So you’ve decided it’s time to invest in gold.

Good thinking. But now you’re wondering, ‘What gold product should I buy?’

In Australia, we have many options available when it comes to buying physical gold or investing in an exchange traded fund (ETF) that tracks the gold price.

As the editor of Strategic Intelligence, I recommend my readers maintain a 10% allocation of their net wealth in gold and silver.

In this article, I’ll explain how to invest in gold bullion in detail.

Australia has had a long-standing relationship with gold.

In 1851 when prospector Edward Hargraves found gold specks in Lewis Ponds Creek, in New South Wales, it triggered one of the biggest gold rushes in history. One that would change Australia forever.

For one, the gold rush shaped Australia’s current resource-based economy.

For another, it brought in huge amounts of people into the country in search for physical gold. Australia’s population almost quadrupled from 430,000 to a whopping 1.7 million over the next 20 years to 1971.

Many of those who came in search for gold found nothing. Truth is, gold prospecting ain’t easy.

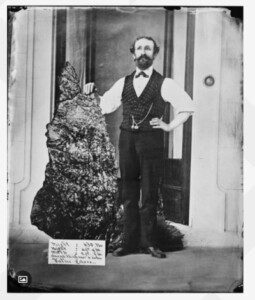

Others, like Bernhardt Otto Holtermann, literally struck gold.

In 1872, he along with Ludwig Hugo Beyers found what later became known as ‘Holtermann’s Nugget’, a 290kg mass. Just to give you an idea of the size of the ‘nugget’, here is a photo of Holtermann next to it.

Investing in Gold ETFs

First, let’s go over some gold ETFs available in Australia.

The spot gold price is volatile. Many investors are looking to take advantage of the price movements. Gold ETFs can suit that purpose. Take note, though, if an ETF shows a markedly different return to the spot price of gold, chances are the fund has exposure to more than gold bullion alone.

You’ll also find some gold-backed ETFs that are leveraged, offering you two, or even three, times the gains — or losses — made by gold. With greater leverage comes greater risk. So I don’t recommend those if you’re just starting off.

There are three 100% gold bullion-backed ETFs listed on the ASX:

- BetaShares Gold Bullion ETF [ASX:QAU]

- ETFS Metal Securities Australia Ltd [ASX:GOLD]

- Perth Mint Gold [PMGOLD]

I’ll give you a quick rundown.

ETFS Metal Securities Australia [ASX:GOLD] has been listed on the ASX since 2003. With this ETF, one unit (share) represents about a tenth of the spot gold price. It means that, if you buy one unit of this ETF, it will cost roughly 10% of the Aussie-dollar gold price per ounce. For example, the physical gold spot price is trading at $1,593.10 an ounce. That means one unit of this ETF will be roughly $153 per unit.

If the Aussie spot gold price moves up by one dollar, the value of the ETF units will increase by 10 cents.

Neither of these ETFs have a currency hedge. Which means you are trading the spot gold price in Aussie dollars, not US dollars.

In contrast, the BetaShares Gold Bullion ETF [ASX:QAU] does have a currency hedge. This means that, while you are still using Aussie dollars to buy QAU units, the ETF tracks the US gold spot price. Basically, this gives you a ‘purer’ exposure to the USD spot gold price.

However, like ZGOL, QAU shares are a hundredth of the USD spot gold price. Again, a one dollar movement in the USD spot gold price will equate to a one cent movement in QAU.

If you are looking to increase your exposure to the gold price through an ETF, these Aussie-listed, 100% backed by gold bullion ETFs are a good way to do so.

Investing in physical gold in Australia

I’m a big fan of owning physical gold as a way to diversify and protect your wealth.

There are some disadvantages though, it’s not as easy or convenient as buying a gold ETF and it costs money to store.

There are also a few decisions — and quite a bit of research — you need to make before purchasing.

First, what type of gold should you buy?

One of the choices is to buy physical gold bars. They can come as cast or minted bars. Cast bars are produced by pouring gold into a mold and are cheaper while mint bars are stamped and have a higher finish.

Gold bars come in different sizes, so you will need to determine which size is right for you, depending on how much gold you want to buy. In general, the smaller amount of gold you buy, the higher the premium over the price of gold you will pay.

Apart from gold bars, you can also look at bullion coins, which also come in different sizes depending on the gold they hold. These have some great advantages as they are easy to store and transport, and many are considered legal tender in the country they are produced.

Also you can look at collectible coins but these are usually valued for their scarcity instead for the amount of gold they have and you investing in them requires quite a bit of research and leg work.

Where to buy gold bullion or physical gold?

Today, there are lots of places both online and physical stores where you can buy gold in Australia.

One of the most important things you need to make sure of is that you do plenty of your own research, and that you find a reputable dealer — I can’t emphasise this point enough.

Some of the well-known gold dealers in Australia are:

- The Perth Mint

- Gold Stackers

- ABC Bullion

- Guardian Gold

- Ainslie Bullion

Please note that these are not recommendations nor do we have an affiliation with any of them. They are just a place to start your research.

One point to note is that if you’re looking to buy physical gold online or over the phone you will need to show proof of identity. So if you’re looking to remain anonymous, you will need to pay a visit to the store.

When you buy physical gold, you will also need to think about how you will be safely storing it.

Gold coins or bars?

Now that you’ve decided on how to store your gold, what type of gold should you buy? Minted bars, bullion coins or cast bullion?

Bullion coins — generally speaking — are quite decorative. Often, the Perth Mint will release a ‘lunar’ coin series to complement its Australian coins each year. It’s still physical bullion, but you’ll pay a premium for this product because there is more work involved in the minting process.

It’s a similar story for minted bars. While they’re less ornate than coins, they come — again, generally speaking — in premium packaging, so they attract a higher price per ounce.

On the other hand, there’s cast bullion. Don’t get me wrong, it’s boring in comparison to minted bars and coins. Aside from the bullion or refinery’s stamp, there’s nothing exciting design-wise about this type of bullion. If you’re after the lowest gold price however, cast bars are the closest to the spot price.

If you are gifting physical gold, people tend to prefer giving decorative bullion. But, if you’re buying gold bullion to store for the long term — over decades — then cast bars offer the most value for your dollar.

Below is a list of the bullion gold commonly found in Australia:

Bullion Coins:

- Australian Kangaroo Gold Bullion Coin: A gold coin from the Perth Mint containing one troy ounce of 99.99% pure gold.

- Royal Canadian Mint Maple Leaf: Similar to the coin from the Perth Mint, it contains one troy ounce and 99.99% pure gold.

- American Gold Eagle: A gold bullion coin from the US Mint. One troy ounce of gold at 99.99% purity.

Minted Bullion Bars:

- Kangaroo Minted Gold Bar: One troy ounce with 99.99%. Other minted bars to consider should come from a reputable refinery, such as PAMP or Argor-Heraeus.

- Kangaroo Mint 100g Minted Gold Bar: Contains 3.215 troy ounces of gold at 99.99% purity. Other refiners, such as PAMP or Argor-Heraeus, also offer a similar product.

Cast Bars:

The Perth Mint Gold Cast Bar 1oz, 10oz or 1kg: Each cast bar contains one troy ounce, 9.99 troy ounces and 32.148 troy ounces respectively.

If you are making a large gold purchase, the larger cast bars are the most cost-effective. Cast bars don’t have to come from the Perth Mint. You can purchase these bars from any reputable bullion dealer in Australia.

You’ll find a list of bullion dealers above. Most of these bullion dealers will have their own stamp on large-size bullion bars.

Don’t forget that silver can also be an investment opportunity — one that is considered a reliable long-term store of wealth. Below, you’ll find some ideas to get you started if you’re looking to buy silver. If you are unsure how much physical silver to invest in, my general rule is that silver should only make up about 1–2% of your total bullion value, not weight.

Silver Bullion Coins and Bars:

- Koala Silver Bullion Coins: One troy ounce at 99.90% pure silver.

- Wedge Tail Eagle Silver Bullion Coin: One troy ounce with 99.90% pure silver.

- Perth Mint 10oz Silver Bullion Minted Bar: 10 troy ounces at 99.90% pure silver.

- Perth Mint 1kg Silver Cast Bar:15 troy ounces of 99.90% pure silver.

- Perth Mint 100oz Silver Bullion Cast Bar: 100 troy ounces at 99.90% pure silver.

Again, most bullion dealers across Australia offer their own branded minted or cast silver bars.

The branding of your bullion isn’t important — as long as it is from a reputable bullion dealer — and comes down to personal preference.

How to store your gold

Many gold dealers provide storage services. That is, once you have bought gold, instead of having it delivered to your address, you can choose for the dealer to hold on to it for you for a price.

Here you can choose between two options: allocated and unallocated.

Allocated means that you own a specific bar or gold coin. You get a serial number and you can always come and pick it up anytime. No one can take that bar, buy it or sell it.

Unallocated is usually cheaper and it gives you rights to the quantity of gold you’ve bought, but it’s not assigned to a specific gold bar.

Another way to store physical gold is through a safety deposit box in the bank. Yet, if you are buying gold to diversify risk there is the chance that you won’t be able to access the deposit box if there is a crisis or a run in the banks and the bank closes its doors.

You could also store your gold in a security vault through a private company.

Or you could always choose to store it at home, which is more risky than all the other options above. If you decide to store it at home, you’ll want to make sure that you install a high-quality secure home safe and don’t tell anyone about it.