March 2023 [Updated]

Dear Reader,

Welcome to our complete guide on how to buy gold in Australia. Learn everything there is to know about investing in gold, from the history of gold right down to where you can buy gold and gold stocks, as well as how to sell and store your gold.

So you’ve decided it’s time to learn how to invest in gold.

Good thinking. But now you’re wondering, ‘What gold product should I buy?’.

In Australia, we have many options available when it comes to buying gold.

Indeed, Australia has had a long-standing relationship with gold.

In 1851, when prospector Edward Hargraves found gold specks in Lewis Ponds Creek, New South Wales, it triggered one of the biggest gold rushes in history. One that would change Australia forever.

For one, the gold rush shaped Australia’s current resource-based economy.

For another, it brought huge amounts of people into the country in search of physical gold. Australia’s population almost quadrupled from 430,000 to a whopping 1.7 million over the next 20 years to 1871.

Many of those who came in search for gold found nothing. Truth is, gold prospecting ain’t easy.

Others, like Bernhardt Otto Holtermann, literally struck gold.

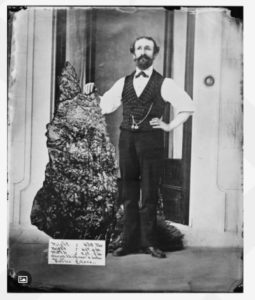

In 1872, he along with Ludwig Hugo Beyers, found what later became known as ‘Holtermann’s Nugget’, a 290kg mass. Just to give you an idea of the size of the ‘nugget’, here is a photo of Holtermann next to it:

Source: Australian Museum

Along with quartz and slate, the mass contained 93.2kgs of gold (3,000 troy ounces) or just above $8.1 million at time of writing.

Physical gold has been around for a long time, and people have been hunting it for centuries.

But…

Is Now a Good Time to Invest in Gold?

Gold was an intrinsic part of our financial system up until only a few decades ago.

The 1944 Bretton Woods Agreement meant that gold determined the value of every major currency. It secured the pegging of the US dollar to gold and tied other currencies to the US dollar.

But the system collapsed in the 1970s, and since then, we’ve had fiat currencies. That is, our currencies aren’t backed by anything.

During the 2008 global crisis, the major global central banks lowered interest rates and resorted to ‘unconventional’ tools like quantitative easing, where they bought treasuries and mortgage-backed securities to prop up the economy.

All this increased the amount of money in the system, but it also pushed asset prices up, like property and the stock market.

With asset prices at record highs, gold lost some of its shine. Some people even dismissed it as a relic or called it uncivilised because gold doesn’t pay a yield, and it costs money to store.

But, in the last few years, gold has become attractive once again.

We’ve gone through a global pandemic, and geopolitical tensions.

Truth is, gold thrives on uncertainty.

In fact, throughout some of the recent crises we’ve seen the gold price spike.

As you can see below, gold prices hit above US$2,000 an ounce in the early stages of the pandemic in 2020. And they did so again in February 2022 when Russia invaded Ukraine:

Source: Market Index

We’ve also seen inflation make a comeback.

Gold is seen as a hedge against inflation and a store of wealth. That’s because gold can maintain its value as it’s in limited supply. To increase the amount of gold, it has to be mined.

Buying Gold as an Investment

Gold is an important tool that can preserve wealth passed on by generations. But there are plenty of other reasons to own gold too.

As I said, gold can hold its value long term. And while it’s also a way to insure your wealth during a crisis, gold can still get you some returns.

In fact, according to Statista, from 1971–2022, gold had an average yearly return of 7.78%. Not too shabby when you consider that until recently, your bank was paying you close to nothing in interest for your savings.

Today, there are many ways you can invest in gold. You can buy physical gold or invest in things like gold Exchange Traded Funds (ETFs) and ASX gold stocks.

Investing in Gold ETFs and Gold Stocks

A gold exchange traded fund (ETF) is an instrument that tracks the price of gold.

There are some advantages to ETFs.

They’re usually a lot cheaper than owning physical gold, as there are no storage fees. It’s also easy to buy and sell and there’s no need to go to a dealer.

The big disadvantage, though, is that you don’t actually hold tangible gold. Also, it brings counterparty risk, which could leave you exposed if they ever went bust. Another way to get direct exposure to gold is to buy physical gold — so how do you go about buying physical gold?

Invest in Physical Gold in Australia

I’m a big fan of owning physical gold as a way to diversify and protect your wealth.

There are some disadvantages, though, it’s not as easy or convenient as buying a gold ETF and it costs money to store.

There are also a few decisions — and quite a bit of research — you need to make before purchasing.

First, what type of gold should you buy?

One of the choices is to buy physical gold bars. They can come as cast or minted bars. Cast bars are produced by pouring gold into a mold and are cheaper, while mint bars are stamped and have a higher finish. If you are making a large gold purchase, the larger cast bars are the most cost-effective.

Gold bars come in different sizes, so you’ll need to determine which size is right for you, depending on how much gold you want to buy. In general, the smaller amount of gold you buy, the higher the premium over the price of gold you will pay.

Apart from gold bars, you can also look at bullion coins, which also come in different sizes depending on the gold they hold. These have some great advantages as they are easy to store and transport, and many are considered legal tender in the country they are produced.

Some of the common gold coins found in Australia include:

- Perth Mint Kangaroo Minted Gold Coin

- Royal Canadian Mint Maple Leaf

- The Royal Mint Brittania Coin

Also, you can look at collectible coins, but these are usually valued for their scarcity instead for the amount of gold they have and investing in them requires quite a bit of research and leg work.

Where to Buy Gold Bullion or Physical Gold

Today, there are lots of places both online and physical stores where you can buy gold in Australia.

One of the most important things you need to make sure of is that you do plenty of your own research and that you find a reputable dealer — I can’t emphasise this point enough.

Some of the well-known gold dealers in Australia are:

- The Perth Mint

- Gold Stackers

- ABC Bullion

- Guardian Gold

- Ainslie Bullion

Please note once again that these are not recommendations, nor do we have an affiliation with any of these companies. They’re just a place to start your research.

When you buy physical gold, you will also need to think about how you will be safely storing it.

How Should I Store My Gold

Here again, you have several options.

Many gold dealers provide storage services. That is, once you have bought gold, instead of having it delivered to your address, you can choose for the dealer to hold on to it for you for a price.

Here, you can choose between two options: allocated and unallocated.

Allocated means that you own a specific bar or gold coin. You get a serial number and you can always come and pick it up anytime. No one can take that bar, buy it, or sell it.

Unallocated is usually cheaper, and it gives you rights to the quantity of gold you’ve bought, but it’s not assigned to a specific gold bar.

Another way to store physical gold is through a safety deposit box in the bank. But if you are buying gold to diversify risk, there is the chance that you won’t be able to access the deposit box if there is a crisis or a run in the banks and the bank closes its doors.

You could also store your gold in a security vault through a private company.

Or you could always choose to store it at home, which is riskier than all the other options above. If you decide to store it at home, you’ll want to make sure that you install a high-quality, secure home safe and don’t tell anyone about it.

Keeping Track of the Gold Price

There are many factors that influence the gold price. One already mentioned is uncertainty and confidence in the financial system. Fear can push demand for gold higher.

There is also supply and demand, after all, gold is a commodity too.

As you can see in the chart below, much of the demand for gold comes from jewellery, and gold bars and coins:

Source: World Gold Council

One thing to note, though, is that gold demand from central bank has been increasing recently.

As you can see in the chart above, from 1992–2008, central banks were net sellers of gold. The global financial crisis marked a turning point, and, since then, central banks have continued to buy tons of gold to add to their reserves.

In fact, in 2022, gold demand from central banks hit a 55-year high. During the year, central banks bought 1,136 tonnes of gold, the highest amount by far since 1967:

Source: GoldHub

Another factor that affects the gold price is interest rates. You see, one of the main criticisms for gold is that it has no yield, but when interest rates go lower or real interest rates turn negative, it makes gold more attractive.

For Aussie gold investors there’s an additional factor, the exchange rate between the AUD and the USD. Gold is priced in USD, so when investing in gold, Australian investors are exposed to the fluctuation of the price of gold and the movements in the exchange rate.

Gold can be a safe haven and a wealth protector. But that’s not to say that investing in gold doesn’t come without certain risks.

There are a lot of advantages to investing in gold. Gold is outside the financial system, it’s in limited supply, and it’s good for times of uncertainty…these are some uncertain times!

All good reasons why you should consider gold as an investment.

We hope all this information helps you get started with investing in gold in Australia.

Check out our gold featured articles page for the latest news and updates on Aussie gold and gold stocks.