In uncertain times, protecting your investments is more important than ever.

When the stock market is bouncing up and down, it can be hard to know the best thing to do.

The emphasis switches from capital appreciation to capital preservation.

What do you do? Do you liquidate your share portfolio and stay in cash?

Or do you hold on, weather the storm, and wait the tough times out?

In this guide we will show how you could protect yourself in recessionary times, bear markets, and hedge against inflation.

Looking for a specific anwer? Use the quick links below:

Will Australia face a recession?

What are recession-proof stocks?

What are recession-proof industries?

How does a recession affect the stock market?

Are inflation and interest rates related?

How does inflation affect stocks?

Does a bear market mean a recession?

How long do bear markets last?

How to profit during bear markets?

How to protect your investments from inflation

How to protect investments from a bear market

Successfully weathering economic volatility

Will Australia face a recession?

Before we get into the details of how to protect your investments, we need to answer an important question: is Australia facing a recession?

A recession is defined as two consecutive quarters of negative economic growth.

According to the authoritative body on recessions, the National Bureau of Economic Research (NBER), a recession is:

‘A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.’

While Australia has not entered a recession, there are real risks to Australia’s economy.

Firstly, Australia is heavily reliant on the export of commodities such as iron ore and coal.

If the prices of these commodities fall sharply, it will have a negative impact on Australia’s terms of trade and economy.

As central banks hike interest rates in unison, the world faces the possibility of a global recession where economic activity contracts.

In that world, demand for key industrial inputs — like iron ore, coal, and oil — dwindles.

As a big exporter of such inputs, Australia could face an economic contraction of its own.

Secondly, rampant inflation and threats of wider repercussions stemming from Russia’s invasion of Ukraine are souring consumer confidence.

Consumer confidence is at one of its lowest levels since the Global Financial Crisis.

Collapsed consumer confidence leads to households retrenching their spending, leading to declining economic activity.

In October 2022, Australia’s Treasurer Jim Chalmers warned that the world is bracing for another global downturn, commenting:

‘I want people to understand that no matter what we have going for us in this country, we won’t be completely spared. Pressures on the budget are intensifying rather than easing.

‘This will be a very different downturn to the two others that we’ve had over the course of the last decade and a half. The first one, the global financial crisis, was a financial shock that became a demand issue.

‘The second one was a health shock which became, mostly, a supply issue. This one is an inflation shock, and the risk here is a hard landing around the world.’

While recession fears are real, several prominent Australian economists have called for calm.

They argue that while economic growth may slow, it likely won’t contract.

What are recession-proof stocks?

Recession-proof stocks are those that tend to hold up well despite macroeconomic turmoil.

They may be companies that provide essential goods and services or those with a strong competitive advantage that allows them to retain pricing power.

Some examples of recession-proof stocks include utility companies, healthcare providers, and food retailers. These companies usually have stable revenue and profit growth even when the economy is struggling.

This is because people still need to heat their homes, consult a doctor, and buy groceries — regardless of whether the economy is in a downturn.

Investors often seek out recession-proof stocks as a way to protect their portfolios from market volatility. However, no stock is completely immune to the effects of an economic downturn.

While there are no guarantees in the stock market, investing in recession-proof stocks may better help you weather the storm during tough economic times.

What are recession-proof industries?

There are a few industries that tend to fare better than others in an economic downturn. These include healthcare, essential services, and consumer staples — as explained in more detail below:

Healthcare: People will always need medical care, no matter the state the of the economy. This industry includes hospitals, clinics, pharmaceutical companies, and insurance providers.

Essential services: Businesses that provide necessary goods and services that people can’t go without. Examples include utility companies, transportation companies, and food retailers.

Consumer staples: Items that people need to live — groceries, personal care products, and cleaning supplies. Purchases of these items tend to remain stable even when households cut their discretionary spending.

For a more in-depth analysis on the possibility of an upcoming recession, check out our interview with Jim Rickards. And to find out what Jim would be investing in today, click here.

Jim is a veteran strategist having worked as a lawyer, economist, and investment banker. Few market events have escaped either his firsthand experience or his wider learning.

Jim’s also an acclaimed author of best-selling books The Death of Money, Currency Wars, The Road to Ruin (2016), and The New Great Depression.

When Jim speaks, it pays to listen. That’s why his advice has been sought by the likes of the Pentagon.

You can find more of Jim’s thoughts and analysis in his investment advisory Jim Rickards’ Strategic Intelligence Australia.

Strategic Intelligence Australia has a focus on how geopolitics and macroeconomic events influence markets … and how investors can position early for investment opportunities.

How does a recession affect the stock market?

Recessions can have a big impact on the stock market.

In general, recessions are associated with falling stock prices.

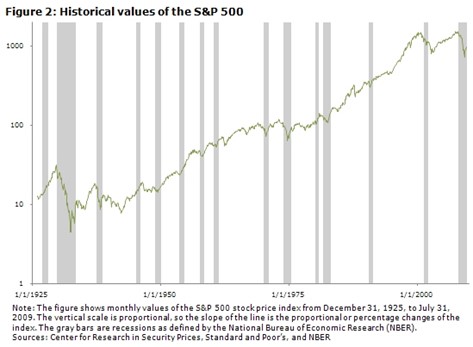

Source: Atlanta Federal Reserve

Are inflation and interest rates related?

Yes, inflation and interest rates are related. When inflation is high, interest rates usually go up as well. The reason for this is that when prices are rising (inflation), central banks raise interest rates to tame inflation. The above graphic depicts the value of the benchmark US S&P 500 index superimposed on instances of US recessions (gray bars).

As you can see, all the recessions recorded in the graphic have been associated with stock price declines.

Recessions are correlated with lower corporate earnings, explaining much of the stock price declines.

If central banks leave interest rates low while inflation rises, inflation can spiral out of control and lead to price instability.

Inflation and interest rates are inextricably linked as central banks use the lever of interest rates to set monetary policy.

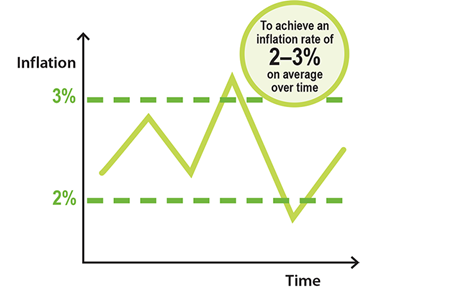

For instance, the Reserve Bank of Australia has an inflation target guiding its interest rate decisions.

The flexible target aims to keep consumer price inflation between two and three percent over time.

Source: Reserve Bank of Australia

How does inflation affect stocks?

Inflation does affect stocks…but not always in nefarious ways.

Modest inflation is actually a boon for share markets as it implies a sustainably growing economy.

But large jumps in inflation or sustained high inflation pose problems – to stocks, economies, and households.

High inflation typically leads to higher borrowing costs, higher input costs (like materials and labour), and lower earnings growth.

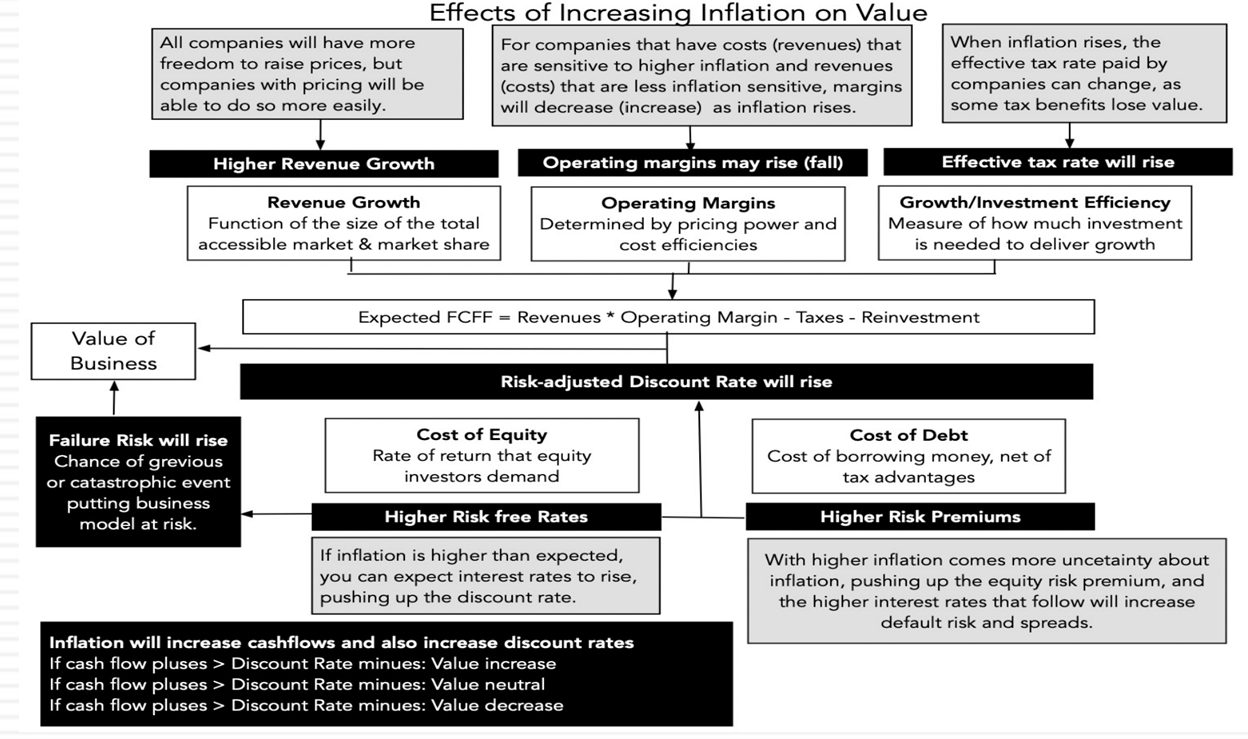

Valuation guru and finance professor Aswath Damodaran has a great graphic breaking down the impact of inflation on value (and, by extension, stock prices).

Source: Damodaran

What is a bear market?

A bear market is characterised by declining stock prices and pessimistic market sentiment.

As a rule of thumb, a bear market happens when a broad market index (like the ASX 200 or the S&P 500) falls by more than 20% from recent highs.

For some invaluable information on surviving a bear market, check out our video with Greg Canavan. To access his special report, click here.

Greg Canavan is our editorial director and runs the Fat Tail Investment Advisory, a premier stock picking service focusing on the ASX 200.

Greg’s service fuses fundamental and technical analysis to hunt out undervalued stocks.

Fat Tail Investment Advisory continues to generate strong and consistent returns since inception in 2014.

If you want to find out more about Greg and his service, you can do so here.

In September 2022, the major US Dow Jones Industrial Average fell into an official bear market.

It was the widely followed index’s first bear market since the pandemic sell-off in early 2020.

As of October 2022, Australia’s major index (the ASX 200) has fared better than its Wall Street counterpart — steering clear of bear market territory.

Does a bear market mean a recession?

Not necessarily. A bear market is defined as a 20% drop in stock prices from their peak. A recession, on the other hand, is defined as two consecutive quarters of negative economic growth.

So, a bear market can happen without a recession, and vice versa. However, bear markets are often associated with recessions since they both involve a decrease in economic activity.

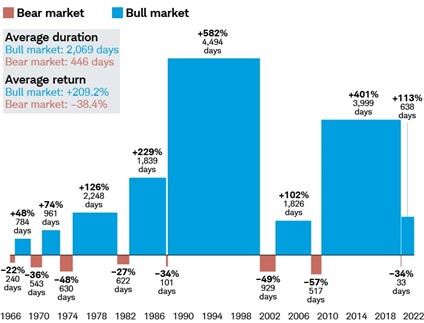

How long do bear markets last?

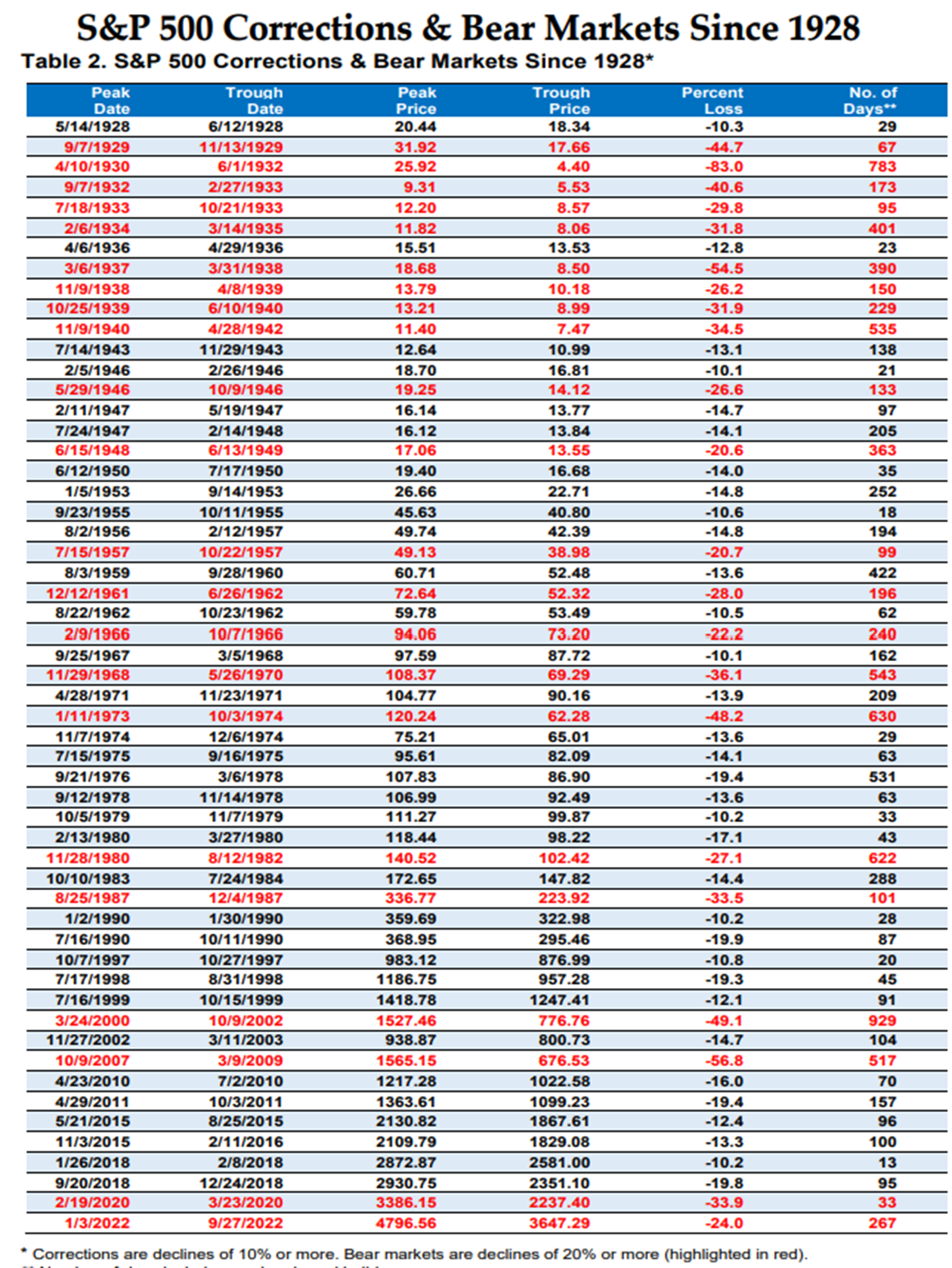

Bear markets are contextual, fitted to the economic circumstances of the day. Bear markets are not so homogenous that they have identical characteristics like duration and severity.

For instance, the March 2020 bear market lasted only a few weeks before a roaring bull run.

But many other bear markets weren’t so brief. Some bear markets could last for months and months.

Following the Global Financial Crisis, the widely followed S&P 500 entered a bear market that spanned 517 days.

Some bear markets could last years, like the one lingering from 2000 to 2002 following the dotcom crash.

Source: Yardeni Research

That said, bear markets have typically lasted less time than bull markets, as the chart from Schwab shows below:

Source: Schwab

How to profit during bear markets?

By definition, a bear market is one where a major index falls at least 20% in a relatively short span.

That can’t happen without most stocks in that index suffering losses.

So, can investors really make money during bear markets?

One way to profit is by not looking at making money during bear markets but after them by taking advantage of the low prices, now with a long-term outlook in mind.

Burton G Malkiel — author of the acclaimed A Random Walk Down Wall Street — warned wary investors late in 2022 that they should not shy away from the stock market.

Long-term investors should realise that equities have been an ‘effective inflation hedge for more than a century and are likely to be so in the future.’

Malkiel also advised that bear markets could offer investors with a sufficiently long-time horizon an opportunity to get into the market at lower prices by means of dollar-cost averaging.

As he explains (emphasis added):

‘Periodic investments of equal dollar amounts ensure that holdings aren’t purchased at temporarily inflated prices and that some shares will be bought after a sharp decline. Because you buy more shares when prices are low, your average price per share will be lower than the average price at which the purchases were executed. Dollar-cost averaging makes it possible for investors to gain positive returns even when the market averages don’t increase. And the greater the volatility of stock prices, the greater the potential of gain.

‘Consider the two recent periods of stock-market downturn. From January 1968 through the start of 1979, the U.S. economy suffered from stagflation and volatile stock markets. The 11 years ended with a zero gain in the major averages. The 13 years from January 2000, the height of the dot-com bubble, were just as bad. Stock valuations fell from bubble-high levels, and market averages at the start of 2012 stood at the same level from where they started at the beginning of the millennium.

‘But despite bad averages, dollar-cost averages earned positive returns. Per dollar invested in a low-cost S&P 500 index fund, they earned 5.2% a year during the stagflation period and 5.7% in the post-bubble period, assuming all dividends were reinvested. Though modest returns, they exceeded inflation. So even if our worst fears are realized regarding valuations and stagflation, the steady equity investor can still come out ahead.’

A way to profit during a bear market involves short selling — betting on falling prices by selling borrowed shares at a higher price than the one at which you buy back the shares, pocketing the difference.

Shorting is a risky venture and is suitable for experienced investors with the means and expertise to execute the strategy well.

A famous example of a shorting strategy during a bear market was featured in Michael Lewis’ The Big Short.

You could also consider short exchange-traded funds (ETFs). Short ETFs are also known as inverse ETFs as they produce returns inverse to a particular index.

Short ETFs are designed to take advantage of broad market falls.

It’s important to remember that bear markets can be volatile, so always do your research and understand the risks before investing, as the downside risks in pursuing this strategy could be significant.

Now that we’ve covered the various economic indicators of a recession and what they mean, let’s look at what you can do to protect your portfolio during a recession.

How to protect your investments from inflation

Rising inflation can be a bane for investors who hold most of their wealth in cash or bonds.

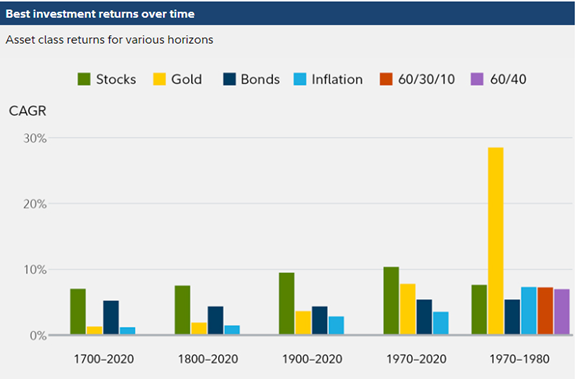

Unsurprisingly, a prudent way to hedge against inflation is to diversify across a range of asset classes with a history of inflation resistance.

Of course, equities have historically outpaced inflation.

Regarding equities, investors may also consider dividend-paying stocks, especially stable companies with a strong record of sustainable high dividend payouts.

As finance professor Burton Malkiel noted in 2022:

‘While equities should also be held to provide inflation protection, they should be tilted toward stocks that pay high dividends. A stock like IBM pays a dividend of 5%, so living expenses can be financed without the need to sell shares. Low-expense-ratio mutual funds and exchange-traded funds of “dividend growth stocks” are the appropriate equity vehicle to provide both liquidity and inflation protection for those living off retirement savings.’

You should be aware, however, that dividends can never be guaranteed, and a company paying dividends can stop doing so at any time. It’s always wise to look at a company’s dividend-paying history.

Commodities also fare well during inflationary times as they serve as key industrial inputs.

When inflation is hot, chances are commodity prices for key materials like iron ore, copper, coal, oil, and gas are elevated.

So, investors could consider investing in commodity stocks or commodity ETFs.

Real estate also tends to provide protection against inflationary times. Investors can gain exposure to real estate investments via REITs.

Gold has also been a historically sound hedge against inflation.

But as research from Fidelity shows, inflation hedge assets like gold may not perform well most of the time when inflation is under control:

‘But while gold has historically kept up with inflation, it doesn’t offer compounding returns and the price can be relatively flat for long stretches of time.’

Source: Fidelity

Inflation is a risk for investors and their portfolios — so it is something investors should prepare for.

Though inflationary pressures may not be fully avoided, investors can take protective measures to mitigate inflation’s impact.

How to protect investments from a bear market

One way to protect yourself from bear market risk is to focus on quality companies that you are comfortable holding for years.

If your investment horizon is 10-plus years, then you are less likely to be phased by a bear market.

Set against your investment time frame, the bear market will be but a blip you can ride out.

But if your investment horizon is far flung, then you must select stocks with longevity; stocks that can sustain or improve their performance long-term.

Investing in well-established companies with strong fundamentals can help to insulate your portfolio from the effects of a recession.

Another way you can protect yourself against the ravages of a bear market is through diversification.

Holding a diversified portfolio can cushion losses. Bear markets are not uniform in that each sector and industry fall in tandem.

Some sectors fall less than others. Some sections of the market fare better than others.

So, a preventive measure against bear market risk is diversifying across asset classes and within the stock market itself.

During the 2007–09 bear market, you didn’t want to be holding only bank stocks, for instance.

As we mentioned earlier, it is important to remember that bear markets do not last forever.

In fact, bear markets typically last much shorter than bull markets.

Riding out a bear market may be worth it if you are a long-term investor.

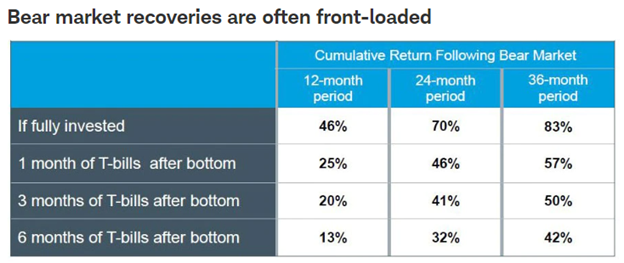

The Schwab Centre for Financial Research studied the effect of pulling out of the market during an average bear market on investment returns.

The research found:

‘The all-stock portfolio was the best performer and was still delivering higher returns than the other portfolios three years after the market bottomed. But investors in that all-stock portfolio had to stay invested at literally the lowest point of the market cycle. Those who waited until the skies were clearer (e.g., a month after the low point of the cycle, or three months, or even six months) still participated in the recovery, but at a far smaller rate.’

Source: Schwab Centre for Financial Research

Remember, no investment is completely safe from market volatility.

Diversify and always remember to monitor your investments closely so you can make quick decisions when the market shifts.

Successfully weathering economic volatility

Whether or not Australia enters a recession and whether Australia’s share market slips into a bear market or not, it always pays to understand market risks and have protective strategies in place.

Whether a threat is imminent or distant, sound investing should always involve some form of risk management.

As legendary investor Howards Marks noted in his book The Most Important Thing:

‘To me, risk is the most interesting, challenging and essential aspect of investing.’

Hopefully, this guide has made you aware of the risks associated with inflationary times, recessionary times, and bear markets.

Such risks can never be eliminated, but hopefully, this guide has shown you some of the ways in which you can deal with those risks.

Happy investing.

For Fat Tail Daily,

Kiryll Prakapenka