of gas and 835 million barrels of gas condensate.

What was hampering the development of this huge project, and what does the latest news mean for Invictus?

![Invictus Energy [ASX:IVZ]](https://daily.fattail.com.au/wp-content/uploads/2023/06/Invictus-Energy-ASX-IVZ-stock-price-news-2023.png)

Source: TradingView

Mukuyu take two for Invictus

Invictus Energy has announced today that the tender process for the servicing of its Mukuyu-2 site has been completed. Invictus has awarded several contracts for the planned exploration of its Cabora Bassa Basin Project; these include:

- SLB [NYSE:SLB] (previously Schlumberger) awarded open-hole wireline logging

- Geolog International awarded the mudlogging contract

- Baker Hughes Co [NASDAQ:BKR] and NOV Inc [NYSE:NOV] have been awarded joint directional drilling and LWD contracts

Mukuyu-2 will test multiple stacked targets with the aim of confirming commercial discovery, and Invictus has announced it remains on track to spud by Q3 of 2023.

However, this will be Invictus Energy’s second attempt at derisking the project and proving that there is an economically viable way of extracting the reserves.

The Mukuyu-1 site exploration was shuttered due to six separate incidents during sampling meant attempts to gain a fluid sample were ‘not feasible’.

As a result of these failures, the exploration had to be abruptly ended and the site demobilised — sending shares plummeting 50% in one day.

Some analysts blamed Baker Hughes, which held the contract for sampling and logging at the Mukuyu-1 site.

Surprisingly, Baker Hughes was contracted again despite the previous site’s failure. The onsite machinery and workers’ localisation was likely a crucial factor in awarding the contract for the remote project.

What a Q3 spud means for Invictus

Cautious optimism seems to be investors’ approach as news of a third-quarter 2023 spud could raise hopes at a second chance at proving the value of the project.

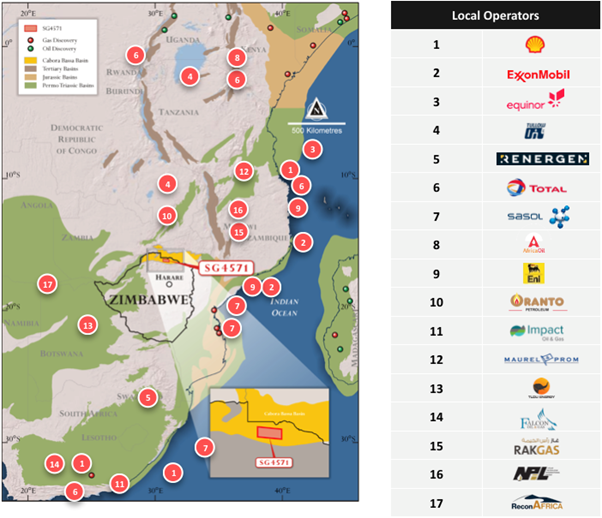

The Cabora Bassa Project sits in the Karoi district of Zimbabwe and is thought to be part of a larger basin that extends into Mozambique and Malawi.

Source: Invictus

It’s estimated to contain 20 trillion cubic feet of gas and 835 million barrels of gas condensate.

If wells are successfully established, it could potentially transform Zimbabwe into a major oil and gas producer.

The success of Invictus could also hang in the balance as the project could see a huge potential upside for the $137 million market cap company.

The company has announced it has secured two Gas Sale MOUs with established customers in Zimbabwe to supply a total of 1.2Tcf of natural gas over 20 years to fertiliser manufacturing and gas power developers.

As long as the Q3 spud remains on track without any surprises this could be another mining junior to watch.

Impending drilling boom to meet demand

The wider energy industry is making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

It’s almost like an alternate universe, the universe of booming drillers.

More of these booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

It’s possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Fat Tail Commodities

Comments